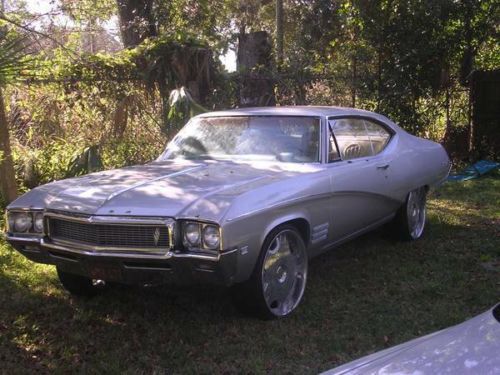

1969 Buick Skylark (picture Link In Description) 350/2brl on 2040-cars

Dover, Ohio, United States

|

**LINK TO SLIDESHOW OF PICTURES**: http://s1175.photobucket.com/user/jjandchrissy/slideshow/1969%20Buick%20Skylark Selling my 1969 Buick Skylark. I bought it in 2006 near Charleston WV and drove it home to Dover, Ohio. It's been a good car and we had a lot of fun joyriding in it. But now we have kids and college funds to start so we've reluctantly decided to sell. I believe everything is original except the paint. Exterior is sharp and has a nice shine to it, the Interior is in great shape other than a small rip above the rear window crank. The radio turns on but no stations come thru since the antenna is broken. A new antenna is included with the sale. (I never got around to putting it on) Dash clock doesn't work. All other gauges, lights and switches work. Engine is a 350-2, it has always started easy and runs well. About 2 years ago I began to have trouble with it overheating. My mechanic decided heat was leaking from the manifolds, so he took them apart and sanded them down to make a tighter fit. It has overheated once since the repair so I'm not sure if the issue is fully resolved. The brakes need some work. I think the break booster has gone bad. Included with sale: ~Original Owner's Manual ~A bag of misc. light bulbs and fuses. ~Two spare tires ~Jumper cables ~Fire extinguisher ~New antenna ~Two car covers |

Buick Skylark for Sale

1964 buick skylark convertible(US $5,000.00)

1964 buick skylark convertible(US $5,000.00) 1963 buick skylark convertible very original car(US $16,500.00)

1963 buick skylark convertible very original car(US $16,500.00) 1965 buick skylark base convertible 2-door 4.9l(US $8,900.00)

1965 buick skylark base convertible 2-door 4.9l(US $8,900.00) 1968 buick skylark convertible. great condition! beautiful car... no reserve

1968 buick skylark convertible. great condition! beautiful car... no reserve Collectors cars(US $2,500.00)

Collectors cars(US $2,500.00) 1954 buick skylark base convertible 2-door 5.3l(US $55,000.00)

1954 buick skylark base convertible 2-door 5.3l(US $55,000.00)

Auto Services in Ohio

Zehner`s Service Center ★★★★★

Westlake Auto Body & Frame ★★★★★

Wellington Auto Svc ★★★★★

Walt`s Auto Inc ★★★★★

Waikem Mitsubishi ★★★★★

Vin Devers- Auto Haus of Sylvania ★★★★★

Auto blog

Buick Encore blitzes first-year sales predictions

Sat, 01 Mar 2014With its first full year of sales in the bag, it's safe to say that Buick has a hit on its hands with the Encore. US buyers have snatched up 31,046 of the small, premium crossovers since the Encore went on sale in January of 2013, while 97,311 were sold globally (not counting its counterparts from Opel and Vauxhall).

While we liked the Encore when we first drove it, we'll admit, we weren't sure how the tiny CUV would do. In fact, the first thing Executive Editor Chris Paukert wrote about the Encore was, "We admit it. We have no earthly idea how this whole thing is going to shake out." But it's done well, and has been subject to heavy demand over the past year, blowing away the estimates of analysts, who, according to an August story from Automotive News, projected no more than 18,500 units would be sold in 2013.

"Right out of the gate, demand for the Encore was high," Tony DiSalle, vice president of Buick marketing said in a statement. "It accounted for most of the segment's growth last year and that's because it offers the right safety, technology and features in the right-sized vehicle for many customers."

GM promises to add 20 EVs and fuel-cell cars to lineup, paid for by SUVs

Mon, Oct 2 2017DETROIT — General Motors outlined plans on Monday to add 20 new battery electric and fuel-cell vehicles to its global product lineup by 2023, financed by robust profits from sales of gasoline-fueled trucks and sport utility vehicles in the United States and China. "General Motors believes in an all-electric future," GM global product development chief Mark Reuss said on Monday during a briefing at the company's suburban Detroit technical center. Future generations of GM electric vehicles "will be profitable," Reuss said, but added it was not clear when GM could make all its new vehicle offerings zero-emission electric cars. Regulators in China and some European countries have floated proposals to ban internal combustion engines by 2030 or 2040. "We will continue to make sure our internal combustion engines will get more and more efficient," Reuss said. GM shares were up more than 4 percent in midday New York trading on positive comments from Rod Lache, auto analyst at Deutsche Bank. Automakers, including electric vehicle market leader Tesla, lose money on electric cars because battery costs are still higher than comparable internal combustion engines. The company offered sneak peeks of three EV prototypes: a Buick SUV, a sporty Cadillac wagon and a futuristic pod car wearing a Bolt badge. GM funds its forays into new technology using a river of cash generated by old-technology vehicles popular with its core customer base in the United States heartland. In comparison, Tesla has burned through an estimated $10 billion in cash and has yet to show a full year profit. GM earned more than 90 percent of its $12.5 billion in pretax profits last year in North America, amid robust demand for its lineup of large sport utility vehicles and pickup trucks. The company's profitable operations in China rely on consumer demand for an expanding lineup of gasoline powered SUVs. GM has previously announced plans to make some of its future electric vehicles capable of driving themselves in robot taxi fleets. The company offered sneak peeks of three electric vehicle prototypes: a Buick brand sport utility vehicle, a sporty Cadillac wagon and a futuristic pod car wearing a Bolt badge. GM collaborated with Korean battery maker LG Chem to build the Bolt battery system. Company officials did not say what companies would supply batteries for the larger fleet of vehicles promised by 2023. Fuel-cell vehicles will also play a role in GM's future, the company said.

GM earnings rise 1% as buyers pay more for popular pickups

Thu, Aug 1 2019DETROIT — General Motors said Thursday that higher prices for popular pickup trucks and SUVs helped overcome slowing global sales and profit rose by 1% in the second quarter. The Detroit automaker said it made $2.42 billion, or $1.66 per share, from April through June. Adjusting for restructuring costs, GM made $1.64 per share, blowing by analyst estimates of $1.44. Quarterly revenue fell 2% to $36.06 billion, but still beat estimates. Analysts polled by FactSet expected $35.97 billion. Global sales fell 6% to 1.94 million vehicles led by declines in North America and Asia Pacific, Middle East and Africa. The company says sales in China were weak, and it expects that to continue through the year. In the United States, customers paid an average of $41,461 for a GM vehicle during the quarter, an increase of 2.2%, as buyers went for loaded-out pickups and SUVs, according to the Edmunds.com auto pricing site. The U.S. is GM's most profitable market. Chief Financial Officer Dhivya Suryadevara said she expects the strong pricing to continue, especially as GM rolls out a diesel pickup and new heavy-duty trucks in the second half of the year. "We think the fundamentals do remain strong, especially in the truck market," she said, adding that strength in the overall economy and aging trucks now on the road should help keep the trend going. Light trucks accounted for 83.1% of GM's sales in the quarter, and pickup truck sales rose 8.5% as GM transitioned to new models of the Chevrolet Silverado and GMC Sierra, according to Edmunds, which provides content to The Associated Press. As usual, GM made most of its money in North America, reporting $3 billion in pretax earnings. International operations including China broke even, while the company spent $300 million on its GM Cruise automated vehicle unit. Its financial arm made $500 million in pretax income. Suryadevara said GM saw $700 million in savings during the quarter from restructuring actions announced late last year that included cutting about 8,000 white-collar workers through layoffs, buyouts and early retirements. The company also announced plans to close five North American factories, shedding another 6,000 jobs. About 3,000 factory workers in the U.S. whose jobs were eliminated at four plants will be placed at other factories, but they could have to relocate. GM expects the restructuring to generate $2 billion to $2.5 billion in annual cost savings by the end of this year.