2000 Cadilac Deville on 2040-cars

Toms River, New Jersey, United States

|

ok i bought the car thinking i was going to make a few dollars on the car. well i was wrong . anyway i just spent over 600.oo dollars

on repairs to get it though new jersey inspection so has a new sticker good for 2 years. car runs great looks good drives great but sometimes the speedo doesnt work i think it might need a new sensor the only other problem is the car has an oil leak, i think its comming from the back valve cover but not sure. i must sell the car tomany car in drive way. the car has DTS rims on it to makes it look great car is relisted due tot he fact it didnt make the reserve but i can tell you it came very close |

Cadillac DeVille for Sale

1998 cadillac deville base sedan 4-door 4.6l

1998 cadillac deville base sedan 4-door 4.6l 2003 deville sedan,v8,heated leather,onstar,16in wheels,56k,we finance!!(US $8,900.00)

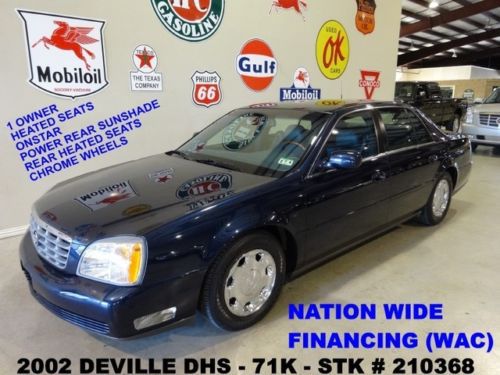

2003 deville sedan,v8,heated leather,onstar,16in wheels,56k,we finance!!(US $8,900.00) 2002 deville dhs,sedan,heated leather,bose,16in chrome wheels,71k,we finance!!(US $6,900.00)

2002 deville dhs,sedan,heated leather,bose,16in chrome wheels,71k,we finance!!(US $6,900.00) No reserve in az-1999 cadillac limousine 6-door with only 53k miles

No reserve in az-1999 cadillac limousine 6-door with only 53k miles White hard top, red body, 4 door(US $8,500.00)

White hard top, red body, 4 door(US $8,500.00) 1998 cadillac funeral hearse excellent condition built by federal

1998 cadillac funeral hearse excellent condition built by federal

Auto Services in New Jersey

Woodland Auto Body ★★★★★

Westchester Subaru ★★★★★

Wayne Auto Mall Hyundai ★★★★★

Two Guys Autoplex 2 ★★★★★

Toyota Universe ★★★★★

Total Automotive, Inc. ★★★★★

Auto blog

Why GM will import the Cadillac CT6 PHEV from China

Fri, Jan 29 2016There's a clear-cut reason that General Motors is going to build its upcoming plug-in hybrid CT6 sedan in China. Sure, the car will be sold in China and the US, but the real reason for the "Made In China" stamp is environmental. If an automaker wants to build a new model in China, adding a green powertrain is an easy way to do that. The CT6 will have both a PHEV option as well as standard gas engine versions. David Leone, Cadillac's executive chief engineer, told AutoblogGreen recently that, "[China is] far more receptive to approving localized production of vehicle programs that have new energy vehicle powertrain applications." To put it succinctly, since the CT6 has a PHEV option, it is easier for GM to build all CT6 models in China. Some of them will then be imported to the US. "Most new global Cadillacs will also be produced in China as well. It's our second-largest market in the world." "To bring any new car into China, to produce it, you need government approval," Leone said. "The government isn't interested in bringing many new cars to market that don't have new energy credits. [The CT6] also provides new energy credits that enables it to be an attractive, well-received product in China." Leone said that there are two main markets for the various CT6 models: China and the US. The car will arrive in the 2017 model year, so some time after the end of June 2016. There are other practical reasons to build the PHEV in China, like the cells in the battery pack. Those are provided by LG Chem, which makes some cells in Michigan but more in South Korea. And GM already builds cars in China through its joint venture with SAIC, Shanghai General Motors, or SGM. "In February 2013 we started making the XTS, in summer of 2014 we started making the ATS-L," Leone said. "We will be producing [the CT6] within a number of months. Most new global Cadillacs will also be produced in China as well. It's our second-largest market in the world." The Chinese and US versions of the CT6 will be identical, Leone said. While some Cadillacs sold in China are slightly different than the US versions – the Chinese ATS is 77 millimeters longer, for example – the CTS6 PHEV will be exactly the same in both places, other than slight tweaks to the trim levels. Still, "more of our cars going forward will be the exact same car," he said. That doesn't mean that sales will be the same everywhere.

Jeep Twitter account hacked, bad language, poor grammar and some hilarity ensue

Tue, 19 Feb 2013Just a day after Burger King's Twitter account was compromised by "unauthorized users," Jeep's social media feed has been similarly hacked. Both instances of digital incursion share some similarities - the BK hackers changed the company's logo for McDonald's familiar golden arches, saying a sale had occurred, while the Jeep miscreants have replaced Jeep's branding with that of General Motors property Cadillac.

The resulting tweets from the damaged Jeep account have been a pretty brutal, to put it bluntly. Most of the content coming from the hacked account is unpublishable here, using language that is peppered with racial epithets, and poorly worded "shout outs."

In addition to the defamatory tweets themselves, the hackers have significantly altered the layout of the page. Jeep's header image now features a picture of the Cadillac ATS to go along with the Wreath and Crest, some language calling out that car as winning the 2013 North American Car of the Year award, and this gem: "The official Twitter handle for the Jeep(R) - Just Empty Every Pocket, Sold To Cadillac =[" Also, perhaps in an ode to yesterday's Burger King heist, the background image for the page now features a McDonald's-themed donk. The devil's in the details, we guess.

GM, UAW poaching Nissan workers in Tennessee

Tue, Sep 8 2015General Motors and the United Auto Workers are going on a recruitment drive at the Spring Hill factory in Tennessee, and they're hoping to poach some skilled workers from Nissan's nearby plant in Smyrna, TN. The General and the union even bought a billboard advertising for industrial electricians near the Japanese automaker's facility, according to the Daily News Journal. The reason for the billboard was simple. "GM was short of electricians," said Tim Stannard, the president of the UAW local at Spring Hill, to the Daily News Journal. The factory currently builds the Chevrolet Equinox but has a contract to assemble the next generation of Ecotec engines and the Cadillac XT5, which replaces the SRX. Thanks to the $185-million deal, employment there is expected to double by May 2016, according to Stannard, with roughly 1,800 additional union jobs. Beyond just several billboards, GM has job postings online for the Spring Hill plant looking for workers with specific skills. There has already been some interest in the positions among Nissan employees, Stannard indicated. According to a recent study by the Center for Automotive Research, the average GM worker currently makes $58 an hour, including benefits. Comparatively, Nissan pays an average of $42 an hour with benefits. The General's number could change in the coming weeks because its contract with the UAW is about to expire, and higher wages are among the major negotiating points.