2012(12)regal Premium Fact W-y Abs Cd Cruise Moon Lthr Park Slvr/blk on 2040-cars

Bedford, Ohio, United States

Engine:2.4L 145Cu. In. l4 FLEX DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sedan

Transmission:Automatic

Fuel Type:FLEX

Make: Buick

Options: Leather, Compact Disc

Model: Regal

Safety Features: Anti-Lock Brakes, Driver Side Airbag

Trim: Base Sedan 4-Door

Power Options: Air Conditioning, Cruise Control, Power Windows

Drive Type: FWD

Doors: 4 doors

Mileage: 6,733

Engine Description: 2.4L L4 DIR DOHC 16V

Sub Model: 4dr Sdn Premium 1

Number of Doors: 4

Exterior Color: Silver

Interior Color: Black

Number of Cylinders: 4

Warranty: Vehicle has an existing warranty

Buick Enclave for Sale

1964~orig 67k miles california car~orig 'marlin blue'/blue interior~rust free!(US $21,500.00)

1964~orig 67k miles california car~orig 'marlin blue'/blue interior~rust free!(US $21,500.00) 1999 buick lesabre sedan 4-door 3.8l series 2(US $3,750.00)

1999 buick lesabre sedan 4-door 3.8l series 2(US $3,750.00) 1992 buick roadmaster estate 8 passenger station wagon

1992 buick roadmaster estate 8 passenger station wagon 1962 buick special for parts or restoration classic !

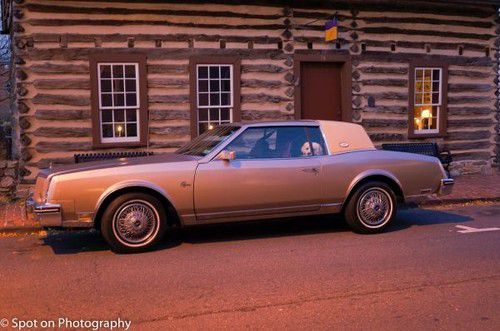

1962 buick special for parts or restoration classic ! 1985 classic buick riviera-beautiful condition-collectors item(US $4,500.00)

1985 classic buick riviera-beautiful condition-collectors item(US $4,500.00) 1990 buick reatta base convertible 2-door 3.8l(US $9,800.00)

1990 buick reatta base convertible 2-door 3.8l(US $9,800.00)

Auto Services in Ohio

West Chester Autobody Inc ★★★★★

West Chester Autobody ★★★★★

USA Tire & Auto Service Center ★★★★★

Trans-Master Transmissions ★★★★★

Tom & Jerry Auto Service ★★★★★

Tint Works, LLC ★★★★★

Auto blog

Reuss says Cadillac CT6-based Buick could happen

Wed, Apr 15 2015Could the upcoming Cadillac CT6 and its Omega platform spawn a Buick variant? According to General Motors' product chief Mark Reuss, it could potentially be in the cards, but "not yet." "We're working on that," Reuss told Automotive News at the 2015 New York Auto Show. While there hasn't been a large, rear-drive Buick on dealerships since the Roadmaster in 1996, the company gave a big hint that it could head in that direction with the Avenir Concept, shown earlier this year at the Detroit Auto Show. As Automotive News explains, a rear-drive Omega-platform Buick could be a real hit in China, where consumers buy 13 Buicks for every one Cadillac. That move would be a big help to GM's bottom line, too, as it'd significantly increase the Omega platform's economy of scale. If a large Buick based on the CT6 were to head to China, though, it likely wouldn't be a simple case of badge engineering (thank God). Reuss hinted to Automotive News that while the mixed-material construction of the CT6 platform "is very flexible," doing an "identical version of that platform or not is a different conversation." What are your thoughts? Should Buick adopt the Omega platform for an Avenir-based sedan? Should that vehicle be sold here in the US, or should it be a China-only offering? Have your say in Comments. Related Video:

Lutz dishes dirt on GM in latest Autoline Detroit

Mon, 20 Jun 2011Bob Lutz sits down for Autoline Detroit - Click above to watch video after the jump

Autoline Detroit recently played host to Bob Lutz, and, as is always the case, the former General Motors vice chairman dished out some great commentary. Lutz was promoting his new book Car Guys vs. Bean Counters: The Battle for the Soul of American Business, and talk quickly turned to his role as it related to product development and high-level decision making at GM. While on the topic of brand management, Lutz revealed a few rather interesting tidbits about his former employer:

All Chevrolet vehicles were required to have five-spoke aluminum wheels and a chrome band up front, as part of the Bowtie brand's overall image.

2014 Chevy Malibu, Buick LaCrosse recalled over brake mix-up

Thu, 08 May 2014The recall madness over at General Motors isn't letting up anytime soon, as evidenced by this latest call-back of 8,208 Chevrolet Malibu and Buick LaCrosse sedans. For those keeping track, this is the fifth recall that GM has announced in the past two weeks, not to mention the massive ignition-switch issue from earlier this year.

GM issued a statement saying these sedans are being recalled due to "possible reduced braking performance," according to Automotive News. The problem? Rear brake rotors may have accidentally been installed in the front brake assembly. And since both cars use more robust braking systems up front than out back, braking power could be reduced, increasing the risk of a crash.

Automotive News reports that, of the over 8,000 cars being recalled, about 1,700 are currently in the hands of customers, while the others are still in dealer inventory. GM is unaware of any crashes or injuries related to this problem. All of the affected vehicles are from the 2014 model year.