1994 Buick Roadmaster Estate Wagon 5.7l on 2040-cars

Seattle, Washington, United States

|

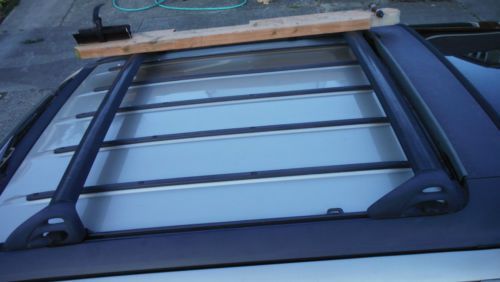

I bought it in 2004 with 80K miles. This was my first Roadmaster wagon. I've had 5 total because I really like them. (I won't try to sell you on their virtues; I assume if you're here, you already know.) I'm selling because I have 3 currently and need to thin the herd. I'm selling this one because the '94s have smaller mirrors than my '95 & '96 and they're both maroon which is my favorite color for these wagons. This car is in excellent mechanical condition and looks very good for a 20-year-old car, but it has a few flaws:

Having owned 5 of these wagons, I know what goes wrong, and I have fixed all the usual Roadmaster wagon flaws:

This wagon has the limited slip rear end (G80 on the Service Parts ID label). In addition, this wagon has had the following major work done recently (see scanned service records):

Always used Mobil1 full synthetic. This car's ready for another 100K miles easy. See twice as many photos, the SPI label, and big-ticket service records at: picasaweb.google.com/101120692823414891191/94Roadmaster The $3K reserve is very attractive considering the $3100 in recent service and these recent eBay sales (search for the auction numbers to verify):

This is the part of the auction text where there's usually a bunch of vaguely threatening language about your bid being a contract, and ask any questions before you bid, and stuff like that. But here's my deal: buying a car online is hard. I've bought and sold several over the years. I take lots of pics and describe every flaw. If you're near Seattle, please come drive this car. You are welcome to have it inspected by a mechanic. If you win this auction and for whatever reason do not like this car when you see it in person and drive it, then you can have your money back, including deposit. No hassle, no negative feedback. The fault will be entirely mine for failing to represent the car accurately. Sound fair? If you will be shipping the car, I'm home during the day and can assist your shipper. If you want to fly in and drive home, I can pick you up at the airport; I live about 10 miles from Sea-Tac. Any questions, don't hesitate. Bill |

Buick Roadmaster for Sale

1953 buick roadmaster 4-door sedan 72r newer paint classic hot rod project car(US $10,000.00)

1953 buick roadmaster 4-door sedan 72r newer paint classic hot rod project car(US $10,000.00) 1996 buick roadmaster estate wagon collector's edition * one-owner * 19k miles *(US $16,500.00)

1996 buick roadmaster estate wagon collector's edition * one-owner * 19k miles *(US $16,500.00) 1941 buick roadmaster, 4-door sedan, black, clear sc title,straight 8, 3 speed(US $4,700.00)

1941 buick roadmaster, 4-door sedan, black, clear sc title,straight 8, 3 speed(US $4,700.00) 1993 buick road master hearse miller-meteor corp built runs and drives great

1993 buick road master hearse miller-meteor corp built runs and drives great 1939 buick roadmaster(US $32,500.00)

1939 buick roadmaster(US $32,500.00) 1992 buick road master hearse s&s built runs and drives great

1992 buick road master hearse s&s built runs and drives great

Auto Services in Washington

Yire Automotive Care ★★★★★

Woodland Auto Body ★★★★★

University Place Tire & Auto ★★★★★

Town Chrysler Dodge ★★★★★

Superior Auto ★★★★★

Sparky`s Towing & Auto Sales ★★★★★

Auto blog

Malaise Era Junkyard Gem: 1979 Buick Electra Limited

Wed, Jun 22 2016In the fall of 1973, the Arab members of OPEC shut off the oil taps, and Detroit got busy making many of their full-sized land yachts a lot smaller. By model year 1977, the downsized fifth-generation Buick Electra was ready to go ... just in time for the 1979 Iranian Revolution to squeeze the supply of the black stuff even further. You won't see many of the 1977-85 Electras these days, but I spotted this faded but solid '79 Limited sedan in a Denver self-service yard last week. General Motors must have bought up the entire world's supply of blue velour around this time, because you'll see this stuff in just about every car they made for the following decade or so. By this time, GM was doing a lot of mixing-and-matching with engines from its various divisions, which meant you could buy an Oldsmobile 88 with a Chevrolet 350 V8 engine, a Chevrolet Monza with a Buick 231 V6 engine, or— as in this case— a Buick Electra with an Oldsmobile 350 V8 engine. Do you want to know how many horses this engine delivered to this 3,631-pound car? 155 horsepower out of 5.7 liters of engine displacement. Times were tough during the Malaise Era. Related Video: Featured Gallery Junked 1979 Buick LeSabre in Colorado Junkyard View 20 Photos Buick Automotive History Luxury Classics Sedan malaise era

Cadillac and Buick boost GM's return to growth in China

Mon, Oct 12 2020BEIJING — General Motors on Monday said continued market recovery from the COVID-19 crisis helped its China vehicle sales grow 12% on year in July-September, marking the Detroit automaker's first Chinese quarterly sales growth in two years. The second-biggest foreign automaker in China by units — after Germany's Volkswagen AG — said on Monday it had delivered 771,400 vehicles in China in the third quarter. That followed a 5% fall in the second quarter, when parts of China were still emerging from virus-busting lockdown measures. GM has a Shanghai-based joint venture with SAIC making Buick, Chevrolet and Cadillac vehicles. It has another venture, SGMW, with SAIC and Guangxi Automobile Group, producing no-frills minivans and which has started manufacturing higher-end cars. Sales rose 26% for cars under its mass-market Buick brand in the third quarter versus the same period a year earlier, while those of premium brand Cadillac jumped 28%, GM said in a statement. Sales of its mass-market Chevrolet marque fell 20%. Sales of no-frills brand Wuling grew 26%, whereas those of mass-market Baojun vehicles tumbled 19%. "GM's compact models returned to four-cylinder engines and that helped sales growth," said LMC Automotive senior analyst Alan Kang, referring to an attempt to market cleaner but noisier three-cylinder versions. "Cadillac also has a more complete lineup this year." China's biggest automakers' association expects overall car sales to grow by double digits in July-September versus a year earlier. Makers such as Toyota, Honda and Geely saw sales jump in the just-finished quarter. GM has seen its China sales suffer in a crowded market and slowing economy. To revive its fortunes, it plans to have electric vehicles (EVs) make up over 40% of new models in the next five years in China, where the government promotes greener cars. The automaker's Wuling Hong Guang MINI EV, a micro two-door EV with a starting price of 28,800 yuan ($4,200), was China's biggest-selling EV in August. GM's sales fell 15% in 2019 from a year earlier to 3.09 million vehicles. The automaker delivered 3.65 million vehicles in 2018 and 4.04 million in 2017. Related Video:

New GM subcompact SUV spied, could be a Chevy or GMC

Mon, Aug 13 2018GM's pair of subcompact crossovers have been trundling along for a while now. The Buick Encore was the first for Americans in the 2013 model year, and the Chevy Trax that was based on the Encore (an encore of the Encore, if you will) arrived for the 2015 model year. Each has undergone a mild update, but these spy photos could indicate their replacements are in the works. Or not. For starters, we can't be sure which GM brand this new SUV is destined for. Though the timing and its flowing lines could indicate Buick, the thick horizontal bars visible in the grille would indicate otherwise. The next Encore being at least related to this is at least a possibility. Making the case for GMC are those thick grille bars, the fact that it extends far below the lights, and may even rise above them, similar to the Acadia. And that rising beltline isn't that different from that of the Acadia. Arguing against the GMC idea is the Encore, which is almost always sold in GMC-Buick combo dealers. Much as the Acadia was made smaller to eliminate confusion and in-house competition with the Enclave, it's hard to see GM opting to resurrect such an issue at the bottom end of the SUV market. That means we're leaning toward this little SUV wearing a Chevy bowtie. The split grille with a large lower section and small upper section is the brand's current design language, as seen on the new Malibus and Cruzes. The shape is vaguely Equinox-like. And like Buick, Chevy also has a subcompact crossover ready for replacement: the Trax. Now, our photographer reports he's seen another subcompact testing that has Blazer design cues, but in this crossover-hungry market, we wouldn't be surprised if two similarly sized but differently styled Chevy crossovers make the grade. It's a strategy that's working pretty well for Jeep. We'll no doubt be seeing more of these disguised test vehicles milling about the country in the coming months, so perhaps we'll eventually get a better idea of what this is before more official information starts trickling out within one or two years. Related Video: Featured Gallery GM Subcompact Crossover spy shots View 10 Photos Image Credit: SpiedBilde Spy Photos Buick Chevrolet GM GMC Crossover SUV buick encore chevy trax