Like New With Low Miles!! on 2040-cars

Staunton, Virginia, United States

Vehicle Title:Clear

Engine:3.8L V6

Fuel Type:Gasoline

For Sale By:Private Seller

Transmission:Automatic

Make: Buick

Model: LeSabre

Options: AM/FM Radio, Cassette Player, Leather Seats

Trim: Limited Sedan 4-Door

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Power Options: Rear Air Conditioning, Power Side Mirrors, Keyless Entry, Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Drive Type: FWD

Mileage: 50,291

Exterior Color: Tan

Disability Equipped: No

Interior Color: Tan

Number of Doors: 4

Number of Cylinders: 6

Warranty: Vehicle does NOT have an existing warranty

Buick LeSabre for Sale

1959 buick lesabre 2-door hardtop - rare lido lavender color

1959 buick lesabre 2-door hardtop - rare lido lavender color 2004(04)lesabre we finance bad credit! buy here pay here low down $1199 ez loan(US $9,997.00)

2004(04)lesabre we finance bad credit! buy here pay here low down $1199 ez loan(US $9,997.00) 2002 buick lesabre(US $6,991.00)

2002 buick lesabre(US $6,991.00) 1998 buick lesabre 4dr sdn limited low miles(US $6,900.00)

1998 buick lesabre 4dr sdn limited low miles(US $6,900.00) 2003 19k original miles buick lesabre limited sedan 4-door 3.8l

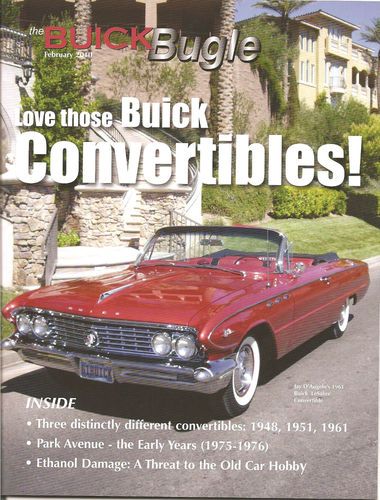

2003 19k original miles buick lesabre limited sedan 4-door 3.8l 1961 buick lesabre convertible

1961 buick lesabre convertible

Auto Services in Virginia

Wilson`s Auto Repair ★★★★★

Wicomico Auto Body ★★★★★

Valley Collision Repair Inc ★★★★★

Toyota of Stafford ★★★★★

Tire City New & Used tires & Affordable Auto Repair ★★★★★

The Brake Squad - Mobile Brake Repair Service ★★★★★

Auto blog

Buick Envision interior just as nice as its exterior

Mon, Jun 29 2020GM China loosed more photos of the all-new 2021 Buick Envision, this time of the interior. We are happy to report that the cabin design is just as pleasing to the eye as the exterior. When the 2021 model shows up for the reunion with its earlier model-year siblings, no one will recognize it. The modestly dated interior of the current crossover with its too-small infotainment screen and Rorschach-blot button placement is all gone. The gaudy curves and textures on the current instrument panel give way to a simple, split-level, bi-color form. What's more, the IP subtly carves out distinct driver and passenger spaces, a design trait normally reserved for sports cars. When Buick and GMC design boss Helen Emsley said the coming Envision would possess "striking styling designed to combine the expressiveness of a car with the practicality of an SUV,” she wasn't lying. The new steering wheel picks up more substantial spokes decorated with linear buttons instead of the circular pads, and its center cap is wider and no longer reminiscent of an alien face. The dash's dark portion up top houses a 10-inch infotainment screen canted at an 18-degree angle for the driver's ease-of-use. Air vents accentuate the break between the top and bottom of the instrument panel. Beneath the center vents, in the cabin-colored portion of the dash, are a slick set of climate controls. The pushbutton gear selectors along the left side of the center tunnel come from the China-market Enclave. And even the cupholders are handsome. The Envision Avenir gets a few exterior changes like a mesh grille and nicer wheels to set itself apart, the interior wearing Ivory White and Jazz Black hues and diamond-stitched seats. We might prefer the interior with peanut-butter brown and black even more. And suddenly, the Cadillac XT4 could have a problem; the Buick and the Cadillac share the E2 platform, but one of them — in photos, at least — is incontestably more fetching. As for tech, expect Android Auto and Apple CarPlay standard, and driver safety features such as automatic emergency braking with pedestrian detection, lane-keep assist, and the automaker's safety alert seat. Regular conveniences will include space for five, nearly two dozen storage cubbies, and an available giant panoramic moonroof. The only engine we've heard tell of so far is a 2.0-liter turbocharged unit, expected to be a carryover mill with 252 horsepower and 295 pound-feet of torque.

eBay Find Of The Day: 1946 Tucker Torpedo Prototype II hides a secret Riviera

Thu, 10 Jul 2014The Tucker Torpedo is one of the great what-if stories of automotive history. Preston Tucker hoped to revolutionize the industry with a car unlike any other on the road at the time. However, due to a variety of problems, he only managed build 51 vehicles before closing shop. Over time, they have become highly sought-after; In 2012, one sold for $2.65 million at auction.

That brings us to this Tucker "replica" that you see above because it might be one of the ugliest monstrosities ever put together. However, we might extend some leniency to the creator, as the vehicle isn't actually trying to replicate the classic look of the 1948 Tucker Torpedo. Instead, it is attempting to reproduce an earlier prototype from 1946 that actually features that weird, trident nose. According to the seller, his uncle built the car as a labor of love and supposedly used actual plans from Tucker as inspiration.

Underneath all of the crazy changes is a 1971 Buick Riviera powered by a 455-cubic-inch (7.5-liter) Buick V8. Some of the replica's odder modifications include the front fenders that turn with the wheels and the fin running down the back. All three headlights work, but the one in the middle is only for the high beams. Oddly, the small hinged sections on the roof are meant to open to avoid hitting your head when getting in or out. Maybe the seller's uncle was a very tall guy?

2017 Buick LaCrosse an evolution of sharp Avenir concept

Wed, Nov 18 2015After years as a bloated, uninspiring, but comfortable near-premium sedan, Buick has taken the wraps off a leaner, lither, far more stylish LaCrosse. The third-generation model has just made its debut at the 2015 Los Angeles Motor Show. While there's a lot to talk about, let's first address the new, Avenir-inspired sheetmetal. The fascia is basically the concept car smoothed over into production form, featuring the same winged trishield. In place of the chrome-trimmed waterfall, the LaCrosse gets a blacked-out, recessed grille with a chrome surround. It looks good in photos but it's better in person, adding a real sense of complexity and depth to the front end. The headlights and lower fascia, meanwhile, adhere closely to the concept. The same cannot be said of the LaCrosse's tail. While the taillight lighting pattern is similar, the overall shape of the lighting element is radically different, refining the design featured on the back of the Regal. Also gone, sadly, is the Avenir's boattail rear deck. Instead, the LaCrosse gets a small rear deck that curves up into a pleasant duckbill spoiler. The rest of the tail is pleasantly restrained. Perhaps the weakest point is the profile, where Buick has instituted a "split-spear" design, featuring a strong shoulder line above the rear wheel well, which sits below an even stronger character line that curves down and towards the front of the car. It strikes us as just a little too much, like the Impala. Underneath that sheetmetal, Buick has managed to trim nearly 300 pounds of body fat, nearly half of which came from the vehicle's actual structure. That 300 lbs, according to Buick's engineers, is equivalent to a Kenmore side-by-side refrigerator, in case you needed a helpful comparison. Despite the weight savings, Buick has upped the torsional rigidity for this new model by 15 percent. The LaCrosse's cabin features a strong, cockpit-like design, with a high, floating-bridge center console. This is possible due to Buick's adaption of the Electronic Precision Shift system, introduced earlier this month on the new Cadillac XT5. Despite the new-fangled console design, Buick's retained the wraparound cabin style introduced on the second-gen model. Based on a quick crawl around the interior, space is great in front, although ingress in back is somewhat difficult due to the roofline. You're probably wondering why we haven't said anything about the mechanicals just yet.