1955 Buick Riviera on 2040-cars

Hughson, California, United States

Fuel Type:Gasoline

Body Type:Coupe

Vehicle Title:Clean

VIN (Vehicle Identification Number): 4B2072239

Mileage: 23326

Number of Doors: 2

Interior Color: Tan

Make: Buick

Number of Seats: 4

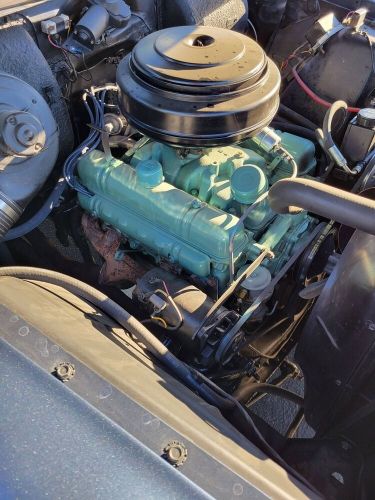

Number of Cylinders: 8

Exterior Color: Blue

Model: Riviera

Buick Riviera for Sale

1998 buick riviera coupe low 79k miles accident free non-smoker!(US $9,999.00)

1998 buick riviera coupe low 79k miles accident free non-smoker!(US $9,999.00) 1950 buick riviera(US $4,209.00)

1950 buick riviera(US $4,209.00) 1963 buick riviera(US $32,500.00)

1963 buick riviera(US $32,500.00) 1968 buick riviera(US $22,990.00)

1968 buick riviera(US $22,990.00) 1969 buick riviera(US $11,000.00)

1969 buick riviera(US $11,000.00) 1969 buick riviera(US $26,000.00)

1969 buick riviera(US $26,000.00)

Auto Services in California

Zube`s Import Auto Sales ★★★★★

Yosemite Machine ★★★★★

Woodland Smog ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Service ★★★★★

Western Brake & Tire ★★★★★

Auto blog

GM’s Charlie Wilson was right: Stronger regulations can help U.S. automakers

Fri, Oct 26 2018Charlie Wilson had been the president and CEO of General Motors before being nominated to become secretary of defense by Dwight Eisenhower. During his Senate confirmation hearings, he controversially said, "For years I thought what was good for our country was good for General Motors, and vice versa." And he was right. While car companies aren't necessarily the most progressive when it comes to things that might have the slightest possibility of political blowback, General Motors should be credited for doing something absolutely forthright in this regard with its announcement that it wants the federal U.S. government not to squash the California Air Resources Board's emissions requirements but to actually create a 50-state "National Zero Emissions Vehicle" program that, in the words of Mark Reuss, executive vice president and president, Global Product Group and Cadillac, "will drive the scale and infrastructure investments needed to allow the U.S. to lead the way to a zero emission future." Filing comments to the Safer Affordable Fuel-Efficient Vehicles Rule for Model Years 2021-2026 Passenger Cars and Light Trucks is one thing. But a graphic the company developed for this announcement — shown above — is something else entirely, something that is absolutely credible, creative and clever. There is a photo of a Chevrolet Bolt EV driving along a highway, which seems to be in Marin County (based on the blurred San Francisco skyline in the background). Text on the photo states: "It's Time for American Leadership in Zero Emissions Vehicles." It seems to say, in effect, "If we want to make America great again, then we're going to do it by leading in technology, not by retreating behind weakened regulations." General Motors understands that the auto market is globally competitive, and if U.S.-based companies are going to be in the game, then they'd better be able to out-innovate the companies based elsewhere, where emissions and economy standards are not being weakened. What's good for our country ... Related Video:

2018 Kia Stinger vs. other luxury hatchbacks compared by the numbers

Sat, Nov 18 2017Ten years ago, if you had told us that one of the many new luxury segments to develop would be sedan-style hatchbacks, we'd have said you'd lost your mind. And yet, here we are today with not one, but four cars competing in just such a niche upscale segment: The Kia Stinger, Buick Regal Sportback, BMW 3 Series Gran Turismo and Audi A5. That's just in one size and price bracket. Two of the manufacturers listed here make larger versions of each luxury hatchback. We aren't entirely sure how it happened, but we're not going to complain, because we love the idea of a car with almost no compromise: luxury features, sporty performance, and plenty of practicality. Try Autoblog' s Car Finder to search for your next new vehicle. One of the reasons we're taking a look at these cars right now is that Kia has recently released pricing for its entry in the segment, the Stinger and Stinger GT. Buick wasn't far behind with the Regal Sportback and Regal GS, nor was Audi with the A5 and S5. So it seemed like an appropriate moment to look at the numbers and see which come out ahead or behind, with victors in each category highlighted with bold and underlined text. What we found when comparing these cars' statistics is that each one has a clear area of expertise. For performance, it's hard to beat the four-cylinder Kia Stinger and the V6 Stinger GT. The four-banger has the most horsepower of the four cars, and is just behind on torque. The V6 has the most power and torque among the six-cylinder versions. The Stingers are also the second lightest of the group when equipped with rear-wheel drive, though they fall to third with all-wheel drive. Space is a split between the Buick Regals and BMW 3 Series Gran Turismos. The Buicks have the most cargo space with the rear seats up or folded by a significant margin. The BMW on the other hand generally offers more space for passengers. It's up to you what's most important. Compare these and other potential new vehicle purchases using our tool. When it comes to cost, nothing can beat the four-cylinder Regal's base price of under $26,000. But if a V6 is what you're after, the Stinger GT is the cheapest. Neither matches the Audi A5 and S5 for fuel economy, though. Both Audis have the highest numbers for city, highway, and combined EPA estimates. Related Video:

1969 Chevrolet Chevelle vs 1987 Buick GNX in Generation Gap showdown

Wed, 15 Oct 2014Generation Gap generally tries to adhere to a theme for each episode, and for the final video from the Lingenfelter collection, the series might have its best idea yet - limited-production muscle cars from General Motors.

On one side you get a 1969 Chevrolet Chevelle COPO, and it's an absolute sleeper. Other than the SS wheels, this classic coupe looks practically bone stock, at least until the engine fires up. Under the hood is a 427-cubic-inch (7.0-liter) V8 making a claimed 425 horsepower and 460 pound-feet of torque. This was the sole year for the COPO package on the Chevelle, and Chevy only made about 323 of them.

The Chevelle's challenger is almost as rare and arguably just as cool. The 1987 Buick Grand National GNX looks just as mean today as when new. It eschews a traditional muscular V8 in favor of a 3.8-liter turbo V6 making a claimed 276 hp and 360 lb-ft, although that number is supposedly a bit underrated. Also, just 547 examples of the GNX version were ever built making it quite a collector's item too.