2014 Cadillac Cts Luxury on 2040-cars

25191 U.S. Highway 19 N, Clearwater, Florida, United States

Engine:3.6L V6 24V GDI DOHC

Transmission:8-Speed Automatic

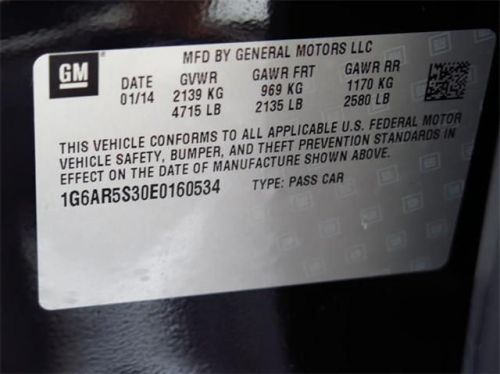

VIN (Vehicle Identification Number): 1G6AR5S39E0163769

Stock Num: E0163769

Make: Cadillac

Model: CTS Luxury

Year: 2014

Exterior Color: Radiant Silver Metallic

Options: Drive Type: RWD

Number of Doors: 4 Doors

Mileage: 14

Dimmitt Automotive is proud to be an official Bentley, Rolls-Royce, Cadillac and Lotus Authorized Dealership. Dimmitt has been in the luxury car business since 1915 in the Tampa Bay Area. We pride ourselves on unsurpassed selection, customer service and providing our clients the top support when purchasing a high line vehicle from us.

Cadillac CTS for Sale

2014 cadillac cts 3.6l luxury(US $54,725.00)

2014 cadillac cts 3.6l luxury(US $54,725.00) 2014 cadillac cts 3.6l luxury(US $54,845.00)

2014 cadillac cts 3.6l luxury(US $54,845.00) 2014 cadillac cts luxury(US $55,615.00)

2014 cadillac cts luxury(US $55,615.00) 2014 cadillac cts luxury(US $56,660.00)

2014 cadillac cts luxury(US $56,660.00) 2014 cadillac cts 3.6l luxury(US $56,880.00)

2014 cadillac cts 3.6l luxury(US $56,880.00) 2014 cadillac cts luxury(US $56,985.00)

2014 cadillac cts luxury(US $56,985.00)

Auto Services in Florida

Xtreme Car Installation ★★★★★

White Ford Company Inc ★★★★★

Wheel Innovations & Wheel Repair ★★★★★

West Orange Automotive ★★★★★

Wally`s Garage ★★★★★

VIP Car Wash ★★★★★

Auto blog

Cadillac says it made CUE infotainment a lot better

Wed, Feb 22 2017We've never been huge fans of CUE, the Cadillac User Experience infotainment interface. It's been around a few years now, and the best thing we can say for it is that it now supports Android Auto and Apple CarPlay, making it easy enough to replace most of the interface with a familiar smartphone-based system. Now Cadillac has made some big upgrades to the system that should address at least some of our concerns. First and foremost, the system is claimed to be more intuitive, with a more logical interface design. Cadillac has added a Summary View that gives an overview of the climate, media, navigation, and phone all at the same time. The system will also be able to receive over-the-air updates, allowing Cadillac to make improvements more often and push them out to owners' cars, mush like Tesla and other automakers already do. The 4G LTE connection will also be used to connect the car with the cloud, where drivers can store and modify their own personalized set of settings. This My Driver Preferences profile will include things like contacts, navigation preferences, and recent destinations, and will also follow them from one car equipped with the system to another. That should come in handy for anyone subscribing to the $1,500-a-month Book by Cadillac vehicle subscription service, which allows participants to swap between cars when they choose. The cloud connection will also carry over to a new available navigation function, which Cadillac claims has a more intuitive, smartphone-like interface. It uses its data connection to provide current destination info and is supposed to learn a driver's habits, such as their preferred routes and frequent destinations, which the system will then attempt to offer up predictively – so the car should be able to know that you're heading home at 5:00. Additional apps for the system will be available through Cadillac's new Collection app store. And it's still compatible with Android Auto and Apple CarPlay. One sore spot that appears to have been improved is the digital gauge package, although Cadillac hasn't offered details on that extension of the system. The current iteration's ability to over-customize the interface (our personal favorite is the option to display a total of four speedometers between the head-up display and the gauge screen; see video below) and unintuitive controls make it difficult to use and learn, while the simulated gauges don't look particularly realistic.

MIT puts V2V technology on its 2015 Top Ten list

Thu, Mar 5 2015Of all the technologies swimming around the automotive world, it is vehicle-to-vehicle communication that the Massachusetts Institute of Technology has fished out as one of its Ten Breakthrough Technologies of 2015. It joined emerging tech like brain organoids, supercharged photosynthesis, and Project Loon on the list, and got the nod over autonomous driving because, as the MIT Technology Review wrote, V2V communication "is likely to have a far bigger and more immediate effect on road safety." How so? Because actual cars transmitting data like their location, speed, steering angle, and state of braking to one another at least ten times per second provides a greater degree of awareness than sensor readings and algorithms. The US Department of Transportation and the National Highway Traffic Safety Administration have been working for years on standards and a regulatory schedule for introducing V2V to the marketplace, and Cadillac plans to incorporate V2V into at least one of its vehicles by 2017. Since we've begun the year with a number of stories of cars being hacked into, that got us wondering about the security of V2V communications. In a recent piece by our own Pete Bigelow on what motorists should know about getting their cars hacked into, he wrote that although cyber break-ins are extremely difficult, expensive, and time-consuming to do remotely, V2V is "one more conceivable avenue a hacker could use to impact multiple cars at a given time." So we spoke to Wilmington, Massachusetts-based Security Innovation about it. The automotive consultancy company has been working with the DOT since 2003 on V2V technology and the issues around it - namely security and privacy - and its chief scientist, William Whyte, is the technical editor of the Institute of Electrical and Electronics Engineers (IEEE) 1609.2 standard outlining its security protocols. Those protocols are expected to be finalized by the DOT toward the end of this year and then come into effect in 2016, and the company's Aerolink product is the security solution Cadillac will use. Whyte said, "If you hack into a car, V2V is the hardest place to start," and Pete Samson, the general manager of Security Innovation's automotive team, said "There are ten or 12 alternate attack surfaces" around the car that would make much easier targets.

2016 Cadillac ELR gets more power, $9,000 price drop

Wed, Apr 15 2015Cadillac has announced a series of updates to the ELR for 2016 that promises to make the plug-in hybrid luxury coupe a more desirable proposition. Perhaps chief among them is a price drop of $9,005 compared to the slow-selling 2014 model. The news follows an announcement yesterday that the Chevy Spark would get a $1,500 price drop. Cadillac is quoting a net price for the updated ELR at $58,495, which is obviously substantially less than the $75k it was asking for the previous version. But it's important to note that the new price is listed after US federal tax credits. The 2014 model came in at $67,500 after the full $7,500 tax credit, so math tells us that Cadillac has slashed the price on the 2016 ELR rather dramatically by about nine grand with a new MSRP of $65,995. One big upgrade on the performance front is a 25-percent boost in output from the hybrid powertrain that marries a pair of electric motors to a 1.4-liter inline-four gasoline-burning generator. The increase is said to be enough to drop 1.5 seconds off the 0-60 time, now quoted at 6.4 seconds. It'll travel for up to 39 miles on electric mode alone, but with the generator spooled up will go up to 330 miles before needing to stop. The engine management software has also been updated and the regenerative braking system reconfigured as well, but GM's luxury division didn't stop at the powertrain, fitting the 2016 ELR with a raft of other enhancements. Visually there's a new grille with the marque's latest emblem embedded. The suspension has been stiffened, the steering recalibrated and the brakes optimized for better feel. Cadillac is also throwing in the previously optional Driver Assistance package of active safety systems as standard, with adaptive cruise control available as an option. And the infotainment system comes with OnStar, 4G LTE connectivity and on-board Wi-Fi. There's even a Performance Package available with 20-inch performance tires offering 10-percent better lateral grip, four-piston Brembo brake calipers up front to help reducing stopping distances by 12 percent, recalibrated dampers and steering and a thicker-rimmed steering wheel. Because of the higher rolling resistance tires, however, the Performance Package kills four miles off of the electric driving range.