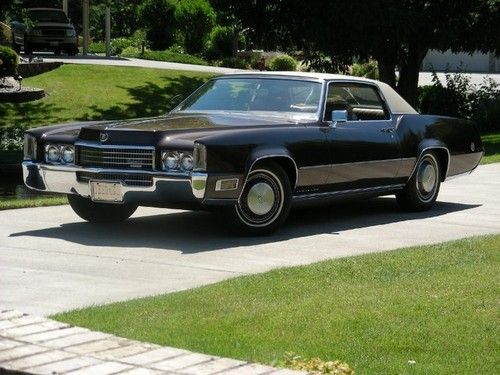

1974 Cadillac Eldorado Convertible 2-door 8.2l 501 Ci on 2040-cars

White River Junction, Vermont, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:8.2L 8195CC 500Cu. In. V8 GAS OHV Naturally Aspirated

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 8

Make: Cadillac

Model: Eldorado

Trim: Base Convertible 2-Door

Options: Full Car Cover, Leather Seats, CD Player, Convertible

Drive Type: U/K

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 5,908

Exterior Color: Black

Interior Color: Black

Cadillac Eldorado for Sale

1991 cadillac

1991 cadillac 1970 cadillac eldorado 2 ht one owner - excellent condition

1970 cadillac eldorado 2 ht one owner - excellent condition 2000 cadillac eldorado esc coupe 2-door 4.6l - florida - no reserve

2000 cadillac eldorado esc coupe 2-door 4.6l - florida - no reserve 1978 cadillac eldorado biarritz-89 k orig miles-leather, orig interior, nice!

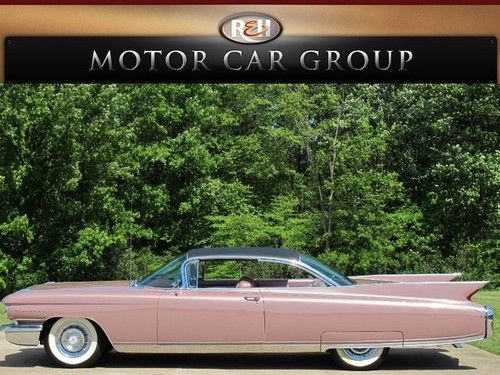

1978 cadillac eldorado biarritz-89 k orig miles-leather, orig interior, nice! 1960 cadillac eldorado, very original(US $74,990.00)

1960 cadillac eldorado, very original(US $74,990.00) 1999 cadillac eldorado etc coupe 2-door 4.6l(US $5,900.00)

1999 cadillac eldorado etc coupe 2-door 4.6l(US $5,900.00)

Auto Services in Vermont

Wassick`s Tire Service ★★★★★

Warren Tire Goodyear ★★★★★

Raymertown Garage ★★★★★

Lunt`s Automotive LLC. ★★★★★

Jay Auto ★★★★★

T & R`s Auto Specialists ★★★★

Auto blog

Watch the 2014 Cadillac CTS live-stream reveal

Tue, 26 Mar 2013Despite many an image leaking onto the Internet over the weekend, today is the official day for the debut of the all-new 2014 Cadillac CTS. You want the nitty-gritty details of Cadillac's new sedan? Click here.

If you want to watch the 2014 CTS makes its live debut in front of a throng of auto journalists, then just watch below, as Cadillac is live-streaming the event at 7:15 PM EST. That's only a few minutes from now, so click here to start watching, and stay tuned for our first live images of the CTS from the New York Auto Show.

Cadillac Ciel concept features in Entourage trailer

Wed, Dec 24 2014Some of us may miss HBO's Entourage more than others, but one way or another, it sure had some cool cars. The characters on the show were constantly trading between Astons, Maseratis and Ferraris – not to mention a smattering of Benzes and Escalades – but one of our favorite sets of wheels from the show's entire eight-year run was the 1965 Lincoln Continental featured in the opening credits. The vintage parade car undoubtedly provided the studio with a great way to showcase the camaraderie between the four members of the title crew, but also made us pine for a time when you could actually get your hands on a four-door convertible. Unfortunately they just don't make 'em like that anymore – not the car and not the TV show in which it featured – but fans of both will be pleased to watch this latest trailer for the upcoming Entourage movie. Not only does it include all the members of the original cast, but it also features Detroit's latest (and arguably most stylish) attempt at reviving the four-door cabriolet: the commandingly elegant and achingly desirable but sadly unobtainable Cadillac Ciel concept of 2011. Related Gallery Cadillac Ciel Concept View 9 Photos News Source: Warner Bros. via YouTube Celebrities TV/Movies Cadillac Convertible Luxury Videos movie trailer cadillac ciel cadillac ciel concept

Next Cadillac CTS-V confirmed for Detroit

Tue, Dec 16 2014As a car enthusiast, you should be excited for the 2015 Detroit Auto Show. Hell, we can barely contain ourselves – it's shaping up to be a great show. And this bit of news only heightens our expectations – Cadillac will be bringing its third-generation CTS-V to January's North American International Auto Show. That bit of high-performance news has been confirmed to Autoblog by Cadillac officials. In fact, we've received an official invitation to the brand's press conference, and while the latter is light on information, it does say, "it's time for the V-Series to elevate to the next level." Considering our last experience with the CTS-V, we're not sure what there is left to elevate, although we're hopeful that Caddy will come up with something. What that could be, of course, is very open to speculation. When the last CTS-V debuted in 2009, it arguably outgunned Germanic challengers like the 500-hp BMW M5 and 518-hp Mercedes-Benz E63 AMG for a lot less money, boasting a detuned version of the Chevrolet Corvette ZR1's 6.2-liter supercharged V8. Could that trend carry on, with the next CTS-V borrowing the supercharged, 650-hp mill from the new Corvette Z06? If escalation is the name of the game, the Z06 engine would seem to once again allow Caddy battle it out on firm, big-booted footing with BMW and Mercedes-Benz. Of course, all will become clear on the morning of Tuesday, January 13. Like we said, we can hardly wait. Related Video: