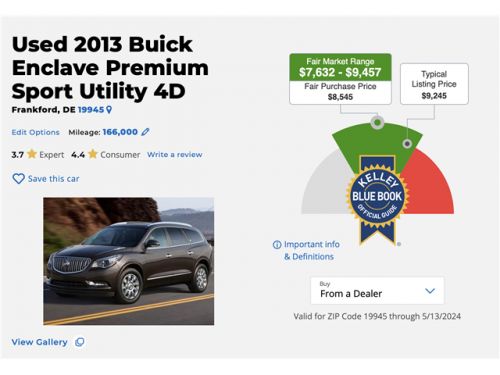

2013 Buick Enclave Leather on 2040-cars

Frankford, Delaware, United States

Engine:V6 Cylinder Engine

Fuel Type:Gasoline

Body Type:Sport Utility

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 5GAKVCKD8DJ155800

Mileage: 166982

Make: Buick

Trim: Leather

Drive Type: AWD

Horsepower Value: 288

Horsepower RPM: 6300

Net Torque Value: 270

Net Torque RPM: 3400

Style ID: 354110

Features: ENGINE, 3.6L VARIABLE VALVE TIMING V6 WITH SIDI...

Power Options: Steering, power, variable effort

Exterior Color: Black

Interior Color: Ebony

Warranty: Unspecified

Disability Equipped: No

Model: Enclave

Buick Enclave for Sale

2012 buick enclave, certified, new tires, gold, awd, power, heated seats(C $19,000.00)

2012 buick enclave, certified, new tires, gold, awd, power, heated seats(C $19,000.00) 2022 buick enclave awd essence-edition(3 row seating)(US $29,750.00)

2022 buick enclave awd essence-edition(3 row seating)(US $29,750.00) 2019 buick enclave preferred sport utility 4d(US $17,995.00)

2019 buick enclave preferred sport utility 4d(US $17,995.00) 2023 buick enclave premium awd(US $34,379.80)

2023 buick enclave premium awd(US $34,379.80) 2020 buick enclave essence 4x4 4dr crossover(US $19,999.00)

2020 buick enclave essence 4x4 4dr crossover(US $19,999.00) 2019 buick enclave awd 3 row avenir-edition(top trim)(US $21,750.00)

2019 buick enclave awd 3 row avenir-edition(top trim)(US $21,750.00)

Auto Services in Delaware

Jeff D`Ambrosio Chevrolet Inc ★★★★★

Jamie`s Towing, LLC ★★★★★

Diamond State Tire Inc ★★★★★

Colonial Hyundai of Downingtown ★★★★★

Bridge Auto Sales ★★★★★

Banghart`s Distributors ★★★★★

Auto blog

2019 Buick Regal TourX sells better than expected, has brand's wealthiest buyers

Wed, Jun 5 2019Being a wagon fan in America is tough, since it seems everyone prefers the higher ride heights and SUV looks of crossovers. But today we have some good news for wagon fans via Buick. Apparently the 2019 Buick Regal TourX is popular with well-heeled buyers, and it's been selling quite a bit better than Buick expected. A representative from Buick revealed that Regal TourX buyers have the highest average income of any of the brand's products. He even noted that TourX buyers' average income is higher than the Buick Enclave Avenir, the extra-plush variant of the three-row crossover and the most expensive vehicle in Buick's lineup. To put the price difference into perspective, the most expensive Regal TourX starts at $35,995, while the Enclave Avenir starts at $54,695. Besides selling to people of some means, the Regal TourX has proven to be more popular than Buick expected. Buick's representative said that initial estimates were that the wagon would make up about 25% of sales, but it's actually making up about 40% right now. Buick has sold 3,408 Regals in total this year, so that means about 1,400 of them were TourX wagons. That number doesn't quite translate over all of 2018 since the TourX was released a little later and the supply was still ramping up through the year. As such sales were closer to 3,000 out of a little over 14,000 for the whole year, or somewhere above 20%. But the increased percentage from the model's release is still impressive. Granted, sales still favor crossovers. Buick's least popular crossover, the Envision, sold about twice as many units as all Regals last quarter. Yet, we count this as good news on the wagon front. Better still, the TourX's top rival, the Subaru Outback, has moved 76,000 units so far this year. Times may be tough for the wagon fan, but there are still some small wins to celebrate. UPDATE: The estimate of Regal TourX numbers for 2018 was higher than actual sales as the TourX was launched later than all Regal models, and the supply wasn't up to full steam for the whole year. The corrected number is now in the text. Related Video:

Consumer Reports says infotainment systems 'growing first-year reliability plague'

Mon, 27 Oct 2014The Consumer Reports Annual Auto Reliability Survey (right) is out, and the top two spots look much the same as last year's list with Lexus and Toyota in first and second place, respectively. However, there are some major shakeups for 2014, with Acura plunging eight spots from third in 2013 to 11th this year, and Mazda replaces it on the lowest step of the podium. Honda and Audi round out the top five. This year's list includes six Japanese brands in the top 10, two Europeans, one America and one Korean.

Acura isn't the only one taking a tumble, though. Infiniti is the biggest loser this year by dropping 14 spots to 20th place. Other big losses come from Mercedes-Benz with an 11-place fall to 24th, and GMC, which declines 10 positions to 19th.

Perhaps unsurprisingly, it's not traditional mechanical bugs hauling down these automaker's reliability scores. Instead, pesky problems with infotainment systems are taking a series toll on the rankings. According to Consumer Reports, complaints about "in-car electronics" were the most grumbled about element in new cars. Problem areas included things like unresponsive touchscreens, issues pairing phones and multi-use controllers that refused to work right.

U.S. new-vehicle sales in 2018 rise slightly to 17.27 million [UPDATE]

Thu, Jan 3 2019DETROIT — Sales of new vehicles in the U.S. rose slightly in 2018, defying predictions and highlighting a strong economy. Automakers reported an increase of 0.3 percent over a year ago to 17.27 million vehicles. The increase came despite rising interest rates, a volatile stock market, and rising car and truck prices that pushed some buyers out of the new-vehicle market. Industry analysts and automakers said strong economic fundamentals pushed up sales and should keep them near historic highs in 2019. "Economic conditions in the U.S. are favorable and should continue to be supportive of vehicle sales at or around their current run rate," Ford Chief Economist Emily Kolinski Morris said after the company and other automakers announced their sales numbers Thursday. That auto sales remain near the 2016 record of 17.55 million is a testimonial to the strength of the economy, said Mark Zandi, chief economist at Moody's Analytics. The job market, he said, has created new employment, and wage growth has accelerated. "That's fundamental to selling anything," he said. "If there are lots of jobs and people are getting bigger paychecks, they will buy more." The unemployment rate is 3.7 percent, a 49-year low. The economy is thought to have grown close to 3 percent last year, its best performance in more than a decade. Consumers, the main driver of the economy, are spending freely. The Federal Reserve raised its key interest rate four times in 2018 but is only expected to raise it twice this year. Auto sales also were helped by low gasoline prices and rising home values, Zandi said. It all means that people are likely to keep buying new vehicles this year even as they grow more expensive. The Edmunds.com auto-pricing site estimates that the average new vehicle price hit a record $35,957 in December, about 2 percent higher than the previous year. It will be harder for automakers to keep the sales pace above 17 million because they have been enticing buyers for several years now with low-interest financing and other incentives, Zandi said. He predicts more deals in the coming year as job growth slows and credit tightens for higher-risk buyers. Edmunds, which provides content, including automotive tips and reviews, for distribution by The Associated Press, predicts that sales will drop this year to 16.9 million.