1970 Buick Skylark Custom Convertible 2 Door 5.7l Call Now on 2040-cars

Saint Cloud, Florida, United States

|

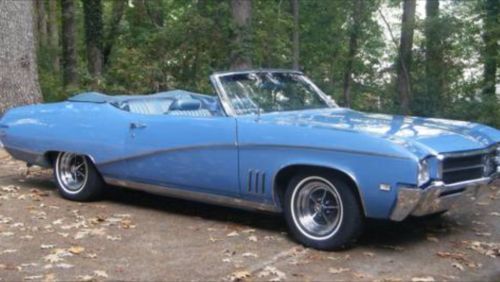

1970 Buick Skylark Custom Convertible. This is a True Vin Number Custom Model. This car is very Original. Original matching number engine. Original Warranty Plan papers with Protect-O-Plate. Original Owner's manual and Sleeve. Deposit slip from when car was purchased new along with extra keys. Bought Brand new in Houston Texas and has been there all it's life. Believe to be Original 78,969 Miles. Original Center console floor shifter. New Convertible top with the expensive Glass Window, not the Vinyl. New Hydraulic Lines. New carpet. New front Seat Skins. Clean inside and out. Original AC Car. Convertible top goes up and down great! This is a very well Documented Car. Please if you have any questions at all, feel free to email me or give me a call at anytime. 407-832-1759. I am open to offers. 407-832-1759. God Bless you on your Classic Car search! Please allow time below for the pictures to upload. Thanks!

|

Buick Skylark for Sale

1965 buick skylark base sedan 4-door 6.6l(US $1,500.00)

1965 buick skylark base sedan 4-door 6.6l(US $1,500.00) 1967 buick skylark base convertible 2-door 4.9l

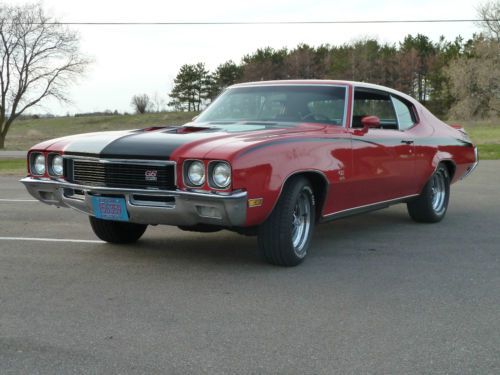

1967 buick skylark base convertible 2-door 4.9l Real gs 455, sloan documented, frame off, 500+ hp(US $36,000.00)

Real gs 455, sloan documented, frame off, 500+ hp(US $36,000.00) 1969 buick skylark custom convertible(US $12,495.00)

1969 buick skylark custom convertible(US $12,495.00) 1962 buick special deluxe convertible 3.5l

1962 buick special deluxe convertible 3.5l Buick skylark convertiable(US $18,000.00)

Buick skylark convertiable(US $18,000.00)

Auto Services in Florida

Yogi`s Tire Shop Inc ★★★★★

Window Graphics ★★★★★

West Palm Beach Kia ★★★★★

Wekiva Auto Body ★★★★★

Value Tire Royal Palm Beach ★★★★★

Valu Auto Care Center ★★★★★

Auto blog

Malaise Era Junkyard Gem: 1979 Buick Electra Limited

Wed, Jun 22 2016In the fall of 1973, the Arab members of OPEC shut off the oil taps, and Detroit got busy making many of their full-sized land yachts a lot smaller. By model year 1977, the downsized fifth-generation Buick Electra was ready to go ... just in time for the 1979 Iranian Revolution to squeeze the supply of the black stuff even further. You won't see many of the 1977-85 Electras these days, but I spotted this faded but solid '79 Limited sedan in a Denver self-service yard last week. General Motors must have bought up the entire world's supply of blue velour around this time, because you'll see this stuff in just about every car they made for the following decade or so. By this time, GM was doing a lot of mixing-and-matching with engines from its various divisions, which meant you could buy an Oldsmobile 88 with a Chevrolet 350 V8 engine, a Chevrolet Monza with a Buick 231 V6 engine, oró as in this case¬ó a Buick Electra with an Oldsmobile 350 V8 engine. Do you want to know how many horses this engine delivered to this 3,631-pound car? 155 horsepower out of 5.7 liters of engine displacement. Times were tough during the Malaise Era. Related Video: Featured Gallery Junked 1979 Buick LeSabre in Colorado Junkyard View 20 Photos Buick Automotive History Luxury Classics Sedan malaise era

Consumer Reports says infotainment systems 'growing first-year reliability plague'

Mon, 27 Oct 2014The Consumer Reports Annual Auto Reliability Survey (right) is out, and the top two spots look much the same as last year's list with Lexus and Toyota in first and second place, respectively. However, there are some major shakeups for 2014, with Acura plunging eight spots from third in 2013 to 11th this year, and Mazda replaces it on the lowest step of the podium. Honda and Audi round out the top five. This year's list includes six Japanese brands in the top 10, two Europeans, one America and one Korean.

Acura isn't the only one taking a tumble, though. Infiniti is the biggest loser this year by dropping 14 spots to 20th place. Other big losses come from Mercedes-Benz with an 11-place fall to 24th, and GMC, which declines 10 positions to 19th.

Perhaps unsurprisingly, it's not traditional mechanical bugs hauling down these automaker's reliability scores. Instead, pesky problems with infotainment systems are taking a series toll on the rankings. According to Consumer Reports, complaints about "in-car electronics" were the most grumbled about element in new cars. Problem areas included things like unresponsive touchscreens, issues pairing phones and multi-use controllers that refused to work right.

Buick Blackhawk concept headed to auction block again

Tue, Jan 27 2015While the collector car auction market is often criticized for inflating the price of vintage models out of the realm of affordability for many buyers, these sales do give us an opportunity to look back on some of the beautiful, rare designs of the past. Just take a glance at this Buick Blackhawk concept with a shape right out of the '40s or '50s. Despite the heritage styling, it was pieced together from older pieces for Buick to celebrate itself in the early 2000s With styling inspiration from the classic Buick Y-Job concept car, the Blackhawk mixes actual vintage components to create its curvaceous shape. However, the power retractable top is thoroughly modern being made from carbon fiber and stows in the deck lid when the roof needs to go down. After so much work on the outside, the Buick has something equally surprising under the hood. It's a 1970 455-cubic-inch (7.5-liter) V8 GS Stage III V8 with a claimed 463 horsepower and 510 pound-feet of torque, and for easy cruising the mill is linked to a four-speed automatic. Built in-house by Buick, the Blackhawk was once part of the General Motors Heritage Fleet, but the automaker sold it off in 2009 at the Barrett-Jackson auction in Scottsdale, AZ, along with many other members of the collection. The concept went for $522,500 after the buyer's premium, according to the auctioneers. Now, it's crossing the block again with no reserve as part of RM Auctions sale of the Andrews Collection on May 2, 2015, in Fort Worth, TX. The 75-car auction also includes highlights like one of seven 1962 Ferrari 400 Superamerica SWB Cabriolet models bodied by Pininfarina. Featured Gallery Buick Blackhawk Concept News Source: RM Auctions, Barrett-Jackson AuctionsImage Credit: Darin Schnabel Courtesy of RM Auctions Design/Style Buick Auctions Convertible Concept Cars