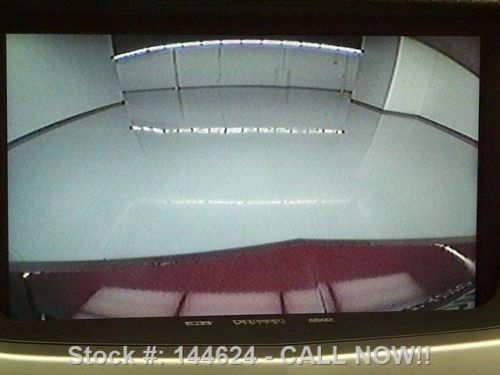

2011 Cadillac Cts4 Performance Awd Nav Rear Cam 16k Mi Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Cadillac CTS for Sale

2008 sedan used 3.6l v6 automatic 6-speed leather black

2008 sedan used 3.6l v6 automatic 6-speed leather black 2011 cadillac rwd sedan premium(US $25,653.00)

2011 cadillac rwd sedan premium(US $25,653.00) 2013 cts-v coupe, 6.2l supercharged, blind spot assist,7k miles,1.49% financing(US $52,950.00)

2013 cts-v coupe, 6.2l supercharged, blind spot assist,7k miles,1.49% financing(US $52,950.00) Prestine condition, no accidents -- we finance!

Prestine condition, no accidents -- we finance! Beautiful florida car only 17k miles bluetooth panoramic roof(US $26,995.00)

Beautiful florida car only 17k miles bluetooth panoramic roof(US $26,995.00) 2009 cadillac ctsv cts v 556 hp supercharged sedan coupe camaro corvette gto

2009 cadillac ctsv cts v 556 hp supercharged sedan coupe camaro corvette gto

Auto Services in Texas

WorldPac ★★★★★

VICTORY AUTO BODY ★★★★★

US 90 Motors ★★★★★

Unlimited PowerSports Inc ★★★★★

Twist`d Steel Paint and Body, LLC ★★★★★

Transco Transmission ★★★★★

Auto blog

GM plans to sell the Chevy Tahoe and Cadillac Escalade in China

Fri, Nov 6 2020General Motors Co plans to sell full-size sport-utility vehicle (SUV) models in China for the first time, and will import a range of models to beef up its product lineup into the world's biggest car market, its China chief told Reuters. The plan would mark a change of tack for GM, which currently produces all of the vehicles it sells in China within the country, which is set to be the only major economy to grow this year amid the COVID-19 pandemic. GM, China's second-biggest foreign automaker, is aiming to offer four models as it looks to improve its brand image and support a sales recovery: Chevrolet's Tahoe and Suburban, Cadillac's Escalade and the GMC Yukon Denali. The Detroit-based company is showcasing those models at the China International Import Expo, or CIIE, an annual import show in Shanghai which started on Wednesday and runs into next week. "Our intention is to get customer reaction and find a way to sell these cars in China," said GM's China chief Julian Blissett. The automaker sees opportunities for such vehicles, partly because Chinese families are expanding, he added. "We are looking into a variety of market sales plans for these vehicles, including online sales, leasing and others," he said, declining to give a detailed timeframe for the plan. GM's Buick and Cadillac mid-size SUVs helped the group's Chinese sales grow 12% in the third quarter this year, the first quarterly growth in the past two years. But it does not have full-size SUV models, which usually have a third row of seats and has room for six or seven people. BATTLEGROUND China, where over 25 million vehicles were sold last year, is a crucial battleground for global automakers including Volkswagen AG, the biggest foreign player by sales volumes, GM and Toyota, as well as local leaders Geely and Great Wall. The country has seen auto sales pick up in recent months following a COVID-19-induced slump, and authorities say they have largely brought the epidemic under control following its emergence in the central city of Wuhan at the end of last year. The expansion plan would also mark GM's first official sales in China of GMC vehicles, a premium brand in the group. Previously GMC vehicles were only sold in the country via unofficial grey importers. The imports will, however, not change GM's basic production strategy in China. It will still mostly sell vehicles made in China - for now, at least. "Depending on however we go we might make other decisions," Blissett said.

GM extends production cuts, affects Cadillacs, Camaro and Acadia

Thu, Apr 8 2021General Motors is extending production cuts at some of its North America factories due to a chip shortage that has roiled the global automotive industry, the U.S. carmaker said on Thursday. The move's impact has been baked into GM's prior forecast that the shortage could shave up to $2 billion off this year's profit. GM's Lansing Grand River assembly in Michigan will extend its downtime through the week of April 26. The plant makes Chevrolet Camaros and Cadillac CT4 and CT5 sedans. It has been out of action since March 15. GM's Spring Hill assembly in Tennessee will shut down for two weeks starting the week of April 12. The plant makes the Cadillac XT5, XT6 and GMC Acadia. The company said it has not taken downtime or reduced shifts at any of its more profitable full-size truck or full-size SUV plants due to the shortage. The news was first reported by CNBC. Reporting by Ankit Ajmera in Bengaluru; Editing by Maju Samuel and Sriraj Kalluvila

Texas sues GM, saying it tricked customers into sharing driving data sold to insurers

Wed, Aug 14 2024Texas filed a lawsuit Tuesday against GM over years of alleged abuse of customers' data and trust. New car owners were presented with a "confusing and highly misleading" process that was implied to be for their safety, but "was no more than a deceptively designed sales flow" that surrendered their data for GM to sell. The suit contends that at no point was selling driving data ever even suggested as a possibility, putting GM in violation of the state's consumer protection laws. Texas Attorney General Ken Paxton is seeking a jury trial and at least $10,000 per offense (every GM car sold in the state since 2015) and a hefty add-on of $250,000 in cases where the victim was over 65. Texas seems to be flying high after a recent $1.4 billion settlement from Meta over other privacy concerns. This may well be a way to solve any pending budgetary issues in the Lone Star State.