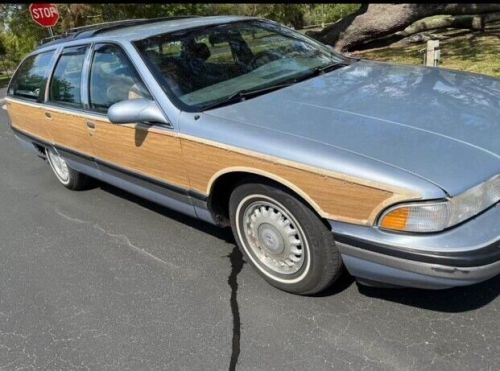

1993 Buick Roadmaster on 2040-cars

Hesperia, California, United States

Transmission:Automatic

Vehicle Title:Clean

Fuel Type:Gasoline

Year: 1993

VIN (Vehicle Identification Number): 1g4br8372pw402837

Mileage: 150301

Interior Color: Blue

Number of Seats: 3

Exterior Color: Blue

Model: Roadmaster

Number of Doors: 4

Make: Buick

Buick Roadmaster for Sale

1996 buick roadmaster base(US $100.00)

1996 buick roadmaster base(US $100.00) 1941 buick series 71c roadmaster convertible phaeton(US $69,900.00)

1941 buick series 71c roadmaster convertible phaeton(US $69,900.00) 1947 buick roadmaster(US $23,700.00)

1947 buick roadmaster(US $23,700.00) 1955 buick roadmaster original numbers matching(US $26,000.00)

1955 buick roadmaster original numbers matching(US $26,000.00) 1949 buick roadmaster(US $23,000.00)

1949 buick roadmaster(US $23,000.00) 1993 buick roadmaster estate wagon(US $19,995.00)

1993 buick roadmaster estate wagon(US $19,995.00)

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

2023 Chicago Auto Show Mega Photo Gallery: See all the new cars from the show

Thu, Feb 16 2023The 2023 Chicago Auto Show played host to a number of reveals this year, and we were there to capture all of them. In traditional auto show fashion, that means you’re getting a mega gallery of galleries to flip through and see all the vehicles on the show floor. Our EditorsÂ’ Picks from the show are already out — spoiler alert, the 2024 Toyota Grand Highlander took home the prize. That said, there were other important reveals like the 2024 Volkswagen Atlas and Atlas Cross Sport and the 2024 Subaru Crosstrek. We also learned some interesting tidbits, such as the fact that VW is considering a pickup, and Jeep owners really are plugging in. To see the photos, scroll on down and start flipping through those galleries.  2024 Toyota Grand Highlander 2024 Toyota Grand Highlander View 7 Photos 2024 Volkswagen Atlas 2024 Volkswagen Atlas View 14 Photos 2024 Volkswagen Atlas Cross Sport 2024 Volkswagen Atlas Cross Sport View 7 Photos 2024 Ford Mustang Dark Horse with its carbon fiber wheels 2024 Ford Mustang Dark Horse with carbon fiber wheels View 7 Photos 2024 Chevrolet Corvette E-Ray 2024 Chevrolet Corvette E-Ray View 10 Photos Jeep Wrangler Anniversary Editions Jeep Wrangler Anniversary Editions View 3 Photos 2023 BMW XM 2023 BMW XM View 6 Photos Ram Revolution Concept Ram Revolution Concept View 6 Photos NASCAR Chicago Street Race Pace Car — Toyota Camry NASCAR Chicago Street Race Pace Car ? Toyota Camry View 4 Photos Everything else at the 2023 Chicago Auto Show Lamborghini Countach LPI 800-4 View 12 Photos Related video: Chicago Auto Show BMW Buick Chevrolet Ford GM GMC Hummer Jeep Lamborghini RAM Toyota Volkswagen Truck Coupe Crossover SUV Concept Cars Electric Hybrid Luxury Off-Road Vehicles Performance Supercars Sedan

Submit your questions for Autoblog Podcast #310 LIVE!

Mon, 26 Nov 2012We record Autoblog Podcast #310 tonight, and you can drop us your questions and comments regarding the rest of the week's news via our Q&A module below. Subscribe to the Autoblog Podcast in iTunes if you haven't already done so, and if you want to take it all in live, tune in to our UStream (audio only) channel at 10:00 PM Eastern tonight.

Discussion Topics for Autoblog Podcast Episode #310

Buick GN and GNX will return

The 2020 Buick LaCrosse we won't get looks exceptional

Thu, Mar 7 2019GM is killing off the Buick LaCrosse in the United States after the 2019 model year, but elsewhere it lives on. Buried by all the Geneva news this week, GM quietly took the wraps off a 2020 Buick LaCrosse facelift for China. It only makes sense to keep selling the big Buick in the popular Chinese market (now Buick's largest), but we're a tad jealous of what we can't have stateside. The changes Buick has implemented make the LaCrosse into a far more handsome option. Both the front and rear get massaged here. A new horizontal patterned grille, slimmer headlights with a neat LED design, plus new lower bumper surround all work together to provide a more upscale look. The view out back is an even larger departure from the old and somewhat awkward rear end on the 2019 LaCrosse. Smaller, flowing taillights mesh well with the chrome strip on the trunk lid, then dual exhaust outlets offer a sporty flair to the squat rear end. The Buick badge looks cohesive with the look as a whole now, instead of just chilling out alone on the expansive trunk lid. An updated powertrain package goes along with the new looks, too. GM is snagging its new 2.0-liter turbocharged four-cylinder LSY engine it uses in the Cadillac XT4 for duty here. It makes 237 horsepower and 258 pound-feet of torque, and is mated to GM's nine-speed automatic transmission. China will be the only market to see this generation of LaCrosse as GM plans to exclusively produce it in its Shanghai facility. The Detroit-Hamtramck plant that previously made it for all North American markets was among those facilities GM announced would close, bringing with it the LaCrosse and other vehicles. Related video: