2021 Buick Enclave Fwd Essence on 2040-cars

Tomball, Texas, United States

Engine:6 Cylinder Engine

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 5GAERBKW6MJ196178

Mileage: 21716

Make: Buick

Trim: FWD Essence

Drive Type: FWD

Features: --

Power Options: --

Exterior Color: White

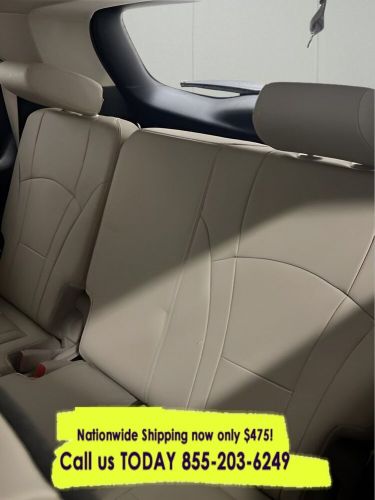

Interior Color: Beige

Warranty: Unspecified

Model: Enclave

Buick Enclave for Sale

2016 buick enclave premium(US $10,752.70)

2016 buick enclave premium(US $10,752.70) 2022 buick enclave fwd essence(US $23,380.00)

2022 buick enclave fwd essence(US $23,380.00) 2015 buick enclave premium(US $12,161.10)

2015 buick enclave premium(US $12,161.10) 2023 buick enclave premium awd(US $32,153.10)

2023 buick enclave premium awd(US $32,153.10) 2020 buick enclave essence(US $19,101.60)

2020 buick enclave essence(US $19,101.60) 2021 buick enclave essence(US $26,999.00)

2021 buick enclave essence(US $26,999.00)

Auto Services in Texas

Z`s Auto & Muffler No 5 ★★★★★

Wright Touch Mobile Oil & Lube ★★★★★

Worwind Automotive Repair ★★★★★

V T Auto Repair ★★★★★

Tyler Ford ★★★★★

Triple A Autosale ★★★★★

Auto blog

We want this Buick Regal wagon rumor to be true

Tue, May 31 2016The car we know in the US as the Buick Regal is sold as a Vauxhall/ Opel Insignia in Europe, where it's offered in four-door sedan, five-door liftback, and wagon body styles. Call it a case of wanting what we can't have, but we like the last two body styles a lot. Based on a report from a Buick/ GMC dealer meeting in Austin, one of them could be coming to the US soon. According to a poster identified as 97GreenRS on the forums at GM Inside News, GM showed dealers the 2018 Buick Enclave, Regal, and Regal GS, as well as the 2018 GMC Terrain, and then confirmed it would offer the Regal wagon here in the US. While that wouldn't normally be all that much to go on, we know Buick has been toying with the idea of a wagon for some time. A Regal-badged wagon was spotted way back in 2011. More recently, we reported on a trademark filing for "Tourx" and "Regal Tourx," which suggest a long roof (Tour) and all-wheel drive (x). If the Regal wagon arrives alongside the base sedan and GS as a 2018 model, we'd expect a debut within the next 15 or so months. That would place it right at the beginning of the 2017 auto show season, which starts next September in Frankfurt, Germany. With that in mind, it seems possible the new Regal would debut first as an Opel Insignia before appearing at a US show like Los Angeles or Detroit, although there's a lot of speculation going on there. We just want to see "Buick" and "wagon" in the same sentence again. Related Video:

Best and Worst GM Cars

Thu, Apr 7 2022Oh yes, because we just love receiving angry letters from devoted Pontiac Grand Am enthusiasts, we have decided to go there. Based on a heated group Slack conversation, the topic came up about the best and worst GM cars. First of all time, and then those currently on sale, and then just mostly a rambling discussion of Oldsmobiles our parents and grandparents owned (or engineered). Eventually, three of us made the video above. Like it? Maybe we can make more. Many awesome GM cars are definitely going unmentioned here, so please let us know your bests and worsts in the comments below. Mostly, it's important to note that this post largely exists as a vehicle for delivering the above video that dives far deeper into GM's greatest hits and biggest flops, specifically those from the 1980s and 1990s. What you'll find below is a collection of our editors identifying a best current and best-of-all-time choice, plus a worst current and worst-of-all-time choice. Comprehensive it is not, but again, comments. -Senior Editor James Riswick Best Current GM Vehicle Chevrolet Corvette We were flying by the seats of our pants a bit in this first outing and my notes were similarly extemporaneous. When it came time to tie it all together on camera, I failed spectacularly. Thank the maker for text, because this gives me the opportunity to perhaps slightly better explain my convoluted reasoning. I chose the C8 Corvette because it's simply overwhelmingly good, and it's merely the baseline from which this generation of Corvette will be expanded. While the Cadillac CT5-V Blackwing (more on that in a minute) is an amazing snapshot of GM's current performance standing and its little sibling so enraptured me that I went out and bought one, their existence is fleeting. Corvette will live on; forced-induction Cadillac sport sedans, not so much. So while all three are amazing machines when viewed in a vacuum, the Corvette stands above them as both a reflection of GM's current performance credentials and a signpost of what is to come. So, given the choice between the C8 and the 5V-Blackwing right now, I'd choose the C8. In 10 years, when the Blackwing is no longer in production and Corvette is in its 9th generation? Well, that might be a different story. Now, just pretend I said something even remotely that coherent when we get to the part of the video where I try to make an argument for the 5-V Blackwing as best GM car I've ever driven. Or just laugh at me while I ramble incoherently.

Avista concept shows Buick's performance potential [w/video]

Mon, Jan 11 2016With names like Wildcat and Riviera in its past, Buick knows how to make a good-looking performance machine. It's just been awhile. But the Avista concept revealed Sunday night ahead of the Detroit Auto Show suggests Buick's sporting heritage might be more than relegated to grainy photos. The Avista is a 2+2 sports coupe running a twin-turbocharged V6 cranking out 400 horsepower through the rear wheels. Look familiar? It should, as it reprises many of the design cues from Buick's last show-stealer, the Avenir, which debuted a year ago in Detroit. "The Avista embodies the dynamic soul of Buick," said Duncan Aldred, vice president of global Buick sales, service, and marketing. "It is a modern expression of the brand's heritage of sophisticated performance, communicated with beautiful elegance." The front end features a prominent grille with Buick's newly colored tr-shield as the centerpiece. It's flanked by wings that stretch out horizontally and edgy headlights that portend the appearance of future Buicks. There's an aggressive fascia, chrome-trimmed vents, and it all rolls on 20-inch wheels. The Avista has a 110.7-inch wheelbase (which is the same as the Chevy Camaro), and the tracks measure 63 inches in front and 62.9 inches in back, which Buick says makes for a sporty stance. The B-pillarless cabin conjures the open layout of great boulevard cruisers of days gone by. It's done up in gray leather punctuated with carbon-fiber and aluminum accents. Yep, Buick does know how to do performance. In case you forgot, the Avista is a strong reminder of the past, and it offers hope for the brand's future. Watch the live unveiling in the video below. Buick Introduces Avista Concept Design elegance, performance heritage conveyed in turbocharged 2+2 coupe DETROIT – Ahead of its public debut at the North American International Auto Show, Buick today revealed the Avista concept – a 2+2 coupe that pushes the brand's contemporary design ethos and rekindles its historic performance roots. A sleek, sweeping proportion is the foundation for this vision of a contemporary grand tourer, with a 400-horsepower twin-turbocharged V-6 driving the rear wheels and a driver-focused cockpit offering a comfortable, connected center of control. "The Avista embodies the dynamic soul of Buick," said Duncan Aldred, vice president of Global Buick Sales, Service and Marketing.