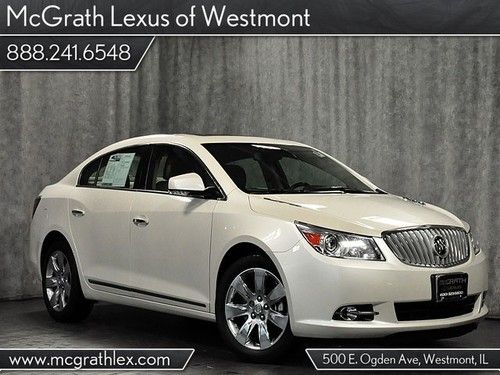

Cxl 3.8l Front & Rear Head-curtain Airbags Front Seat Frontal Airbags Tachometer on 2040-cars

Lutz, Florida, United States

Vehicle Title:Clear

Engine:3.8L 3800CC 231Cu. In. V6 GAS OHV Naturally Aspirated

For Sale By:Dealer

Body Type:Sedan

Fuel Type:GAS

Make: Buick

Warranty: Unspecified

Model: LaCrosse

Trim: CXL Sedan 4-Door

Power Options: Air Conditioning

Drive Type: FWD

Number of Doors: 4

Mileage: 72,166

Sub Model: CXL

Number of Cylinders: 6

Exterior Color: White

Buick Lacrosse for Sale

Leather new 2.4l power door locks power driver's seat power passenger seat(US $32,570.00)

Leather new 2.4l power door locks power driver's seat power passenger seat(US $32,570.00) 2011 cxs 3.6l auto silver

2011 cxs 3.6l auto silver Lacrosse cxs nav heated wheel park assist(US $28,000.00)

Lacrosse cxs nav heated wheel park assist(US $28,000.00) 2012 new storm grey metallic convenience group auto!! call us today!!(US $27,745.00)

2012 new storm grey metallic convenience group auto!! call us today!!(US $27,745.00) 11k, heated leather, remote start, pwr seats, chrome wheels, 1-owner 12608(US $22,995.00)

11k, heated leather, remote start, pwr seats, chrome wheels, 1-owner 12608(US $22,995.00) 2008 buick lacrosse cxl

2008 buick lacrosse cxl

Auto Services in Florida

Yogi`s Tire Shop Inc ★★★★★

Window Graphics ★★★★★

West Palm Beach Kia ★★★★★

Wekiva Auto Body ★★★★★

Value Tire Royal Palm Beach ★★★★★

Valu Auto Care Center ★★★★★

Auto blog

Buick version of Equinox/Terrain CUV spied testing... with autonomous gear?

Wed, 12 Jun 2013Let's get the most pressing bits of this story out of the way right off the bat: What we see here appears to be a new compact crossover from Buick. According to the spy photographer, this machine may be a little bit smaller on the outside than the current Chevrolet Equinox and GMC Terrain 'utes, which makes sense since recent rumors suggest GM's small crossovers will migrate to a new platform that will mark a convergence between the automaker's Delta (Chevy Cruze, Buick Verano) and Theta (Equinox, Terrain) platforms. This Buick would likely use this new D2UX platform.

We've been expecting Buick to unleash a crossover to slot between the very small Encore and the very large Enclave, and various rumors have indicated that the model may be known as either the Anthem or Envision. It's worth mentioning that Buick had planned, back in 2009, to release a vehicle in the compact CUV market, but abandoned those plans after a particularly poor reception.

And now for something completely different... Take another look at the spy shots above, and pay special attention to the cylindrical device mounted to the vehicle's roof. We can't say for sure what it is, but our spy photographer opines that it looks quite a bit like the 360-degree Lidar camera equipment used by Google for its autonomous cars. Is General Motors working with Google on autonomous car technology? We don't know, but you can definitely consider us intrigued.

Buick Adam a reality after all... but only in China

Mon, 03 Mar 2014General Motors may have parred down its brand portfolio, but it still has more under its umbrella than most. That's why, while a company like Ford might market the same vehicle under its own name in markets around the world, GM uses different brands in different markets. But no two are aligned quite as closely as Opel in Europe and Buick in the United States and China.

What we know here as the Buick Regal is sold overseas as the Opel Insignia. Our Encore is their Mokka. Verano? Astra sedan. But one thing we don't get here is the Opel Adam. The diminutive city car is GM's take on the Mini Cooper, Fiat 500, Citroën DS3 et al. Launched at the 2012 Paris Motor Show, the Opel Adam is named after the company's founder (like an ironic thumbing of the nose to the Ferrari Enzo). But while it's sold, like most Opels, in the UK as a Vauxhall, the prospect of it porting over to Buick seems slim to none. Right?

Sorta. While the Adam isn't likely to come Stateside, the latest reports (as yet unconfirmed by GM) suggest that The General is planning to sell the Adam in China where the Buick brand is also a strong seller. Local production could ensue, with prices targeting the Fiat 500 and engines - according to CarNewsChina.com - to include inline-fours displacing 1.2 and 1.4 liters with 69 and 100 horsepower, respectively.

Buick Verano to go turbo-only for 2014?

Sat, 22 Dec 2012If VIN tags recently posted online prove accurate, the 2014 Buick Verano may be getting a new base engine. Presently the Verano makes use of GM's 2.4-liter Ecotec four-cylinder engine in non-turbo trim; 2014 documentation appears to indicate that GM's entry-level luxury compact will instead feature a 1.6-liter turbocharged mill.

If this is the same engine seen in Europe, GM Inside News suggests it may offer 192 horsepower and 170 pound-feet of torque - useful improvements over the larger naturally aspirated mill's 180 hp and 171 lb-ft. More importantly, the downsized engine would likely improve on the Verano's current fuel mileage estimates of 21 city and 31 highway.

We like the Verano in both of its current iterations, but the 1.6 turbo engine sounds like a worthwhile upgrade if this reports turns out to be true. Plus, if more performance is your bag, baby, there's always the Verano's optional 2.0 turbo engine with an impressive 250 horsepower and 260 lb-ft from just 2.0 liters of displacement.