1997 Buick Lesabre Limited Sedan 4-door 3.8l on 2040-cars

Pittsburgh, Pennsylvania, United States

Vehicle Title:Clear

Transmission:Automatic

Body Type:Sedan

For Sale By:Estate

Fuel Type:GAS

Number of Doors: 4

Make: Buick

Mileage: 47,500

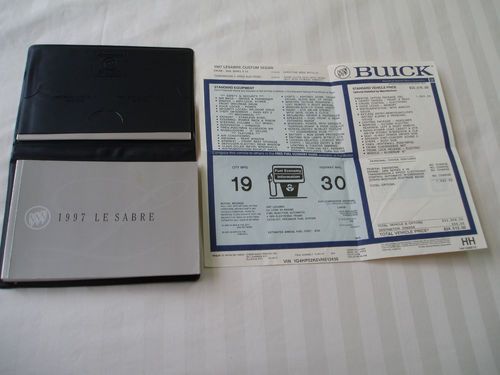

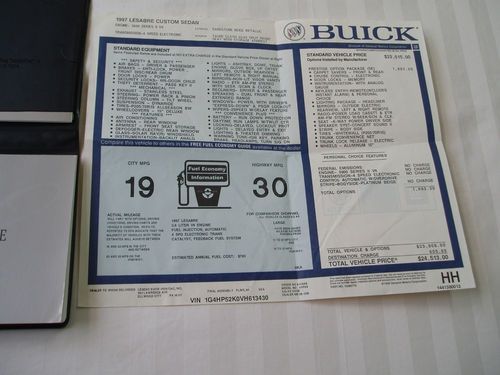

Model: LeSabre

Exterior Color: Sandstone Beige Metallic

Trim: Custom Sedan 4-Door

Interior Color: Taupe Cloth

Drive Type: FWD

Options: Cassette Player

Number of Cylinders: 6

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats, Please see window sticker

This car is very clean, very well maintained with maintenance records available, garage kept second owner car. Tires and battery were recently replaced.

Buick LeSabre for Sale

1999 buick lesabre limited sedan 4-door 3.8l(US $1,550.00)

1999 buick lesabre limited sedan 4-door 3.8l(US $1,550.00) 1975 buick lesabre custom..convt

1975 buick lesabre custom..convt Outstanding 2003 limited with celebration pkg - florida car with 47k miles

Outstanding 2003 limited with celebration pkg - florida car with 47k miles 1965 buick lesabre coupe 2-door wildcat

1965 buick lesabre coupe 2-door wildcat 2002 buick lesabre custom sedan 4-door 3.8l

2002 buick lesabre custom sedan 4-door 3.8l 1960 buick lesabre air ride hotrod original paint bubble top survivor low miles

1960 buick lesabre air ride hotrod original paint bubble top survivor low miles

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

West Shore Auto Care ★★★★★

Village Auto ★★★★★

Ulrich Sales & Svc ★★★★★

Trust Auto Sales ★★★★★

Steve`s Auto Body & Repair ★★★★★

Auto blog

Buick Encore GX expected to come to the U.S. alongside the popular Encore

Mon, Apr 22 2019When we posted on Buick unveiling the Encore GX at Auto Shanghai 2019 as a longer-wheelbase version of the Encore, we though the GX trim could supplant our local Encore. According to Automotive News, citing "sources familiar with the plans," Buick will sell both the Encore and the Encore GX here. Brand boss Duncan Aldred told Buick dealers in January to expect a new model this year, and it appears the slightly larger subcompact crossover is that product. GM Authority reported the same news in March, the outlet saying that Buick intends to re-create in the U.S. the "model family" strategy the carmaker employs in China. Over there, our rebadged Verano sold as the first-generation Excelle, Excelle GT and Excelle GX, the GX being the wagon version of the sedan. When the Excelle trio moved a less expensive platform for the second generation, Buick introduced a Verano model in China in both sedan and Verano GS hatchback forms. AN reported that Buick is also planning a smaller three-row Enclave for China. The Encore GX differs fundamentally from both the Chinese- and U.S.-market Encores. Our Encore, a rebadged Opel/Vauxhall Mokka, rides on the Gamma II platform. The second-generation China-market Encore rides on GM's new Global Emerging Markets (GEM) platform, an updated version of the Gamma II for regions like China and Latin America. The Encore GX rides on the Vehicle Strategy Set - Front (VSS-F) architecture. AN wasn't sure yet where our U.S.-market Encore GX will be built, but doesn't expect it to come from China. The Encore GX here will slide into the lineup between the $23,200 Encore and $31,995 Envision. Whereas the Chinese model aims to stop hemorrhaging Encore sales in China, our version will want to expand the Encore success story. Since it went on sale in 2013, the model has posted double-digit sales increases here every year save for last year. In 2018 the model sold 93,073 units, accounting for 47 percent of brand sales. There's no reason to doubt the Encore GX will boost that number.

Buick Velite 6 to come in PHEV, electric versions for China

Wed, Apr 18 2018In addition to the all-electric Enspire crossover concept revealed this week ahead of the Beijing Auto Show, Buick is adding a new production variant to its Velite series of electrified vehicles for China. It's called the Velite 6, a plug-in hybrid that will launch this year in Buick's largest market. A full-electric version, shown in the lead photo above at right, is coming later. Buick already sells a vehicle called a Velite 5 in China, which is essentially a rebadged Chevrolet Volt, only with a higher electric-only driving range. This one is based on the Velite concept PHEV introduced in late 2016 at Auto Guangzhou. The PHEV and battery-electric versions look nearly identical, with a wide stance, plenty of creases and a hatchback design that bears some similarities to the longer 2018 Regal TourX wagon. The Velite 6 uses two AC permanent-magnet synchronous motors, a lithium-ion battery and a 1.5-liter four-cylinder combustion engine. Buick says combined gas-electric driving range is 435 miles, which is 15 miles greater than the Volt. Buick will assemble what it calls the "new-generation" ternary battery pack at its new SAIC-GM Power Battery Development Center in Shanghai. The company says the Velite 6 electric vehicle "will adopt a new-generation pure electric drive system to offer customers a smooth, quiet and natural driving experience." Both models get the cloud-based Buick eConnect technology, which allows over-the-air software updates, real-time integration with China's WeChat social media network, and other digital perks. Owners will also be able to use their smartphone as the vehicle's key, and they can also authorize others to use the car through their phones. China has long been Buick's largest market, with more than 1.18 million vehicles sold in 2017 compared to just 219,231 in the U.S., and the country has established aggressive mandates for production of electric vehicles. GM has plans to add 20 new electric and fuel-cell vehicles globally by 2023. Related Video:

2014 Chevy Malibu, Buick LaCrosse recalled over brake mix-up

Thu, 08 May 2014The recall madness over at General Motors isn't letting up anytime soon, as evidenced by this latest call-back of 8,208 Chevrolet Malibu and Buick LaCrosse sedans. For those keeping track, this is the fifth recall that GM has announced in the past two weeks, not to mention the massive ignition-switch issue from earlier this year.

GM issued a statement saying these sedans are being recalled due to "possible reduced braking performance," according to Automotive News. The problem? Rear brake rotors may have accidentally been installed in the front brake assembly. And since both cars use more robust braking systems up front than out back, braking power could be reduced, increasing the risk of a crash.

Automotive News reports that, of the over 8,000 cars being recalled, about 1,700 are currently in the hands of customers, while the others are still in dealer inventory. GM is unaware of any crashes or injuries related to this problem. All of the affected vehicles are from the 2014 model year.