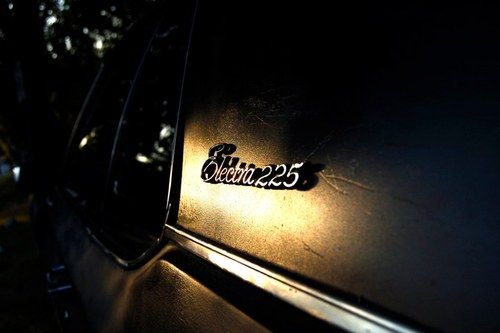

1966 Buick Electra 225 on 2040-cars

Smiths Creek, Michigan, United States

Vehicle Title:Clear

Engine:V8 Wild Cat

Fuel Type:Gasoline

For Sale By:Private Seller

Transmission:Automatic

Make: Buick

Model: Electra

Power Options: Air Conditioning

Mileage: 14,339

Exterior Color: Tan

Number of Doors: 2

Interior Color: Burgundy

Trim: Base coupe 2 door

Number of Cylinders: 8

Drive Type: Rear wheel drive

1966 Buick Electra 225

2 door hard top

One owner car (bought new by grandfather)

All original car

Wildcat 445 Engine

Original mileage

Radio is original AM

Power Steering/brakes Air (non-factory)

Runs and drives like new

Original plastic seat covers

Original factory paper work

Light tan paint with original maroon vinyl interior trim

For sale locally

Buick Electra for Sale

'79 electra 225 limited rare 403 v8 turbo 400 cold ac 52k orig. miles clean

'79 electra 225 limited rare 403 v8 turbo 400 cold ac 52k orig. miles clean Buick electra 225 limit edition 430(US $24,000.00)

Buick electra 225 limit edition 430(US $24,000.00) 1971 buick electra 225 7.5l black deuce and quarter v8 muscle car 2door hardtop(US $4,800.00)

1971 buick electra 225 7.5l black deuce and quarter v8 muscle car 2door hardtop(US $4,800.00) 1972 buick electra 225 limited(US $22,000.00)

1972 buick electra 225 limited(US $22,000.00) 1969 buick electra 225 no reserve with youtube video link

1969 buick electra 225 no reserve with youtube video link 1969 buick electra 225 custom convertible(US $14,900.00)

1969 buick electra 225 custom convertible(US $14,900.00)

Auto Services in Michigan

Zielke Tires & Towing ★★★★★

Your Auto Service Inc ★★★★★

Victory Motors ★★★★★

Tireman Central Auto Center ★★★★★

Thomas Auto Collision ★★★★★

Tel-Ford Service ★★★★★

Auto blog

2016 Buick Regal prices slashed

Tue, Aug 4 2015The Buick Regal is getting an aggressive price cut for the 2016 model year to keep pace in a crossover-centric world and its own hyper-competitive midsize sedan segment. The 2016 Buick Regal GS now starts at $35,915, after a $925 destination charge, which amounts to a $3,320 price cut compared to 2015. There's no de-contenting associated with the cost decreases either, and the vehicles are now available with Apple CarPlay. The lower prices follow through much of the lineup. The 1SP Premium model sees a $2,535 savings at $33,415 after destination; the 1SL trim falls $1,000 to $30,840; and the 1SV maintains at $28,915. The decision to make these cuts is meant to better position the midsize sedan against its rivals. "We know consumer sentiment towards sedans has decreased," Buick spokesperson Nick Richards said to Autoblog. CUVs like the company's own Encore are where buyers are moving. "Repositioning the Regal to more aggressively compete in the midsize sedan segment is the first of many steps we are taking in advance of next year's product offensive," Buick sales vice president Duncan Aldred said in a letter to dealers, according to USA Today. The decision probably couldn't have come at a better time because the Regal has suffered so far in 2015. Through July, the company has delivered 10,928 of them, down a significant 19.3 percent from the same period last year. A recent study also found that the model was among the most likely in the US to be sold after just one year of ownership.

Driving Volvos on ice, and the 2025 Toyota 4Runner is almost here | Autoblog Podcast #826

Fri, Apr 5 2024In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Road Test Editor Zac Palmer. The two kick things off by talking about what they've been driving, including the 2025 Volvo EX30 (on ice), 2024 Lexus LC 500h and 2024 Lexus TX 350. After the review section, it's time for the news. The impending 2025 Toyota 4Runner reveal is dissected; a new Buick Envision arrives, and Tesla has a rough quarter. Once the pair finish with the news, they move on to discuss the current state of affairs in Formula 1 and give a quick rundown of the New York Auto Show Editors' Picks. Finally, the show finishes with a great Spend My Money segment where a listener is trying to find a new car that might be able to take down their brother's BMW M5. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #826 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown Cars we're driving 2025 Volvo EX30 2024 Lexus LC500h 2024 Lexus TX 350 News Toyota 4Runner teased 2024 Buick Envision revealed Tesla has a rough first quarter Formula 1 check-in NY Auto Show Editors' Picks Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Green Podcasts New York Auto Show Buick Lexus Tesla Toyota Volvo Coupe Crossover SUV Electric Hybrid Luxury Off-Road Vehicles Racing Vehicles Performance Podcasts

Little-bit-bigger 2020 Buick Encore GX gets two three-cylinder engines

Thu, Aug 8 2019Ford broke the ice on selling three-cylinder engines in the U.S. with the 2014 Fiesta, then followed up with the EcoSport. Buick is about to widen that supermini-sized crack in the ice with the 2020 Encore GX. The semi-subcompact crossover will come in three trim levels that mix-and-match two turbocharged three-cylinder engines, two transmissions, and two drivetrains. The smaller engine is a 1.2-liter three-pot with 137 horsepower and 166 pound-feet of torque. This comes in one horse and 18 lb-ft of twist beyond the 1.4-liter four-cylinder in the smaller Encore. This engine will only be paired with a CVT and front-wheel drive in the Preferred, Select, and Essence trims. The meatier motor is a 1.3-liter three-cylinder with 155 hp and 174 lb-ft. That's down on the 163 hp and 177 lb-ft that the same engine produces in the Chinese-market version of the Encore GX. However, it gets buyers close to the 1.4-liter turbocharged four-cylinder that used to be optional on the smaller Encore, producing 153 hp and 177 lb-ft. This engine can be optioned on the front-wheel drive Select and Essence trims, where it would be mated to the CVT. The 1.3-liter three-cylinder is standard on all trims optioned with all-wheel drive, where it gets paired with GM's nine-speed automatic. GM does say the horsepower figures are estimates at the moment, so don't be surprised at any slight changes before deliveries begin next year. The Encore GX will serve buyers who would love it if the Encore had a bit more room but don't want to step up to the Envision. For a price GM hasn't announced yet, the Encore GX will reward those buyers with five more feet of cargo space, and some extra power for all those who decide to level up further. The junior Encore weighs just over 3,200 pounds, it's likely the Encore GX will shade that some. The Encore GX does ride on GM's new VSS-F platform, though, so the advanced architecture could provide an overall superior experience even with the lesser three-cylinder. GM has also said that the Encore GX will come standard with safety kit like forward collision alert and lane keep assist with a lane departure warning, features that are cost extras on the Encore. The Encore GX will also include automatic emergency braking, which can't be had on the Encore at any price.