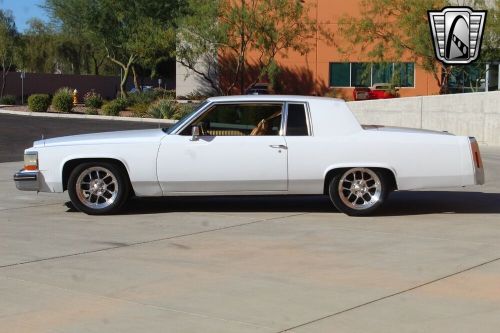

1982 Cadillac Deville on 2040-cars

Engine:Chevrolet 5.3L V8

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1G6AD4783C9150876

Mileage: 20035

Make: Cadillac

Drive Type: 2dr Coupe

Features: --

Power Options: --

Exterior Color: White

Interior Color: Tan

Warranty: Vehicle does NOT have an existing warranty

Model: DeVille

Cadillac DeVille for Sale

2005 cadillac deville dts(US $10,900.00)

2005 cadillac deville dts(US $10,900.00) 1959 cadillac deville(US $95,000.00)

1959 cadillac deville(US $95,000.00) 2005 cadillac deville base 4dr sedan(US $6,900.00)

2005 cadillac deville base 4dr sedan(US $6,900.00) 1992 cadillac deville(US $1,000.00)

1992 cadillac deville(US $1,000.00) 1996 cadillac deville custom package(US $0.99)

1996 cadillac deville custom package(US $0.99) 1979 cadillac deville(US $20,500.00)

1979 cadillac deville(US $20,500.00)

Auto blog

Cadillac Rear Camera Mirror | 2017 Autoblog Technology of the Year Finalist

Wed, Jan 25 2017We give Cadillac a lot of credit for being the first to make good on the promise to replace mirrors with cameras and displays. That was good enough to earn the Cadillac Rear Camera Mirror a place on our 2017 Technology of the Year awards shortlist for new features. The idea behind this system is relatively simple; what perhaps took more doing was getting the regulations in place to allow a video feed to replace the government-mandated mirror. The hardware and that rules compliance starts with what looks like a normal rearview mirror – because it defaults to being a mirror until you switch on the display or in the event the system somehow fails. Flip the little toggle at the bottom of the mirror – the one normally used to switch from day to night mode – and the reflection is replaced by a very crisp feed from a camera at the back of the vehicle. This live stream gives you a wide-angle view of what's behind, without obstruction from back-seat passengers, headrests, or any bodywork. The camera is even shielded from weather and has a coating to shed water. What you see doesn't exactly look like a normal reflection, but the quality is good enough and you see more than you would normally with something aimed through today's small rear windows. But because it isn't actually a reflection, you have to make some adjustments. When your eyes are focused down the road, glancing at a mirror gives you a view the same distance away but in the rear. With the rear camera mirror, a glance back requires your eyes to first refocus on the display, which takes a moment. And unlike a normal mirror, which you look through at an angle, this display is angled toward the driver but projecting an image that looks straight back – no matter how you move it, the image doesn't change like a mirror's would. And because it's an image and not a reflection, you can't choose what's in focus and lose your sense of depth perception. It's not clear whether objects in mirror are closer or farther than they appear. And there are other limitations. For instance, while the display balances bright lights and dark surroundings well at night, it is tricked by LED headlights, which flicker at a rate faster than the camera shoots. The result is a distracting strobe effect like you get when you point a smartphone camera at any LED light source. For those with migraine sensitivity, this kind of fast flashing can cause real problems.

Cadillac says it made CUE infotainment a lot better

Wed, Feb 22 2017We've never been huge fans of CUE, the Cadillac User Experience infotainment interface. It's been around a few years now, and the best thing we can say for it is that it now supports Android Auto and Apple CarPlay, making it easy enough to replace most of the interface with a familiar smartphone-based system. Now Cadillac has made some big upgrades to the system that should address at least some of our concerns. First and foremost, the system is claimed to be more intuitive, with a more logical interface design. Cadillac has added a Summary View that gives an overview of the climate, media, navigation, and phone all at the same time. The system will also be able to receive over-the-air updates, allowing Cadillac to make improvements more often and push them out to owners' cars, mush like Tesla and other automakers already do. The 4G LTE connection will also be used to connect the car with the cloud, where drivers can store and modify their own personalized set of settings. This My Driver Preferences profile will include things like contacts, navigation preferences, and recent destinations, and will also follow them from one car equipped with the system to another. That should come in handy for anyone subscribing to the $1,500-a-month Book by Cadillac vehicle subscription service, which allows participants to swap between cars when they choose. The cloud connection will also carry over to a new available navigation function, which Cadillac claims has a more intuitive, smartphone-like interface. It uses its data connection to provide current destination info and is supposed to learn a driver's habits, such as their preferred routes and frequent destinations, which the system will then attempt to offer up predictively – so the car should be able to know that you're heading home at 5:00. Additional apps for the system will be available through Cadillac's new Collection app store. And it's still compatible with Android Auto and Apple CarPlay. One sore spot that appears to have been improved is the digital gauge package, although Cadillac hasn't offered details on that extension of the system. The current iteration's ability to over-customize the interface (our personal favorite is the option to display a total of four speedometers between the head-up display and the gauge screen; see video below) and unintuitive controls make it difficult to use and learn, while the simulated gauges don't look particularly realistic.

Autoblog Podcast #318

Tue, 29 Jan 2013Toyota back on top, Barrett Jackson, Crowdsourcing your Dodge Dart payments, Nissan and Toyota double down on pickups

Episode #318 of the Autoblog Podcast is here, and this week, Dan Roth, Zach Bowman and Michael Harley talk about Toyota regaining the No. 1 sales crown, getting your friends and family to buy you a Dodge Dart, Barrett-Jackson, and Toyota and Nissan remaining committed to their pickup trucs. We wrap with your questions, and for those of you who hung with us live on our UStream channel, thanks for taking the time. Keep reading for our Q&A module for you to scroll through and follow along, too. Thanks for listening!

Autoblog Podcast #318: