As-is No Reserve Doesnt Run Sunroof Leather Auto Plan To Bid Plan To Pay on 2040-cars

Baltimore, Maryland, United States

Vehicle Title:Clear

Engine:3.8L 3800CC 231Cu. In. V6 GAS OHV Naturally Aspirated

For Sale By:Dealer

Body Type:Sedan

Fuel Type:GAS

Make: Buick

Warranty: Vehicle does NOT have an existing warranty

Model: Park Avenue

Trim: Base Sedan 4-Door

Options: Sunroof

Power Options: Power Locks

Drive Type: FWD

Mileage: 169,642

Number of Doors: 4

Sub Model: 4dr Sdn

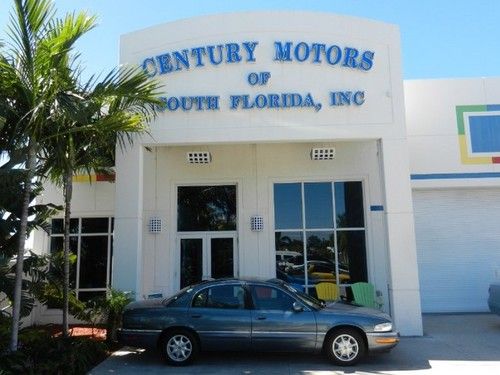

Exterior Color: Green

Number of Cylinders: 6

Interior Color: Gray

Buick Park Avenue for Sale

2005 buick park ave. silver, loaded, leather, nice. no reserve!!!!!

2005 buick park ave. silver, loaded, leather, nice. no reserve!!!!! Florida car with a clean carfax. prestige option pck $2,140+ feature pck $2,150(US $10,900.00)

Florida car with a clean carfax. prestige option pck $2,140+ feature pck $2,150(US $10,900.00) 2002 buick park avenue 45,200 miles 1-owner florida leather dual power seats!(US $8,900.00)

2002 buick park avenue 45,200 miles 1-owner florida leather dual power seats!(US $8,900.00) 1996 buick park avenue base sedan 4-door 3.8l

1996 buick park avenue base sedan 4-door 3.8l Supercharged buick park avenue ultra w/ leather and sunroof clean car fax(US $6,977.00)

Supercharged buick park avenue ultra w/ leather and sunroof clean car fax(US $6,977.00) Buick park avenue blue no reserve

Buick park avenue blue no reserve

Auto Services in Maryland

Wes Greenway`s Waldorf VW ★★★★★

Virginia Tire & Auto of Ashburn/Dulles ★★★★★

The Body Works of VA INC ★★★★★

Streavig`s Service Center ★★★★★

Southern Stables Automotive ★★★★★

Sedlak Automotive, LLC ★★★★★

Auto blog

Is this GM's next electric crossover?

Thu, Nov 16 2017GM made headlines this week when CEO Mary Barra presented the company's electrification and automation plans at the Barclays Global Automotive Conference in New York. "We are committed to a future electric vehicle portfolio that will be profitable," Barra said, which could be taken as a jab at Tesla. In the presentation ( PDF here), though, we see a new vehicle in a slide titled "Leveraging existing BEV platform to expand in near term." The vehicle, seen above, accompanied the captions "New CUV entries" and "two entries by 2020." Is this a sneak preview of an upcoming electric crossover from GM? The image seems too realistic and intentional to be a random placeholder. If this is, indeed, an upcoming battery-electric CUV based on the Bolt, the question remains: Will it be a Chevy or a Buick? It has no visible badging, but it shares DNA from both brands. As Inside EVs points out, though, it does bear a resemblance to the Chevrolet FNR-X concept unveiled in Shanghai earlier this year. With two CUVs on the way, it's not unthinkable that there could be a version for each brand. In addition to this slide, the presentation includes plans for an "All new multi-brand, multi-segment platform" launching in 2021. The all-new modular battery system will cost less than $100 per kWh, providing higher energy density and faster charging. The platform will host at least nine different vehicles, including a compact crossover, seven-seat luxury SUV and a large commercial van. GM has said it will launch 20 new EVs by 2023, and that it targets 1 million EV sales per year by 2026. Many of those sales will be in China. Related Video:

GM posts $4 billion third-quarter profit thanks to trucks and SUVs

Thu, Nov 5 2020DETROIT — General Motors is posting huge third quarter numbers, pulling in $4 billion in profit over three months after losing money due to the virus outbreak. GM's adjusted earnings were $2.83 per share, easily outpacing Wall Street's per-share projections of $1.43, according to a survey by FactSet. Revenue of $35.5 billion also edged out most expectations. Shares jumped almost 6% before the opening bell Thursday. The company swung back from a $806 million loss in the second quarter, when it was restarting factories shuttered for safety during the early stages of the pandemic. The Detroit automaker joined most global automakers in reporting better-than-expected earnings from July through September as sales across the globe started to rebound from coronavirus lockdowns, especially in China. GM sales in China jumped 12% in the third quarter, with sales of its Buick and Cadillac brands both rising more than 25%. In the U.S., GMÂ’s most profitable market, sales fell 9.9% in the third quarter compared with a year ago, but were a dramatic improvement over the 34% drop in the second quarter. Sales improved sequentially each month, the automaker said, an encouraging trend. GMÂ’s profit was boosted by higher-priced pickup trucks and large SUVs, which have seen strong sales in the U.S. through the pandemic. It was the best quarter on record for GM's Chevrolet Blazer. Sales of the Cadillac XT6 spiked 45% in the U.S. over last year. Large pickups also sold well. GM also said it was pumping $2 billion into its Spring Hill, Tennessee manufacturing plant to push its transition to produce electric vehicles. Last week, crosstown rivals Fiat Chrysler and Ford reported strong third-quarter net income. FCA said it made $1.4 billion for the period, while Ford earned $2.39 billion. Related Video: Earnings/Financials Buick Cadillac Chevrolet GM GMC

Mixed sales results, but automaker stocks rise on need for cars in Houston

Fri, Sep 1 2017DETROIT — The Big Three Detroit automakers on Friday reported better-than-expected August sales and issued optimistic outlooks for demand as residents of the Houston area replace flood-damaged cars and trucks after Hurricane Harvey, sending their stocks higher. General Motors, Ford and Fiat Chrysler posted mixed August U.S. sales, with GM up 7.5 percent and Ford and Fiat Chrysler down. Japanese automaker Toyota improved sales by nearly 7 percent, while Honda fell 2.4 percent. Still, analysts focused on the potential for Detroit automakers to cut inventories and stabilize used vehicle prices as residents of Houston, the fourth largest city in the United States, are forced to replace tens of thousands, perhaps hundreds of thousands, of vehicles after the devastation from Hurricane Harvey. Mark LaNeve, Ford's U.S. sales chief, told analysts on Friday that following Hurricane Katrina in 2005 "we saw a very dramatic snapback" in demand. That said, Ford sales fell 2.1 percent in August. It sold 209,897 vehicles in the United States, compared with 214,482 a year earlier. Sales were down 1.9 percent in the Ford division and off 5.8 percent at Lincoln. Demand was down for cars, crossovers and SUVs. It was not clear how many vehicles in the Houston area will be scrapped, LaNeve said, saying he had seen estimates ranging from 200,000 to 400,000 to 1 million. Ford's Houston dealers may have lost fewer than 5,000 vehicles in inventory, he said. Ford is the No. 1 automaker in the Houston market, with 18 percent share, according to IHS Markit. The company plans to ship used vehicles to Houston dealers and has "every indication we would have to add some production" of new vehicles to meet demand, LaNeve said. Investor concerns about inventories of unsold vehicles and falling used car prices have weighed on Detroit automakers' shares most of this year. Now, automakers can anticipate a jolt of demand from a big market that is a stronghold for Detroit brand trucks and SUVs. "It's got to be a positive for the industry," LaNeve said. Investors appeared to agree. GM shares rose as much as 3.3 percent to their highest since early March. Ford increased 2.8 percent at $11.34, and Fiat Chrysler's U.S.-traded shares were up 5.2 percent $15.91, hitting their highest in more than five years. GM reported a 7.5 percent increase in U.S. auto sales in August, helped by robust sales of crossovers across its four brands.