1983 Buick Riviera - Clean Title - 2 Owners - Great Condition on 2040-cars

Phoenix, Arizona, United States

Vehicle Title:Clear

Make: Buick

Drive Type: RWD

Model: Riviera

Mileage: 88,500

Trim: 2DR

For Auction - Very nice 1983 Buick Regal. Has clean title - no accidents, only 2 owners, completely original, odometer reads just over 88k original miles. 5.0 V8, Automatic, cold AC, power windows, power seat, tilt, cruise control - (power mirrors & power door locks do not work)

Car is located in Phoenix, AZ and has been garaged for the last several years and has no sun fading or interior issues.

A $500 deposit due within 24 hours through paypal & balance due at delivery.

Please contact me with any questions. Thanks

Buick Riviera for Sale

1898 buick riviera 2dr coupe/3.8 litre 3800 v6 automatic transmission/nice!(US $7,500.00)

1898 buick riviera 2dr coupe/3.8 litre 3800 v6 automatic transmission/nice!(US $7,500.00) Classic car

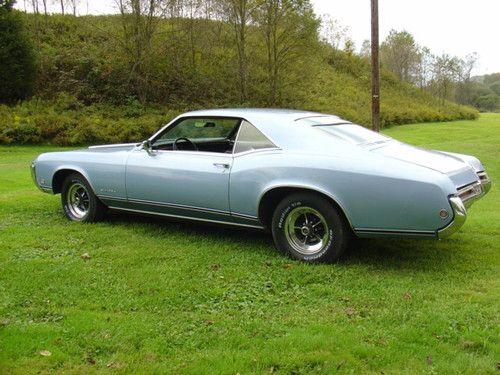

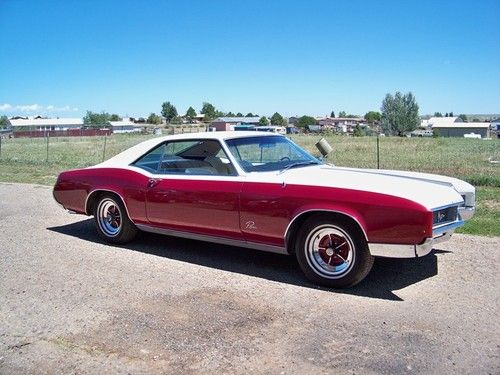

Classic car 1966 buick riviera

1966 buick riviera Orignal 40,500 miles,mist gray color with pearl white interior(US $14,500.00)

Orignal 40,500 miles,mist gray color with pearl white interior(US $14,500.00) 1964 buick riviera nailhead, airconditioning rebuilt motor new interior(US $10,000.00)

1964 buick riviera nailhead, airconditioning rebuilt motor new interior(US $10,000.00) Buick rivera 1969 blue

Buick rivera 1969 blue

Auto Services in Arizona

Vibert Auto Tech ★★★★★

Valvoline Instant Oil Change ★★★★★

Town & Country Motors ★★★★★

Tempe Kia ★★★★★

Tanner Motors ★★★★★

Sycata Car Care ★★★★★

Auto blog

Car technology I'm thankful and unthankful for

Mon, Nov 27 2017The past few years have seen a surge of tech features in new vehicles — everything from cloud-based content to semi-autonomous driving. While some of it makes the driving experience better, not all tech is useful or well thought out. Automakers who are adept at drivetrains, ride quality and in-cabin comforts often fail at infotainment interfaces and connectivity. From testing dozens of vehicles each year and in the spirit of gratitude, here are three car tech features I'm thankful — and a trio I could live without. Thanks Connected search: This seems like a no-brainer since everyone already has it on their smartphones, but not all automakers include it in the dashboard and as part of their nav systems. The best ones, such as Toyota Entune, leverage a driver's connected device to search for a range of services and don't charge a subscription or require a separate data plan for the car. I also like how systems like Chrysler Uconnect use Yelp or other apps to find everything from coffee to gas stations and allow searching via voice recognition. Apple CarPlay and Android Auto: It took two of the largest tech companies to get in-dash infotainment right. While they have their disadvantages (you're forced to use Apple Maps with CarPlay, for example), the two smartphone-integration platforms make it easier and safer to use their respective native apps for phoning, messaging, music and more behind the wheel by transferring a familiar UI to the dashboard — with no subscription required. Heated seats and steering wheels: I really appreciate these simple but pleasant features come wintertime. It's easy to get spoiled by bun-warmers on frosty mornings and using a heated steering wheel to warm the cold hands. I recently tested a 2018 Mercedes-Benz E400 Coupe that also had heated armrest that added to a cozy luxury experience. Bonus points for brands like Buick that allow setting seat heaters to turn on when the engine is remotely started. No thanks Automaker infotainment systems: Automakers have probably poured millions into creating their own infotainment systems, with the result largely being frustration on the part of most car owners. And Apple CarPlay and Android Auto coming along to make them obsolete. While some automaker systems, such as Toyota Entune and FCA's Uconnect, are easy and intuitive to use, it seems that high-end systems (I'm looking at you BMW iDrive and Mercedes-Benz COMAND) are the most difficult.

Junkyard Gem: 2002 Buick Regal Joseph Abboud Edition

Sun, Aug 23 2020Ever since we saw that snazzy green 2000 Buick Regal GSE last month, with its supercharger and Monsoon Audio speakers, I've made it my junkyard-searching goal to find a genuine Joseph Abboud Edition Regal among the not-so-interesting Luminas and Vues in the GM sections of my local car graveyards. While this publication once stated that the Joseph Abboud Regal was "the low point of the brand" (in my view, the nadir was achieved with the Iron Duke-powered Skylarks of 1980-1985), my great love of designer-edition Detroit cars overrides any so-called rational opinions on the subject. It took less than three weeks of walking the aforementioned junkyard GM sections to find a Regal with the mark of the famous menswear company on the fenders. The heyday of designer-edition cars came during the 1970s, when Lincoln offered Continentals co-branded by Bill Blass, Givenchy, Pucci, and Cartier. At the same time, American Motors teamed up with Levi's and Oleg Cassini, and fashion-industry players continued to work with car manufacturers here and there after that time. It appears that the Abboud package got you nice leather seats with these monograms, plus the stylish fender badges. Otherwise, it was just a nicely-equipped but unspectacular late W-Body. For you GM trivia fans out there, the W platform stayed in production for an impressive near-three-decade span, from the 1988 Pontiac Grand Prix through the (fleet-only) 2016 Chevrolet Impala Limited. The final W-based Regals rolled off the assembly lines in 2005. This car has the 240-horsepower supercharged 3800 V6, so it's the GS version. You could get the Abboud package on the non-supercharged LS Regal as well. If you did, you got the better tires and suspension used on the GS. These Roots-type Eaton M90 blowers are by far the easiest superchargers to find and extract from a junkyard car. In fact, there's such a glut of these things at swap meets that the going price now hovers around 50 bucks. This car looks to have been in decent shape when it arrived in the junkyard. The original owner's manual was still in the glovebox when I found it. The 240-horse supercharged engine was Harley Earl's idea, turns out. He'd been dead since 1969, but that's a technicality. Some tips for selling the new Regal.

Buick Envision spied fully disrobed in China

Wed, 27 Aug 2014The Buick Envision crossover is supposed to have its big reveal on August 28 and be on display at the Chengdu Motor Show, but apparently the new midsize crossover just can't wait to meet its public. Car News China caught a completely undisguised example parking outside of the convention center where the show is held.

The Buick designers are going right down the middle with the styling with nothing too flashy to turn off potential buyers. Still, it's a handsome CUV that kind of looks like a stretched Encore from some angles with vents along the hood, a large greenhouse and a prominent crease running down the side.

This new midsizer is hitting the Chinese market first and reportedly rides on GM's Delta platform that's also found underneath the Buick Verano. According to Car News China, prices there are between 160,000 yuan and 220,000 yuan ($26,000 - $35,800 at current rates). However, it's also rumored to eventually make its way across the Pacific to give Buick buyers in the US an option between the Encore compact crossover and larger Enclave.