Super Rare 2013 Cts-v Wagon, Every Option, Only 1600 Miles, Aftermarket Exhaust! on 2040-cars

Scottsdale, Arizona, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:6.2L 376Cu. In. V8 GAS OHV Supercharged

Body Type:Wagon

Fuel Type:GAS

Make: Cadillac

Warranty: Vehicle does NOT have an existing warranty

Model: CTS

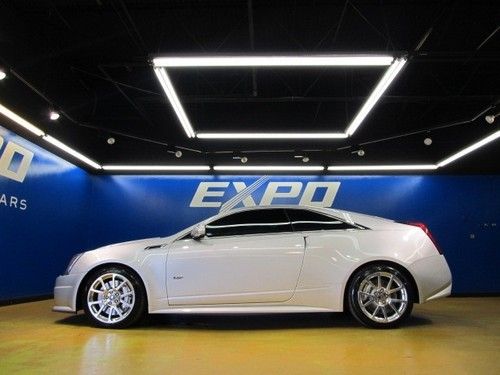

Trim: V Wagon 4-Door

Doors: 4

Drive Type: RWD

Engine Description: 6.2L V8 SFI OHV 16V SUPER

Mileage: 1,659

Sub Model: 5dr Wgn

Number of Cylinders: 8

Exterior Color: Silver

Interior Color: Black

Cadillac CTS for Sale

2010 cadillac cts luxury sedan 4-door 3.0l

2010 cadillac cts luxury sedan 4-door 3.0l 2004 cadillac cts low 73k miles silver with gorgeous tan leather(US $8,500.00)

2004 cadillac cts low 73k miles silver with gorgeous tan leather(US $8,500.00) 2005 cadillac cts base sedan 4-door 3.6l

2005 cadillac cts base sedan 4-door 3.6l 11 cts-v v nav navigation pano roof 6 speed manual supercharged sc v8 leather(US $50,990.00)

11 cts-v v nav navigation pano roof 6 speed manual supercharged sc v8 leather(US $50,990.00) Cadillac cts-v coupe recaro seats sunroof wood trim navigation camera bose usb(US $48,995.00)

Cadillac cts-v coupe recaro seats sunroof wood trim navigation camera bose usb(US $48,995.00) 2013 cadillac cts premium sedan 4-door 3.6l(US $44,225.00)

2013 cadillac cts premium sedan 4-door 3.6l(US $44,225.00)

Auto Services in Arizona

Wright Cars ★★★★★

World Class Automotive Repair ★★★★★

Walt`s Body & Paint, LLC ★★★★★

Upark We Sell IT ★★★★★

Tristan Express Auto Sales ★★★★★

Superstition Springs Lexus ★★★★★

Auto blog

This 1969 Ford F-100 has a Cadillac CTS-V engine lurking underhood

Fri, Jan 30 2015Something always feels just a little taboo when someone builds a custom and then slots in a powertrain from a rival automaker. That's exactly the case with this modded 1969 Ford F-100 boasting a highly tuned LSA supercharged V8 like from the second-gen Cadillac CTS-V. However, with a claimed 800 horsepower on tap thanks in part to running an estimated 20 pounds of boost, it's easy to get over any bad feelings. Built by Tommy Pike Customs in South Carolina, the truck tries to keep the exterior looking somewhat stock. Although, the jade green and satin gold paint, Quaker State logo, lowered suspension and black wheels immediately suggest something is up. Once the F-100 starts up with its menacing growl, absolutely any doubts of this beast being unaltered are immediately gone. Not so obvious are some tweaks to actually help put all that power down, including disc brakes and independent suspension setups at the front and rear. The video gives some glimpses at a few of Pike's other creations, but the real star here is definitely his mean, green Ford.

Kia Seltos, electric Cadillac and a looming Bronco | Autoblog Podcast #615

Fri, Feb 21 2020In this week's Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder, and Associate Editor Byron Hurd makes his ABP debut. This week, they start with the cars they've been driving: the Jaguar XE, Kia Seltos, Hyundai Venue and Ford Escape. Then they dig into the news, including an upcoming Cadillac EV, Lincoln and Chevy sedans and the Ford Bronco. Finally, they help a listener replace his Jeep Patriot in the Spend My Money segment. Autoblog Podcast #615 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving: Jaguar XE 300 R-Dynamic S Kia Seltos Hyundai Venue Ford Escape Cadillac bringing EV to New York Auto Show Chevy and Lincoln dealers say they still want sedans Ford tells dealers the Bronco is weeks away from its global debut Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on iTunes Related Video: 2020 Ford Escape 2.0T #POV drive

Cadillac Celestiq and Honda Civic Type R revealed | Autoblog Podcast #740

Fri, Jul 29 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. They kick things off by talking about the latest vehicle reveals, specifically the Cadillac Celestiq show car and the 2023 Honda Civic Type R. They discuss Chevy's move to offer incentives to help prevent customers from flipping the new Corvette Z06. Greg has spent time behind the wheel of the 2022 Range Rover First Edition, while John has been driving the 2023 Genesis GV60 Performance. From the mailbag, a listener is looking to replace a 2003 Subaru Forester with something that can hold three dog crates and gets decent fuel economy. Another listener asks whether to keep a 2008 Porsche 911 Turbo or replace it with a 992-generation 911 for which he is awaiting an allocation. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #740 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cadillac Celestiq show car revealed 2023 Honda Civic Type R revealed Chevy offers incentives to prevent Corvette Z06 flipping Cars we're driving 2023 Genesis GV60 Performance 2022 Land Rover Range Rover First Edition Spend My Money: Replacing a 2003 Subaru Forester Spend My Money Update: New or 2008 Porsche 911? Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: