1990 Cadillac Sedan Deville on 2040-cars

Mitchell, Indiana, United States

Body Type:Sedan

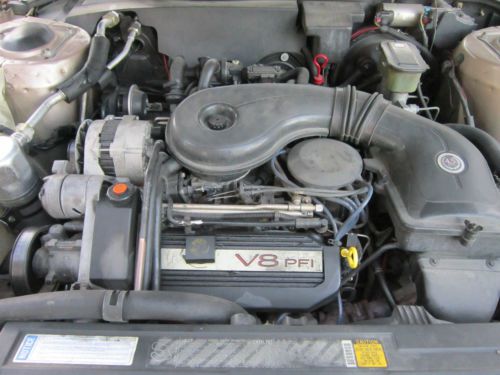

Engine:4.5

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Used

Year: 1990

Interior Color: Tan

Make: Cadillac

Number of Cylinders: 8

Model: DeVille

Trim: Base Sedan 4-Door

Drive Type: FWD

Options: Cassette Player, Leather Seats

Mileage: 133,785

Power Options: Air Conditioning, Power Locks, Power Windows, Power Seats

Sub Model: Sedan Deville

Exterior Color: Tan

|

Two owner car man that owens it now bought from brother inlaw Well maintained only 1 place in interior needs attention the drivers side door armrest is worn and have to use security bypass to start Any questions please ask

|

Cadillac DeVille for Sale

1969 red runsdrivesgreatbodyinteriorvgoodtopwindowswork!

1969 red runsdrivesgreatbodyinteriorvgoodtopwindowswork! 1966 cadillac deville base convertible 2-door 7.0l(US $8,500.00)

1966 cadillac deville base convertible 2-door 7.0l(US $8,500.00) 1966 cadillac deville convertible own registered owner solid original low mi car

1966 cadillac deville convertible own registered owner solid original low mi car 1978 cadallic sedan deville, one owner from new(US $8,500.00)

1978 cadallic sedan deville, one owner from new(US $8,500.00) 1968 cadillac coupe deville(US $9,700.00)

1968 cadillac coupe deville(US $9,700.00) 1983 cadillac deville coupe 2-door 4.1l rust free winter stored 2 owner 68k mi(US $5,450.00)

1983 cadillac deville coupe 2-door 4.1l rust free winter stored 2 owner 68k mi(US $5,450.00)

Auto Services in Indiana

Xtreme Precision ★★★★★

Whetsel`s Automotive ★★★★★

USA Auto Mart ★★★★★

Tony Kinser Body Shop ★★★★★

Tire Barn Warehouse ★★★★★

The Tire Store ★★★★★

Auto blog

Recharge Wrap-up: Cadillac CT6 Plug-In on sale in China, Oregon utilities spur EV adoption

Fri, Dec 30 2016The Cadillac CT6 Plug-In is now available in China. The luxury plug-in hybrid sedan uses a turbocharged 2.0-liter engine plus two electric motors, which give the car a 0-62 mph time of 5.4 seconds. Its liquid-cooled 18.4-kWh lithium-ion battery pack gives the car an all-electric range of 50 miles, with a total range of 581 miles. Cadillac offers a 200V charger with the CT6 Plug-In, which provides a full charge in less than five hours. Owners can check charging status remotely using OnStar or the MyCadillac app. The CT6 Plug-In is offered in two variants, priced at about $80,400 and $94,800. Read more from GM. Two Oregon utilities are launching a program to increase EV adoption. Portland General Electric (PGE) will build six charging locations, each with up to four dual-standard fast chargers. PGE will also build and operate charging sites for electric buses, freeing up money for Portland's TriMet transit agency to spend on the actual buses. Pacific Power will also build public EV chargers, and lower some electricity rates for operators. Both companies will also work to inform the public about the benefits of electric mobility. Oregon utilities are required to stop using coal by 2030, and use 50 percent renewable energy by 2040, which will make EVs even cleaner. Read more at Green Car Reports. Continental says a shift to EVs will cost its company jobs. The automotive parts supplier's CEO, Elmar Degenhart, says that while the company will need to cut production jobs, those will be offset at least in part by the creation of new positions related to electric mobility. "There is enough time to design the process such that the blow is softened and major pain can be avoided," says Degenhart. Some 30,000 jobs at Continental are tied to combustion engines. Read more at Automotive News Europe. Featured Gallery 2017 Cadillac CT6 Plug-in Hybrid View 15 Photos News Source: GM, Green Car Reports, Automotive News EuropeImage Credit: Cadillac Green Hirings/Firings/Layoffs Cadillac GM Green Culture Electric Luxury recharge wrapup

Cadillac considering more radical ATS-V

Tue, May 5 2015Cadillac is stepping up its performance game with the launch of the new ATS-V and CTS-V, but it's not about to rest on the laurels it removed from its own badge. While it's tipped to launch additional V models in the future, the latest word is Caddy could also come out with an even more extreme version of the ATS-V in the near future. According to Car and Driver, the prospect is on the table: "We might have something down the road that is a little bit more aggressive," chief engineer Dave Leone said, while another source pegged its potential arrival for 2017. It's too early to say what would constitute the more extreme model. The magazine points toward the Mercedes-AMG Black Series as an example. Jaguar took a similarly extreme approach with the XKR-S GT, as BMW has with the M3 GTS. As it is, the ATS-V is offered in both coupe and sedan variants with a 3.6-liter twin-turbo V6 producing 464 horsepower channeled to the rear wheels through a six-speed manual. Cadillac reportedly considered employing a dual-clutch transmission and all-wheel drive, but went the old-school route to avoid excess weight and (no doubt) cost.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.059 s, 7882 u