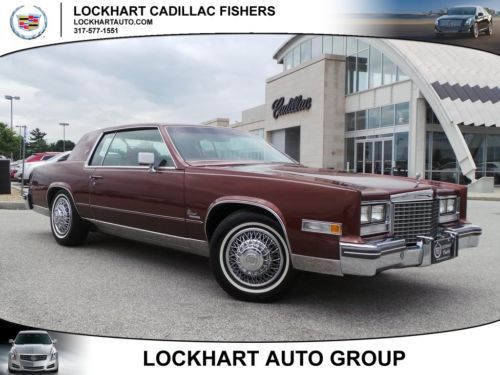

One Owner Vehicle 5.7l V8 350ci Efi Fwd on 2040-cars

Fishers, Indiana, United States

Cadillac Eldorado for Sale

1954 cadillac eldorado convertible, stored over 30 years

1954 cadillac eldorado convertible, stored over 30 years Little old lady's car! 1984 cadillac eldorado biarritz garage kept always(US $7,995.00)

Little old lady's car! 1984 cadillac eldorado biarritz garage kept always(US $7,995.00) Triple black eldorado biarritz coupe(US $1,500.00)

Triple black eldorado biarritz coupe(US $1,500.00) Stunning 1957 eldorado biarritz convertible, 1 of 1800 built, from hyman ltd.(US $175,000.00)

Stunning 1957 eldorado biarritz convertible, 1 of 1800 built, from hyman ltd.(US $175,000.00) 1984 cadillac eldorado with 5,700 original miles(US $18,000.00)

1984 cadillac eldorado with 5,700 original miles(US $18,000.00) 1984 cadillac eldorodo biarritz convertable white with red leather, white top !!(US $14,900.00)

1984 cadillac eldorodo biarritz convertable white with red leather, white top !!(US $14,900.00)

Auto Services in Indiana

Xtreme Precision ★★★★★

Whetsel`s Automotive ★★★★★

USA Auto Mart ★★★★★

Tony Kinser Body Shop ★★★★★

Tire Barn Warehouse ★★★★★

The Tire Store ★★★★★

Auto blog

Ultra-luxury land yachts from Cadillac and Rolls-Royce | Autoblog Podcast #752

Fri, Oct 21 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by News Editor Joel Stocksdale. In this week's news, we about a pair of ultra-luxury electric cars, the 2024 Cadillac Celestiq and Rolls-Royce Spectre. We also cover the 2024 GMC Sierra EV and 2024 Chevy Trax, plus some of the reveals from the Paris Motor Show. The show is capped off with a discussion about the electric cars Greg Migliore has driven for the North American Car and Truck of the Year Awards: the Rivian R1S SUV and Lordstown Motors Endurance pickup truck. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #752 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2024 Cadillac Celestiq 2024 Rolls-Royce Spectre 2024 GMC Sierra EV 2024 Chevy Trax Paris Motor Show: Jeep Avenger EV Cars we're driving 2023 Rivian R1S 2023 Lordstown Motors Endurance Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video:

Book by Cadillac is like a streaming service for cars

Thu, Jan 5 2017Cadillac is launching a subscription-based service that gives users access to most of its models for a flat fee of $1,500 a month. Called Book by Cadillac, the program starts in February in New York City and its surrounding areas. Cadillac's goal: attract users who want flexibility without the costs and commitment of ownership. The monthly fee is steep, but Cadillac argues it's competitive with the cost of leasing a well-equipped luxury car. It also includes maintenance, taxes, and insurance fees. The Book service can also be stopped at any time, which frees users from any payments. There's no restrictions on mileage, though users pay for gas either by filling up the car when they're done with it or through a Caddy concierge who bills their account. Cadillac will deliver and pick up the vehicles from the user's choice of location via a white-gloved driver. Users can change vehicles up to 18 times per year, and they can be reserved with a mobile app. The theoretical goal is a Book user could head to the airport in New York in a Cadillac and reserve another one for their use in Los Angeles. Cadillac ran a test program last year and decided to move forward with Book after receiving a positive response on the price and features. "The overwhelming result is this is something competitive," spokesman Eneuri Acosta said. The program features the Escalade, Escalade ESV, CT6, CTS-V, ATS-V, and XT5 decked-out in Platinum trim. Other vehicles, like the non-V-series ATS or CTS could be added if there's demand. Book by Cadillac starts in New York, but will expand to other unspecified markets. Related Video:

2015 Cadillac ATS-V gunning for the BMW M3

Mon, 03 Jun 2013Spy photographers have spotted something interesting. Cadillac engineers have taken to public streets with the upcoming ATS-V and a playmate: the current BMW M3 Sedan. The prototype seen here wears a more aggressive front fascia, flared fenders and beefy brakes. Quad exhaust tips and what looks to be a small lip spoiler on the trunk deck sum up the most obvious visual changes over the standard ATS outside. Word has it the ATS-V will bow with the same twin-turbo 3.6-liter V6 available in the nose of the XTS. In that application, the engine is good for a stout 410 horsepower, which should be more than enough to hustle the sedan around a track.

Other details are still murky, however. First and foremost: will GM offer the ATS-V with an honest manual transmission, like it does with its big brother, the CTS-V? Something tells us we won't have long to wait to find out - the machine will likely bow next year as a 2015 model. Until then, dig in on our newest bevy of spy photos.