1990 Buick Reatta Convertible on 2040-cars

Tolland, Connecticut, United States

Body Type:Convertible

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Engine:3.8 Litre 3800 V-6

Number of Cylinders: 6

Make: Buick

Model: Reatta

Trim: Base Convertible 2-Door

Warranty: AS IS NO Warranty

Drive Type: FWD

Mileage: 95,361

Exterior Color: White

Interior Color: Red

1990 Buick Reatta Convertible 95k 1owner Arctic white red leather/ books /window sticker/MSRP was $36641. / Craftsmans log/ it is being sold as is no warranty

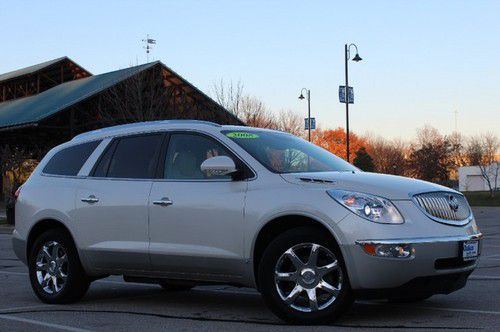

Buick Enclave for Sale

2012 premium awd navigation sunroof 20s chrome rear dvd lifetime warranty(US $46,286.00)

2012 premium awd navigation sunroof 20s chrome rear dvd lifetime warranty(US $46,286.00) 1952 buick special(US $6,500.00)

1952 buick special(US $6,500.00) 2012 premium awd navigation sunroof leather heated 20s aluminum rear dvd video(US $46,286.00)

2012 premium awd navigation sunroof leather heated 20s aluminum rear dvd video(US $46,286.00) 2009 buick enclave cxl front wheel driver leather back up camera 7 passenger(US $26,988.00)

2009 buick enclave cxl front wheel driver leather back up camera 7 passenger(US $26,988.00) 2012 premium group awd navigation sunroof leather heated 20s chrome rear dvd(US $45,938.00)

2012 premium group awd navigation sunroof leather heated 20s chrome rear dvd(US $45,938.00) 08 buick enclave 4wd awd 4x4 3.6l v6 autp leather dual sunroof navigation dvd

08 buick enclave 4wd awd 4x4 3.6l v6 autp leather dual sunroof navigation dvd

Auto Services in Connecticut

Traynor Collision Centers ★★★★★

T L Automobile Supply ★★★★★

Sunset Collision Repair ★★★★★

Pruven Performance And Automotive Electronics ★★★★★

New Rochelle Toyota ★★★★★

Mad City Inc ★★★★★

Auto blog

New Forza Horizon 2 pack features Chevy Monte Carlo SS, Audi RS6 Avant [w/video]

Tue, Dec 2 2014The latest car pack for Forza Horizon 2 is hitting Xbox Live today, giving Xbox One owners a shot at six new vehicles that date back to 1970. Leading the charge in the hearts and minds of the Autoblog staff is, of course, the 1988 Chevrolet Monte Carlo SS, one of the most 80s-tastic performance coupes of its time. Chevy's 80s-era NASCAR representative is joined by another General Motors performance two-door, in the form of the 1970 Buick GSX. Complete with a 455-cubic-inch V8, the GSX could best be thought of as the grandpappy to the iconic GNX of the late 1980s. Crossing the pond, we have a trio of offerings from the United Kingdom, with the 2002 Lotus Esprit V8, the redesigned, aluminum-intensive 2014 Land Rover Range Rover Supercharged and finally, the 2015 McLaren 650S. The mid-engined offerings should be a riot on the winding roads of Forza Horizon 2's European locales, while the Range Rover should make cross-country efforts an absolute breeze. Finally, virtual wagon lovers will be able to enjoy the 2015 Audi RS6 Avant and its combination of Quattro all-wheel drive and a twin-turbocharged V8. As per usual, this latest car pack will be available to gamers for $5 while season pass owners will score the sextet of vehicles for free. Scroll down for a video of the new offerings in action, as well as the official press release from Turn 10 Studios. "Forza Horizon 2" NAPA« Chassis Car Pack Now Available The roads and countryside of "Forza Horizon 2" beg for you to leave your mark on them. The NAPA┬« Chassis Car Pack for "Forza Horizon 2" on Xbox One has arrived, bringing five amazing new cars to blaze trails, break records, or just enjoy a casual cruise in. First off, the new McLaren 650S Coupe's uncanny acceleration and preposterous top speed will satisfy the elitist in you. If you want get away from it all, there's no better way than in the Supercharged Land Rover. Need muscle? Take the classic form of the Buick GSX or the later model Monte Carlo SS for a spin. We all need more wagon in our lives and the Audi RS6 is ready to run around town or serve up surprises at the track. The NAPA┬« Chassis Car Pack for "Forza Horizon 2" on Xbox One is available today for $5 in the Xbox Live store. Starting today, also available this month for free for all Xbox One players is the 2002 Lotus Esprit V8.

Buick: Odell Beckham Jr.

Mon, Feb 8 2016An Opel droptop in Buick drag crashes a wedding. No one's quite sure who made the Cascada, but Emily Ratajkowski definitely got the bouquet. She channels Odell Beckham Jr., laying out to make the catch ľ and conveniently Beckham is actually there to jokingly shoot her down. Did Buick nail this one, or was it (as Beckham quips) "out of bounds?" Let us know.

Volvo and GM team with Amazon for in-car deliveries

Tue, Apr 24 2018Volvo and GM are the first automakers to pair their vehicles with a new service from Amazon that lets owners have their packages delivered inside their cars, without them having to be there. The service will initially be rolled out in 37 U.S. cities at no extra charge to Amazon Prime members with a Volvo On Call or OnStar account, and it works with same-day, two-day and standard shipping. It's intended as an alternative for people who don't want to risk having their package stolen from their front porch or receive deliveries at their workplace, and both automakers say it's an example of how they're embracing innovation as a way to make their customers' lives easier. Volvo released a video (above) showing how the service works. Users download the Amazon Key App (or " Ama-zin," as the narrator pronounces it) and link their Amazon Prime account with their Volvo On Call account Ś or OnStar, in the case of GM-branded vehicles. Once they register their delivery location in a publicly accessible location, users can select the "In-Car" option at checkout. They get a notification when the delivery is en route and once it's completed and the car is relocked. Volvo has been offering in-car delivery in certain European countries since 2015 through its Volvo On Call platform, which enables services like the ability to send calendar-based navigation destinations directly to the vehicle, find nearby gas stations and help locate the vehicle when you forget where you parked it. Volvo says the platform is now available in roughly 50 countries and covers more than 90 percent of its global sales. The service is compatible with 2015 or newer Volvo, Buick, Cadillac, Chevrolet and GMC vehicles. Volvo says it's available to the majority of Volvo owners, while GM says more than 7 million vehicle owners can qualify. The service is expected to roll out to more cities later. You can check eligibility at amazon.com/keyincar. Related Video: Buick Cadillac Chevrolet GM GMC Volvo Technology Infotainment Amazon connected car volvo on call e-commerce