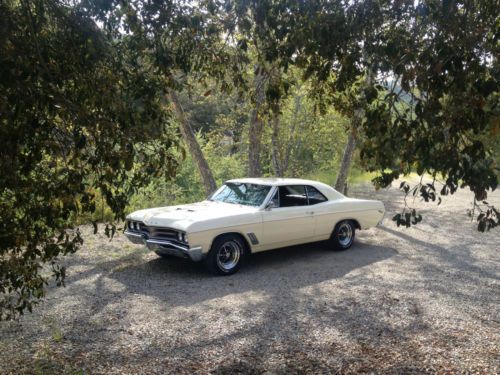

1962 Buick Skylark Base Hardtop 2-door 3.5l Very Original on 2040-cars

Denville, New Jersey, United States

|

For sale is a very original 1962 Buick Skylark 2 door coupe, with a 3-speed manual transmission couple to a feisty 215 cc V* aluminum head V8 engine. Color is deep blue with roof being off white. This car is in a very good running condition. I just drove 180 miles without a hitch. We just recently gave it a full tune up, replacing the plugs, the filters engine and trans oils. We also replaced the rear shocks and springs with brand new ones. I have the front springs and shocks which will be included in the sale. We just had the carburetor rebuilt, replacing all worn or defective parts. The car stars right up without any hesitation thanks in part to the new battery and new fuel filter plus the cleaned out gas tank. The car has been stored inside most of its life maintaining a beautiful luster to its original deep blue paint. Not a show car by any means but a solid daily driver ready for the next step to restore it without much effort to its original simple yet elegant glory. This car is 99% complete and 99% rust free. Only very small surface rust at the rear wheel and a small dent on the front fender. the underbody is solid having received undercoating some years back.The rest of the body is straight minus minute scratches and normal scratches. The interior is very presentable too- minus the front seat covers as they will need replacement. It has working front seat belts. The AM radio, the heat, the mirrors and the lights word very well. The tires are very good, the brakes front and back have been serviced recently. The trunk is very clean, sold and the jack parts plus the spare tire are all there. The weather-stripping rubber while old still keeps water off the car. The instrument cluster works very well except for the gas gauge which moves when filled with gas but it does not show the actual gallonage. The speedometer, the odometer, the temp and Gen work properly. The heat/vent levers work as well. The carpet is very solid and has no visible stains or tears. The headliners is intact and not sagging. Overall, this car is a joy to drive, and its aluminum engine is an automotive first, Original owner's manual. Great fuel economy for its age and size! Pre-inspection and further inquiries are cheerfully welcome. Shipping, taxes and vehicle transfer fees are the responsibility of the buyer. A PayPal deposit of $1000.00 is required within 24 hours of the auction end. Balance either in cash or bank certified check only. Car is being offered for sale locally. Good luck! |

Buick Skylark for Sale

Auto Services in New Jersey

Xclusive Auto Tunez ★★★★★

Volkswagen Manhattan ★★★★★

Vito`s Towing Inc ★★★★★

Vito`s Towing Inc ★★★★★

Singh Auto World ★★★★★

Reese`s Garage ★★★★★

Auto blog

Despite strong profits, GM still fighting flat market share

Fri, Jan 17 2014Looking at the progress General Motors has made since it entered bankruptcy, it's easy to forget that the company still has a long way to go before it's the juggernaut it once was. A recent report from Reuters points out that, while GM is making money, it isn't making any gains in terms of US market share. Quite the opposite, really. Consider this factoid: In 1963, nearly half of the cars sold in the United States were from Chevrolet, Cadillac, Buick, GMC or Pontiac. Now, the company's US market share is stagnant at 17.9 percent. That same number is half of just Chevy's 1963 market share. This is all despite GM going on a binge replacing or updating its models. "Market share increases are not instantaneous," Mark Reuss told Reuters at the 2014 Detroit Auto Show. "We've got a lot of baggage. Don't underestimate what people though of us, or these brands, through these hardships and 30 years." The reasons for the stagnant market share are numerous. Reuters points out that retooling of factories and a focus on limiting incentives are both good things for profit, but not necessarily for market share. There's also the troubling turnover of the brand's marketing department. These issues don't change the fact that Chevrolet has lost 1.4 percent of its market share in two years, and that Cadillac - arguably GM's most improved brand overall - has lost 1.2 percent in the same period. Part of that can be blamed on GM's avoidance of fleet sales in favor of more profitable customer sales. "Our focus has really been on retail and that's where we've got the growth," said Alan Batey, GM's interim global marketing boss. "We want to grow GM and that means growing market share and profits, but it's not at all costs," Reuss said. News Source: ReutersImage Credit: paul bica - Flickr CC 2.0 Earnings/Financials Buick Cadillac GM GMC sales profits

2014 Buick Regal priced from $29,690*

Mon, 09 Sep 2013Buick has announced pricing for the refreshed 2014 Regal. The base model offers a 2.0-liter, turbocharged, 259-horsepower, four-cylinder engine for $30,615 (*after $925 delivery and destination fee). The standard turbo can be replaced by Buick's eAssist mild hybrid system for $32,485. The electrified powertrain delivers 36 miles per gallon, in place of the turbo's 30 mpg on the highway.

The big powertrain news for 2014 is the inclusion of an all-wheel-drive system for an extra $2,175. Marking one of the few uses of all-wheel drive on a Buick car, the new Regal AWD has an electronic, limited-slip differential and a HiPer Strut front suspension, which is the same front arrangement used on the hot, front-drive Regal GS.

Speaking of the Regal GS, it's not so hot for 2014. It sports the same 259-horsepower engine as the standard Regal, but offsets that with a wealth of standard, optional or flat-out exclusive equipment like active dampers, Brembo brakes and a Bose stereo. Prices (all including the $925 fee) start at $37,830. Like the standard car, the GS will be available with all-wheel drive for the first time, bringing it a bit more in line with its cousins across the pond - Opel Insignia OPC and Vauxhall Insignia VXR. Prices for the GS AWD start at $40,195.

GM raises 2023 guidance on strong sales, higher profits

Tue, Apr 25 2023General Motors beat first-quarter profit estimates and raised its full-year earnings and cash-flow guidance after vehicle demand at the start of the year surpassed expectations. Its shares rose in premarket trading. GM made $2.21 a share in adjusted profit in the first quarter, compared to a consensus forecast of $1.72 a share. Revenue rose 11% to $39.99 billion, it said Tuesday, which was more than the $39.24 billion analysts expected. The stronger results stem from rising sales in the US, even in the face of higher interest rates and inflation. GM executives said demand was strong enough to revise 2023 guidance upward, boosting profit estimates for the year by $500 million to between $11 billion and $13 billion. “We did it with strong production and inventory discipline and consistent pricing,” GM Chief Financial Officer Paul Jacobson said on a call with journalists. “All in all, weÂ’re feeling confident about 2023.” The Detroit automaker raised per-share full-year guidance to between $6.35 and $7.35, up from $6 to $7 a share, and said free cash flow would also increase by $500 million to a range of $5.5 billion to $7.5 billion. GMÂ’s shares pared a gain of as much as 4.4% before the start of regular trading Tuesday, rising 3.5% to $35.50 as of 6:55 a.m. in New York. The stock was up 1.9% for the year as of the close on Monday. North American Strength The automakerÂ’s sales were particularly strong in North America, where first-quarter earnings rose before interest and taxes rose to $3.6 billion. Vehicle sales rose 18% to 707,000 in the region. Jacobson said the company originally expected to sell 15 million vehicles in the US this year, slightly less than the 15.5 million annualized rate automakers foresaw in the first quarter. North American demand was enough to offset a weak performance in China, GMÂ’s second-largest market. The automaker continues to struggle in the country, where its vehicle sales fell 25% to 462,000 vehicles in the quarter. Profits from its joint ventures in the market slumped 65% to $83 million. The market has struggled overall in the wake of Covid-19 restrictions and foreign automakers have had to overcome a growing preference for Chinese brands by competing on price, squeezing profit margins. The situation in China probably wonÂ’t significantly improve until the second half of the year, according to Jacobson. GM remains on target to sell 150,000 electric vehicles this year, the CFO said.

1967 buick skylark gs400

1967 buick skylark gs400 1968 buick skylark conv. 5.7l v8 2dr coupe w/ center shift horse shoe shifter

1968 buick skylark conv. 5.7l v8 2dr coupe w/ center shift horse shoe shifter 1968 buick skylark custom convertible 2-door 5.7l

1968 buick skylark custom convertible 2-door 5.7l 1971 buick gs clone skylark 455 project

1971 buick gs clone skylark 455 project Project

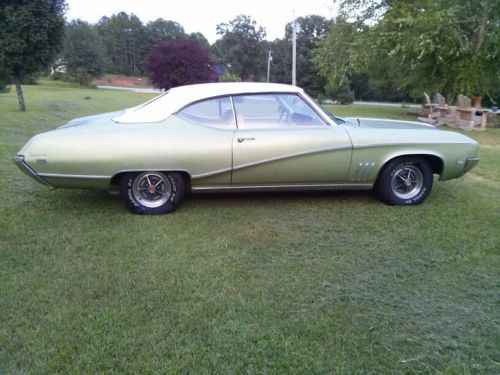

Project 1969 buick skylark custom 2-door 5.7l

1969 buick skylark custom 2-door 5.7l