1973 Riviera 'undocumented' Gs Stage One Car~no Rust~no Accidents~great Driver! on 2040-cars

Santa Monica, California, United States

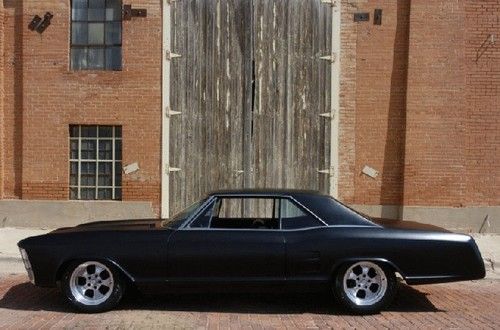

Body Type:Coupe

Engine:455 V8

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 8

Make: Buick

Model: Riviera

Trim: Neytral Trim

Warranty: Vehicle does NOT have an existing warranty

Drive Type: 2WD

Power Options: Air Conditioning, Power Windows

Mileage: 0

Sub Model: 455 V8 GS STAGE ONE COUPE

Exterior Color: White

Number of Doors: 2

Interior Color: Neutral

Buick Riviera for Sale

1983 buick riviera xx anniversary edition coupe 2-door 5.0l

1983 buick riviera xx anniversary edition coupe 2-door 5.0l 1964 buick riviera 2 door hardtop fully customized hollywood car(US $24,500.00)

1964 buick riviera 2 door hardtop fully customized hollywood car(US $24,500.00) 1973 buick riviera

1973 buick riviera 1965 buick riviera gran sport w/dual quads & posi. immaculate! true gs!(US $55,000.00)

1965 buick riviera gran sport w/dual quads & posi. immaculate! true gs!(US $55,000.00) No reserve clean carfax auto 3.8l v6 4dr sdn keyless entry alloy wheels

No reserve clean carfax auto 3.8l v6 4dr sdn keyless entry alloy wheels Restored 1964 buick riviera #'s matching 425 nail head loaded with power options(US $21,895.00)

Restored 1964 buick riviera #'s matching 425 nail head loaded with power options(US $21,895.00)

Auto Services in California

Zube`s Import Auto Sales ★★★★★

Yosemite Machine ★★★★★

Woodland Smog ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Service ★★★★★

Western Brake & Tire ★★★★★

Auto blog

Opel Insignia OPC getting facelift. Will the Buick Regal GS see it, too?

Tue, 07 Aug 2012We've seen spy shots of the base Opel Insignia wearing facelifted front and rear ends, and now it appears that the more potent OPC version will be benefitting from a nip/tuck, as well.

The front bumper has been redesigned, incorporating new air intakes - toned-down versions of the model's signature fangs - as well as a new grille. Out back, there will be minimal changes to the overall fascia, most likely stuff like slightly redesigned taillamps, and inside, these spy shots show a larger navigation/infotainment screen sitting atop the center console.

This is all well and good for the Insignia, but we're wondering how these changes will impact North America's Buick Regal GS. No, it may not share the same powertrain punch as the Euro-spec OPC, but visually, the cars are nearly identical. When questioned about possible changes for the GS, a Buick spokesperson told us that the automaker "can't comment" on any changes at this point. Even so, we wouldn't be surprised if some small changes come our way in the next year or so.

2019 Buick Regal GS Review | Because Buicks are allowed to be cool, too

Mon, May 27 2019Buick continues to try to convince everyone that its cars are cool, but we still haven't seen much evidence of this working. However, the 2019 Buick Regal GS is exactly the car that can help change people's minds about Buick in 2019. It has big red Brembos sitting inside superbly stylish wheels, bright red GS emblems everywhere, aggressive bodywork and some of the best sport seats in any car today. Buick truly made the GS look the part, and if you can get past the brand's Wal-Mart greeter personality, you're going to like the way it drives, too. The Regal GS is powered by GM's 3.6-liter V6 that makes a healthy 310 horsepower and 282 pound-feet of torque in this application. That gets mated to a nine-speed automatic transmission, which is the only option for the GS this time around. The previous generation Regal GS offered a six-speed manual, but we weren't missing it too badly here. With seemingly every car under the sun going the turbocharged route, it was refreshing to see GM use a big, naturally aspirated V6. Even stranger was that the Regal GS before this one was boosted, so you could say GM went the opposite direction of the industry trend. That previous GS made 270 horsepower and 295 pound-feet of torque from its turbocharged 2.0-liter four cylinder. So, while the V6 beats it by 40 horsepower, the old GS has it by 13 measly pound-feet of torque. Still, we dig the V6, because this car's power delivery is fantastic with a snarly but restrained exhaust note to go with. My largest quibble is taking off from a stop. The GS's throttle response is a little numb from the get-go, but put any revs to it and the car is ready to leap forward at any speed. This immediacy is increased when you put it into "GS" mode, which sharpens up the throttle, quickens shifts, stiffens the suspension, sends more power to the rear wheels and makes the steering heavier. The nine-speed is seamless and unobtrusive in traffic, but offers up surprisingly quick shifts when you're flat-out. Most of the time I end up ignoring the paddle shifters on cars with torque converter automatics, so I wasn't exactly missing them here. You can select the gears via the gear lever's slapstick function if you really want to, but it's hardly more engaging than just letting the car go at it. In GS mode it holds gears long enough and resists shifting out of the power band. During fall-attack on a backroad, it works smart and is on-par with the eight-speed in our Stinger GT long-termer.

Bring back the Bronco! Trademarks we hope are actually (someday) future car names

Tue, Mar 17 2015Trademark filings are the tea leaves of the auto industry. Read them carefully – and interpret them correctly – and you might be previewing an automaker's future product plans. Yes, they're routinely filed to maintain the rights to an iconic name. And sometimes they're only for toys and clothing. But not always. Sometimes, the truth is right in front of us. The trademark is required because a company actually wants to use the name on a new car. With that in mind, here's a list of intriguing trademark filings we want to see go from paperwork to production reality. Trademark: Bronco Company: Ford Previous Use: The Bronco was a long-running SUV that lived from 1966-1996. It's one of America's original SUVs and was responsible for the increased popularity of the segment. Still, it's best known as O.J. Simpson's would-be getaway car. We think: The Bronco was an icon. Everyone seems to want a Wrangler-fighter – Ford used to have a good one. Enough time has passed that the O.J. police chase isn't the immediate image conjured by the Bronco anymore. Even if we're doing a wish list in no particular order, the Bronco still finds its way to the top. For now (unfortunately), it's just federal paperwork. Rumors on this one can get especially heated. The official word from a Ford spokesman is: "Companies renew trademark filings to maintain ownership and control of the mark, even if it is not currently used. Ford values the iconic Bronco name and history." Trademarks: Aviator, AV8R Company: Ford Previous Use: The Aviator was one of the shortest-run Lincolns ever, lasting for the 2003-2005 model years. It never found the sales success of the Ford Explorer, with which it shared a platform. We Think: The Aviator name no longer fits with Lincoln's naming nomenclature. Too bad, it's better than any other name Lincoln currently uses, save for its former big brother, the Navigator. Perhaps we're barking up the wrong tree, though. Ford has made several customized, aviation themed-Mustangs in the past, including one called the Mustang AV8R in 2008, which had cues from the US Air Force's F-22 Raptor fighter jet. It sold for $500,000 at auction, and the glass roof – which is reminiscent of a fighter jet cockpit – helped Ford popularize the feature. Trademark: EcoBeast Company: Ford Previous Use: None by major carmakers.