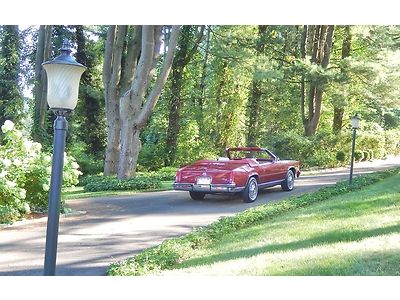

1984 Cadillac Eldorado Biarritz Convertible on 2040-cars

Kennett Square, Pennsylvania, United States

Body Type:Convertible

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 8

Make: Cadillac

Model: Eldorado

Mileage: 21,000

Warranty: Vehicle does NOT have an existing warranty

Sub Model: Biarritz

Exterior Color: Red

Interior Color: White

Cadillac Eldorado for Sale

Auto Services in Pennsylvania

Witmer`s Auto Salvage ★★★★★

West End Sales & Service ★★★★★

Walter`s Auto Wrecking ★★★★★

Tony`s Towing ★★★★★

T S E`s Vehicle Acces Inc ★★★★★

Supreme Auto Body Works, Inc ★★★★★

Auto blog

First-edition Detroit muscle raises millions for charity at Barrett-Jackson

Mon, Jan 19 2015Amidst all the classic metal crossing the auction block each year in Scottsdale, AZ, Detroit automakers have a tradition of donating the first examples of their most enticing new muscle cars, with the proceeds of their sales going towards worthwhile charities. This year, Barrett-Jackson handled three noteworthy examples. The highest price among them was the first Ford Shelby GT350R Mustang with the VIN #001, which raised $1 million for the Juvenile Diabetes Research Foundation. General Motors donated the first new Chevy Corvette Z06 Convertible, the first retail example of the droptop supercar garnering $800,000 for the United Way. Along with the Z06, GM also donated the first new 2016 Cadillac CTS-V sedan, which brought in $170,000 for Detroit's College for Creative Studies. Although these were the headline Motown muscle machines furnished by the automakers themselves, they weren't the only vehicles auctioned off for worthy causes. A 1950 GM Futurliner bus donated by collector Ron Pratte led the charge when it brought in $4.65 million for the Armed Forces Foundation. Other lots included a custom Jeep Wrangler donated by SEMA ($85k), a new M5 donated by BMW ($800k), a '79 Oldsmobile Cutlass Hurst ($140k), '39 Cadillac LaSalle C-Hawk ($410k), Jeff Gordon's 1999 NASCAR-spec Chevy Monte Carlo ($500k) and a Victory Cross Country 8-Ball motorcycle ($180k). All told, the charity lots raised over $8.7 million for local and national charities. BARRETT-JACKSON REACHES HISTORIC HIGHS FOR SALES, CROWDS AND CELEBRITY APPEARANCES IN SCOTTSDALE • Barrett-Jackson sold 1,611 vehicles, which went for more than $130 million (unaudited), smashing records in the company's 44-year history during the 10-day auction at WestWorld of Scottsdale • Automobilia sales nearly tripled world records, with 2,000 pieces selling for more than $6.55 million • Celebrity attendance and crowds, along with ratings on Discovery and Velocity, spike SCOTTSDALE, Ariz. – Jan. 18, 2015 – Barrett-Jackson, The World's Greatest Collector Car AuctionsTM, reached historic highs during the Scottsdale auction at WestWorld from Jan. 10-18, 2015. During the 10-day auction, Barrett-Jackson recorded more than $130 million in vehicle sales (unaudited) and a world record $6.55 million in automobilia sales (unaudited), making it the highest auction in sales to date. The Ron Pratte Collection alone brought in over $40.44 million in vehicle and automobilia sales.

Cadillac considering more electric cars, Elmiraj business case gaining popularity

Fri, 01 Nov 2013Cadillac's electrification isn't likely to stop at the $76,000 ELR coupe, according a report from TheDetroitBureau.com. Speaking to Cadillac's global sales boss, Bob Ferguson, a successful ELR will likely lead to a larger, even more upscale offering than the Volt-based two-door. "I could certainly see a larger vehicle, something even more luxurious," Ferguson said of a potential second, battery-powered Caddy.

That car would likely boast a more potent version of the Voltec powertrain that motivates the Volt and ELR. This next-generation system is still sometime off, though, and won't likely arrive until the second-generation Volt hits the market.

Besides hinting at future plug-in hybrids, Ferguson spoke to TDB about the improving business case for the Elmiraj Concept, shown at the Pebble Beach Concours in Monterey in August. "I'm very excited about the reception for the Elmiraj," Ferguson said. "I'd like to see it in showrooms as soon as possible," he added, before saying that a business case for the production version of the big coupe still needed to be presented to the brass. "It was made to be operationalized," Ferguson added, which is just what we want to hear when it comes to big, flashy concept cars.

Recharge Wrap-up: BMW to test autonomous cars, Korea bans sales of BMW, Nissan, Porsche models

Thu, Jan 5 2017BMW will test autonomous cars on public roads by the second half of 2017. The German automaker, with partners Mobileye and Intel, will operate a fleet of 40 self-driving vehicles using a "scalable architecture" that will be made available to other automakers. The partners plan to offer products ranging from key components to "a complete end-to-end solution" for autonomous driving. Since parting ways with Tesla, Mobileye also recently announced it would provide its technology to Lucid Motors. For BMW, it all leads up to its fully autonomous iNext model slated for introduction in 2021. See the video above, and read more in the press release from Intel. South Korea has banned the sale of certain models from BMW, Nissan, and Porsche over emissions cheating. Following an investigation, regulators determined emissions testing documents to be falsified. The country's Ministry of Environment has fined the three automakers a total of $5.9 million, and revoked the certification of 4,523 vehicles across banned 10 models. Six of the models were still on sale, while the other four have been discontinued. Read more from Automotive News Europe. China's prices for the Cadillac CT6 Plug-in are significantly higher than those announced for the US. The plug-in hybrid version of the luxury sedan recently went on sale with the two variants priced at RMB 558,800 and RMB 658,800. At the time of this writing, that's $80,420 and $94,812. Cadillac announced it would bring the CT6 Plug-In Í– which is built in China – to the US in the spring of 2017, starting at $76,090 before federal and local tax incentives. Hybrid Cars points out that China's own generous incentives could help to make it more competitive. The offering of a charger with free installation as well as an eight-year warranty on the electric powertrain should help, too. Read more at Hybrid Cars. A Connecticut court has ruled in favor of Tesla's gallery showroom in Greenwich. Last May, the Connecticut Automotive Retailers Association brought the suit to block the showroom on Greenwich Avenue, which has now been dismissed by the Connecticut Superior Court. Tesla cannot offer test drives, sell cars, or operate a Supercharger at the location, but it can sell other branded items and educate the public about its vehicles. It's possible that the issue of Tesla's direct sales model could come up again this year in Connecticut state legislature. Read more at Teslarati .

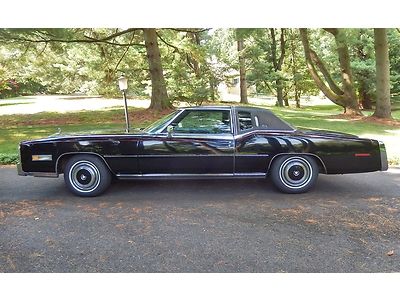

1977 cadillac eldorado biarritz

1977 cadillac eldorado biarritz 1973 cadillac eldorado convertible

1973 cadillac eldorado convertible 1997 cadillac eldorado base coupe 2-door 4.6l

1997 cadillac eldorado base coupe 2-door 4.6l 1973 cadillac eldorado base convertible 2-door 8.2l

1973 cadillac eldorado base convertible 2-door 8.2l 1988 barritz cadillac baltic blue

1988 barritz cadillac baltic blue 1976 cadillac eldorado base convertible 2-door 8.2l

1976 cadillac eldorado base convertible 2-door 8.2l