1970 Buick Skylark Custom Convertible, Full Custom, Digital Dash, Shaved, Clean! on 2040-cars

Staten Island, New York, United States

Body Type:Convertible

Engine:5.7L 5736CC 350Cu. In. V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 8

Make: Buick

Model: Skylark

Trim: Custom Convertible 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: U/K

Options: Convertible

Mileage: 800

Power Options: Power Top, Power Windows

Exterior Color: Blue

Interior Color: White

Buick Skylark for Sale

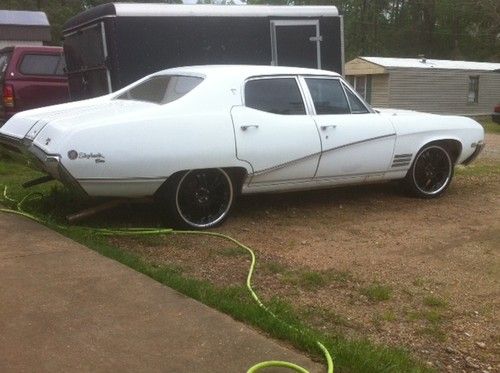

White 1967 2 door buick skylark, v6, auto, ps, 107k,beautiful black cloth inter.

White 1967 2 door buick skylark, v6, auto, ps, 107k,beautiful black cloth inter. 1967 buick skylark convert.

1967 buick skylark convert. 1962 buick skylark base convertible v-8(US $22,750.00)

1962 buick skylark base convertible v-8(US $22,750.00) 1968 buick skylark base sedan 4-door 5.7l(US $3,800.00)

1968 buick skylark base sedan 4-door 5.7l(US $3,800.00) 1971 buick skylark custom convertible 2-door 5.7l

1971 buick skylark custom convertible 2-door 5.7l 1963 buick skylark convertible in broze mist .... excellently restored !

1963 buick skylark convertible in broze mist .... excellently restored !

Auto Services in New York

Wheeler`s Collision Service ★★★★★

Vogel`s Collision Svc ★★★★★

Village Automotive Center ★★★★★

Vail Automotive Inc ★★★★★

Turbine Tech Torque Converters ★★★★★

Top Line Auto Glass ★★★★★

Auto blog

Volvo and GM team with Amazon for in-car deliveries

Tue, Apr 24 2018Volvo and GM are the first automakers to pair their vehicles with a new service from Amazon that lets owners have their packages delivered inside their cars, without them having to be there. The service will initially be rolled out in 37 U.S. cities at no extra charge to Amazon Prime members with a Volvo On Call or OnStar account, and it works with same-day, two-day and standard shipping. It's intended as an alternative for people who don't want to risk having their package stolen from their front porch or receive deliveries at their workplace, and both automakers say it's an example of how they're embracing innovation as a way to make their customers' lives easier. Volvo released a video (above) showing how the service works. Users download the Amazon Key App (or " Ama-zin," as the narrator pronounces it) and link their Amazon Prime account with their Volvo On Call account — or OnStar, in the case of GM-branded vehicles. Once they register their delivery location in a publicly accessible location, users can select the "In-Car" option at checkout. They get a notification when the delivery is en route and once it's completed and the car is relocked. Volvo has been offering in-car delivery in certain European countries since 2015 through its Volvo On Call platform, which enables services like the ability to send calendar-based navigation destinations directly to the vehicle, find nearby gas stations and help locate the vehicle when you forget where you parked it. Volvo says the platform is now available in roughly 50 countries and covers more than 90 percent of its global sales. The service is compatible with 2015 or newer Volvo, Buick, Cadillac, Chevrolet and GMC vehicles. Volvo says it's available to the majority of Volvo owners, while GM says more than 7 million vehicle owners can qualify. The service is expected to roll out to more cities later. You can check eligibility at amazon.com/keyincar. Related Video: Buick Cadillac Chevrolet GM GMC Volvo Technology Infotainment Amazon connected car volvo on call e-commerce

2020 Buick Enclave adds Sport Touring trim, tweaks tech

Wed, Jul 10 2019With its redesign for 2018, the Buick Enclave added the fancy Avenir trim level. Now the 2020 Enclave moves a bit in the other direction with a new Sport Touring model. The Sport Touring package is based on the Essence trim level, and consists of a body-color grille surround in place of chrome, and special 20-inch wheels that combine a bright finish with darker insets. The package doesn't touch the 310-horsepower V6 or the Enclave's suspension, so this development is hardly one to threaten the Ford Explorer ST or the Dodge Durango SRT8. Instead, it is perhaps a baby step toward an Enclave Gran Sport, although we might rather see the Regal TourX wagon move in that direction. Other Enclave news falls into the more traditional Buick wheelhouse. There's a new message function and power lumbar adjustment for the Premium and Avenir models. GM's HD rear vision camera — in which the rear-view mirror can switch to show a wide-angle camera feed — is newly available, as is an HD surround-view feature. In other tech developments, the standard 8-inch touchscreen infotainment system gains new capabilities, now supporting connected navigation and Sirius XM's higher-level 360L service, both of which require a subscription. The 2020 Buick Enclave rolls quietly into dealerships this summer, with an asking price of $41,195.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.