Attention Getting Buick With Everything New In 2013 on 2040-cars

New Hartford, New York, United States

|

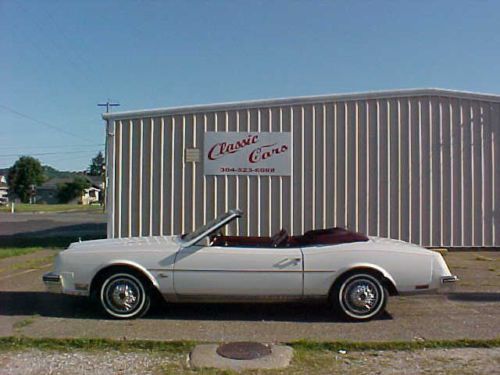

I bought this beauty in Jan. 2014. She was sold new in Georgia and parked from 1963 to 1989. V8 engine was rebuilt in 1990. Does not have power steering and has a 12 volt system. Clock and radio do not work which is normal. All other gauges do work. Previous owner spent $13k in 2013 and I have every receipt. 3000 paint, 3800 entire new interior, 2800 new tires and wire wheels, 1775 engine and brakes, 1150 chrome, 635 carb. Most chrome replated and in good condition but some small flaws. This big lady starts, stops, runs and drives nice. I have driven her 400 miles so far. I love all cars and I need to sell this one to buy something different. Thanks for looking. Call Jerry with any questions 315-264-1061 |

Buick Riviera for Sale

1968 buick riviera base hardtop 2-door 7.0l

1968 buick riviera base hardtop 2-door 7.0l 1968 buick riviera gs tuxedo black 430 ci/360 hp factory a/c 1 family owned

1968 buick riviera gs tuxedo black 430 ci/360 hp factory a/c 1 family owned 1979 buick riviera

1979 buick riviera Original family owned 1971 model with original factory custom trim & vinyl top!(US $18,500.00)

Original family owned 1971 model with original factory custom trim & vinyl top!(US $18,500.00) 1982 buick riviera convertible(US $14,800.00)

1982 buick riviera convertible(US $14,800.00) 1970 buick riviera good driver, straight body,good seat.

1970 buick riviera good driver, straight body,good seat.

Auto Services in New York

Wayne`s Auto Repair ★★★★★

Vk Auto Repair ★★★★★

Village Auto Body Works Inc ★★★★★

TOWING BROOKLYN TODAY.COM ★★★★★

Total Performance Incorporated ★★★★★

Tom & Arties Automotive Repair ★★★★★

Auto blog

GM may kill 6 car models as it works with UAW to tackle sales slump

Fri, Jul 21 2017The president of the United Auto Workers union said on Thursday the union is talking with General Motors about the potential threat to plants and jobs from slumping U.S. car sales. GM's response will be more trucks and SUVs, and sources say at least six slow-selling car models may be killed off. "We are talking to (GM) right now about the products that they currently have" at underused car plants such as Hamtramck in Michigan and Lordstown in Ohio, and whether they might be replaced with newer, more popular vehicles such as crossovers, Dennis Williams told reporters. "We are tracking it (and) we are addressing it," Williams added. GM has cut shifts at several U.S. plants this year as inventories of unsold cars have ballooned. Industry analysts said more jobs could be at risk as the automaker wrestles with permanently shrinking production of small and midsized sedans. GM is reviewing whether to cancel at least six passenger cars in the U.S. market after 2020, including the Chevrolet Volt hybrid, which could be replaced in 2022 with a new gasoline-electric crossover model, Reuters has learned from people familiar with the plans. Other GM cars at risk include the Buick LaCrosse, Cadillac CT6, Cadillac XTS, Chevrolet Impala and Chevrolet Sonic, sources said. Some analysts have singled out GM's Hamtramck plant in Detroit as one of the most vulnerable because of plummeting car sales. The plant, which opened in 1985, builds four slow-selling models: Buick LaCrosse, Chevrolet Impala, Cadillac CT6 and Chevrolet Volt. In the first half, it built fewer than 35,000 cars, down 32 percent from the same period in 2016, according to suppliers familiar with GM's U.S. production schedule. The typical GM assembly plant builds 200,000-300,000 vehicles a year.COMING ATTRACTIONS: TRUCKS AND SUVS GM must "create some innovative new products" to replace slow-selling sedans "or start closing plants," said Sam Fiorani, vice president of AutoForecast Solutions. The auto maker already has begun to shift future production plans from cars to trucks, according to Morgan Stanley auto analyst John Murphy. He estimates that fewer than 10 percent of the new vehicle models that GM will introduce over the next four years will be passenger cars, with the rest divided among trucks, SUVs and crossovers. GM plans to add production of the new Cadillac XT4 crossover next year to its Malibu sedan plant in Fairfax, Kansas.

Why Buick's Encore wasn't a Chevy

Wed, 31 Oct 2012Buick is taking a gamble with its 2013 Encore. General Motors' near-luxury brand has enjoyed great success attracting conquest buyers to its larger Enclave crossover, but it has never offered something quite like this small CUV.

Very early signs suggest that the gamble might be working. According to Mark Reuss, President of General Motors, the automaker expected about 1,500 initial orders from its dealers for the Encore, but it's tracking closer to 9,000 units. Alluding to the fact that historically, Buick has shared similar products with GM's other brands, Reuss says that Buick dealers are "thrilled to have an exclusive." The automaker already markets almost identical models in other markets as the Opel/Vauxhall Mokka and Chevrolet Trax, but The General's other brands won't offer a twin to the new baby Buick.

The new Encore is based on the Gamma architecture that underpins the Chevrolet Sonic, and it shares the economy car's available turbocharged 1.4-liter four-cylinder engine. With standard front-wheel drive and available all-wheel drive, GM says its Encore will be pitted against competitors like the BMW X1 and Audi Q3, both of which are much more expensive but also much more powerful.

Neil Young to auction model train collection, classic cars

Thu, Nov 2 2017LOS ANGELES — Rock singer Neil Young is selling some of his most prized possessions — part of his model train and classic car collections. The Canadian folk-rock star is putting more than 230 of his vast collection of Lionel trains and some of his cars up for auction in Los Angeles in December. Some of the trains have estimated selling prices of up to $9,000, Julien's Auctions said on Thursday. Young, 71, known for his Woodstock-era songs as well as "Ohio," "Heart of Gold" and many, many others, has been a passionate model train enthusiast for more than 20 years. His collection and vast layouts at his California ranch took off in the early 1990s as a means of connecting with his son Ben, who has cerebral palsy, Young said. Young is also selling some of his classic car collection. They include: A first-in-production 1953 Buick Roadmaster Skylark convertible 50th anniversary special edition, with a steering wheel hub saying "customized for Neil Young," that has a pre-auction estimate of $200,000 to $300,000. A 1954 Cadillac Fleetwood Imperial eight-passenger limousine (estimate $30,000-$40,000) with the Cadillac crest styled "Broken Arrow" emblem on the rear passenger door, referring to both the Buffalo Springfield song and his ranch of the same name in Portola Valley, Calif. A 1948 Buick Roadmaster Hearse built by Flxible (estimate: $8,000-$10,000) used by Young and his band, The Squires, to haul equipment to gigs in the early 1960's. Dubbed "Mortimer," it's decorated with backstage passes and bumper stickers, and it inspired Young's song "Long May You Run." A 1941 Chrysler Series 28 Windsor Highlander two-door, three-person coupe (estimate: $15,000-$20,000), considered Chrysler's most prestigious model in its day. (For a closer look at Young's lifetime interest in cars, here's a New York Times interview from 2012, which includes an anecdote about the time he ate road tar. Or his memoir "Special Deluxe: A Memoir of Life & Cars," in which he recounts every car he ever owned, and describes how he wrote the lyrics for "Like a Hurricane" in the back of a friend's 1950 DeSoto. He promoted the book in this NPR interview. He also tipped us off to the return of the Lincoln Continental, and is known for his LincVolt plug-in biodiesel 1960 Lincoln.) As for Young's train collection, he designed a remote control that allows multiple trains to run at once, and a device that delivers realistic railroad audio to help his son get the most of out the hobby.