1998 Cadillac Deville Base Sedan 4-door 4.6l on 2040-cars

Dallas, Texas, United States

|

1998 Cadilac Deville 4 door Sedan 106K miles Color: Burgany Very Clean and very good mechanical repair. This Vehicle was owned by a senior Citizen and Garage kept The paint is in very good condition and there are no noticeable dents from collision or otherwise. The owner has elected to sell because she is not driving anymore. Everything works ( power Windows/Door locks/Seats/AM/FM/ Cassette) and this Vehicle has new tires and a new battery The engine does not smoke and there are no engine or transmission leaks. We will accept and independent appraisal for a potential buyer at the buyers expense.

|

Cadillac DeVille for Sale

1970 cadillac deville convertible blue with blue leather interior(US $5,500.00)

1970 cadillac deville convertible blue with blue leather interior(US $5,500.00) 1994 cadillac deville concours only 26k! all original!

1994 cadillac deville concours only 26k! all original! 1966 cadillac kustom 4 dr. hardtop

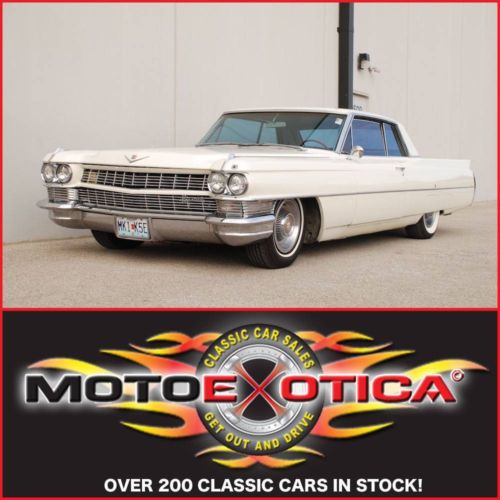

1966 cadillac kustom 4 dr. hardtop 1964 cadillac coupe de ville-429-cid v8-a/c operable-red leather interior

1964 cadillac coupe de ville-429-cid v8-a/c operable-red leather interior 1969 cadillac deville **two owner time capsule!!**

1969 cadillac deville **two owner time capsule!!** 1979 cadillac deville coupe 7.0l 425 original 62k miles call now(US $13,495.00)

1979 cadillac deville coupe 7.0l 425 original 62k miles call now(US $13,495.00)

Auto Services in Texas

Yale Auto ★★★★★

World Car Mazda Service ★★★★★

Wilson`s Automotive ★★★★★

Whitakers Auto Body & Paint ★★★★★

Wetzel`s Automotive ★★★★★

Wetmore Master Lube Exp Inc ★★★★★

Auto blog

VW, Rivian, Nissan, BMW, Genesis, Audi and Volvo lose EV tax credits starting tomorrow

Mon, Apr 17 2023The U.S. Treasury said Monday that Volkswagen, BMW, Nissan, Rivian, Hyundai and Volvo electric vehicles will lose access to a $7,500 tax credit under new battery sourcing rules. The Treasury said the new requirements effective Tuesday will also cut by half credits for the Tesla Model 3 Standard Range Rear Wheel Drive to $3,750 but other Tesla models will retain the full $7,500 credit. Vehicles losing credits Tuesday are the BMW 330e, BMW X5 xDrive45e, Genesis Electrified GV70, Nissan Leaf , Rivian R1S and R1T, Volkswagen ID.4 as well as the plug-in hybrid electric Audi Q5 TFSI e Quattro and plug-in hybrid (PHEV) electric Volvo S60. The Swedish carmaker is 82%-owned by China’s Zhejiang Geely Holding Group. The rules are aimed at weaning the United States off dependence on China for EV battery supply chains and are part of President Joe Biden's effort to make 50% of U.S. new vehicle sales by 2030 EVs or PHEVs. Hyundai said in a statement it was committed to its long-range EV plans and that it "will utilize key provisions in the Inflation Reduction Act to accelerate the transition to electrification." Rivian declined to comment and the other automakers could not immediately be reached for comment. Treasury also disclosed General Motors electric Chevrolet Bolt and Bolt EUV will qualify for the full $7,500 tax credit. GM said earlier it expected at least some of its EVS would qualify for the $7,500 tax credit under the new rules, including the 2023 Cadillac Lyriq and forthcoming Chevrolet Equinox EV SUV and Blazer EV SUV. Treasury said all GM EVs will qualify. Earlier, Ford Motor and Chrysler-parent Stellantis said most of their electric and PHEV models would see tax credits halved to $3,750 on April 18. Treasury confirmed the automakers' calculations. The rules were announced last month and mandated by Congress in August as part of the $430 billion Inflation Reduction Act (IRA). The IRA requires 50% of the value of battery components be produced or assembled in North America to qualify for $3,750, and 40% of the value of critical minerals sourced from the United States or a free trade partner for a $3,750 credit. The law required vehicles to be assembled in North America to qualify for any tax credits, which in August eliminated nearly 70% of eligible models and on Jan. 1 new price caps and limits on buyers income took effect.

GM earnings rise 1% as buyers pay more for popular pickups

Thu, Aug 1 2019DETROIT — General Motors said Thursday that higher prices for popular pickup trucks and SUVs helped overcome slowing global sales and profit rose by 1% in the second quarter. The Detroit automaker said it made $2.42 billion, or $1.66 per share, from April through June. Adjusting for restructuring costs, GM made $1.64 per share, blowing by analyst estimates of $1.44. Quarterly revenue fell 2% to $36.06 billion, but still beat estimates. Analysts polled by FactSet expected $35.97 billion. Global sales fell 6% to 1.94 million vehicles led by declines in North America and Asia Pacific, Middle East and Africa. The company says sales in China were weak, and it expects that to continue through the year. In the United States, customers paid an average of $41,461 for a GM vehicle during the quarter, an increase of 2.2%, as buyers went for loaded-out pickups and SUVs, according to the Edmunds.com auto pricing site. The U.S. is GM's most profitable market. Chief Financial Officer Dhivya Suryadevara said she expects the strong pricing to continue, especially as GM rolls out a diesel pickup and new heavy-duty trucks in the second half of the year. "We think the fundamentals do remain strong, especially in the truck market," she said, adding that strength in the overall economy and aging trucks now on the road should help keep the trend going. Light trucks accounted for 83.1% of GM's sales in the quarter, and pickup truck sales rose 8.5% as GM transitioned to new models of the Chevrolet Silverado and GMC Sierra, according to Edmunds, which provides content to The Associated Press. As usual, GM made most of its money in North America, reporting $3 billion in pretax earnings. International operations including China broke even, while the company spent $300 million on its GM Cruise automated vehicle unit. Its financial arm made $500 million in pretax income. Suryadevara said GM saw $700 million in savings during the quarter from restructuring actions announced late last year that included cutting about 8,000 white-collar workers through layoffs, buyouts and early retirements. The company also announced plans to close five North American factories, shedding another 6,000 jobs. About 3,000 factory workers in the U.S. whose jobs were eliminated at four plants will be placed at other factories, but they could have to relocate. GM expects the restructuring to generate $2 billion to $2.5 billion in annual cost savings by the end of this year.

Confident new Cadillac marketing boss ready to take on Tesla, BMW

Thu, Jun 26 2014When there's a former BMW executive heading Cadillac's efforts to boost sales of its only plug-in, it's a pretty safe guess that the marketing emphasis won't be on environmental friendliness and tree-hugging tendencies. The General Motors luxury brand has appointed ex-Bimmer executive Uwe Ellinghaus to be its marketing chief late last year, and the German-born Ellinghaus is now saying that he's targeting potential customers of Tesla Motors, in addition to BMW, for potential growth in sales of the Cadillac ELR extended-range plug-in. Appointed to Cadillac's head of marketing last November, Ellinghaus recently told Advertising Age that GM needs to highlight the Cadillac's looks and performance. He complimented Tesla for putting more emphasis on those attributes in the Model S than on its lack of emissions or lack of refueling costs (but Tesla hasn't shied away from highlighting the EV's savings). Ellinghaus says that trying to gear advertising "for people who are tree-huggers and green-wash an entire brand" won't be successful. You don't say. So far, the ELR hasn't made much of a dent in US car sales. Through May, Cadillac, which spent about $280 million on all of its US marketing last year, sold 293 units, whereas Tesla had been approaching the 11,000-unit figure for the Model S. With that in mind, Cadillac may be working on a sportier version of the ELR, as spy shots of a test vehicle from May revealed larger brakes and wheels. You can read our First Drive impressions of the ELR here.