2014 Buick Lacrosse Leather Group on 2040-cars

6000 S 36th St, Fort Smith, Arkansas, United States

Engine:2.4L I4 16V GDI DOHC Hybrid

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1G4GB5GR8EF253738

Stock Num: 14470

Make: Buick

Model: LaCrosse Leather Group

Year: 2014

Exterior Color: Quicksilver Metallic

Interior Color: Ebony

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 6

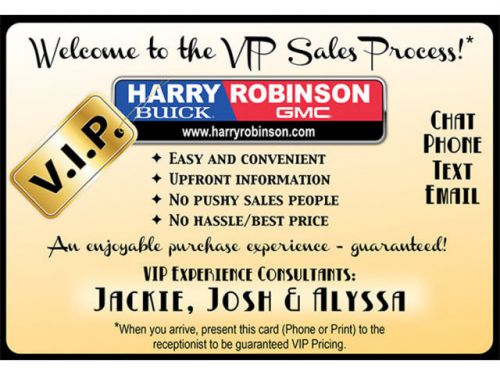

Shopping with the VIP department gives you VIP Pricing! Haggle-free pricing means a pleasant experience for all of us. Call/text 888-231-6584 to speak with Jackie, Alyssa, James or Jon. We price low and fair, allowing us to focus on your needs. Shopping with the VIP department gives you VIP Pricing! Haggle-free pricing means a pleasant experience for all of us. Call/text 888-231-6584 to speak with Jackie, Alyssa, James or Jon. We price low and fair, allowing us to focus on your needs. June Rebates: $1500 off Acadia and Enclave, $1000 off 14 Lacrosse and 14 Regal. Huge discounts on all trucks! 2015 Yukons and 2500's in stock.

Buick Lacrosse for Sale

2014 buick lacrosse leather group(US $38,795.00)

2014 buick lacrosse leather group(US $38,795.00) 2014 buick lacrosse leather group(US $38,895.00)

2014 buick lacrosse leather group(US $38,895.00) 2014 buick lacrosse leather group(US $36,835.00)

2014 buick lacrosse leather group(US $36,835.00) 2014 buick lacrosse leather group(US $39,795.00)

2014 buick lacrosse leather group(US $39,795.00) 2014 buick lacrosse leather group(US $40,495.00)

2014 buick lacrosse leather group(US $40,495.00) 2014 buick lacrosse leather group(US $42,990.00)

2014 buick lacrosse leather group(US $42,990.00)

Auto Services in Arkansas

Xtreme Collision & Auto Sales ★★★★★

Wholesale Tire Outlet Automotive ★★★★★

Western Auto NAPA ★★★★★

U-Haul of North Little Rock ★★★★★

Texarkana Tire & Wheel ★★★★★

Rusty`s Automotive ★★★★★

Auto blog

First 2013 Buick Encore TV ad features... dinosaurs

Thu, 14 Mar 2013The whole "SUVs as dinosaurs" trope has become something of a threadbare cliché among auto writers, but that doesn't mean the wider world of consumers has caught on to the Jurassic nature of our line of thinking. That's what General Motors appears to be betting on, at least. Just check out Buick's first television spot for its 2013 Encore, the tiny crossover that is pushing the Tri-Shield into territories unknown while looking to outrun the brand's reputation as a refuge for elderly clientele.

Set to air this weekend on ESPN during the NCAA college basketball tournament, the ad plays up the Encore's maneuverability and surprising interior space by setting the baby Buick amongst a herd of lumbering CG dinosaurs created by Tippett Studio, the folks behind Hollywood blockbusters like Jurassic Park, Ted, and the Twilight series of films.

We can't help but snigger a little - while the Encore is indeed surprisingly roomy, nimble, and composed, our first drive found it to be glacially slow, too... not unlike a certain prehistoric race of animals. Check out the commercial below and judge for yourself.

Hyundai, Buick dealer apologize in wake of Chinese baby social media incident

Sat, 09 Mar 2013A very strange story out of China today, as Hyundai and a Chinese Buick dealer were forced to face allegations of using allusions to an infamous child murder on a social media site as a way of promoting the safety features of their respective vehicles.

The original sad tale goes something like this: On March 4, a man reported to police that he had left his infant child in a running Toyota RAV4 while he ran into a supermarket briefly. When he came back out, the vehicle and the child were gone. Later in the week a suspect turned himself in to the police; confessing to them that he had stolen a sport-utility vehicle, strangled the infant that was in it, and then buried the child in the snow.

As you might imagine, the gristly incident was covered massively in the Chinese media. (There was huge public outcry as well, as evidenced by the vigil scene, above.) "Changchun baby abduction" was very quickly amongst the highest ranking search teams of the China's Weibo social media site - an equivalent of Twitter in the English-speaking world.

Neil Young's 1953 Buick Roadmaster Skylark brings $400,000 at auction

Mon, Dec 11 2017Singer-songwriter Neil Young's extensive collection of model trains have fetched nearly $300,000 at auction, along with classic cars and musical equipment owned by the 72-year-old folk-rock icon. Young, a model train enthusiast for decades, offered more than 230 pieces at Julien's Auctions in Los Angeles from his collection of Lionel trains, including a custom-painted Commodore Vanderbilt 4-6-4 locomotive that sold for $10,000. Several cars that Young owns were also sold. A 1953 Buick code 76X Roadmaster Skylark convertible with a steering wheel hub that says, "Customized for Neil Young," went for $400,000, the auction house said on Saturday. Young, best known for his Woodstock-era songs as well as his work with the bands Buffalo Springfield and Crosby, Stills, Nash & Young has said the vast model train layouts at his California ranch helped him connect with his son Ben, who has cerebral palsy. Other items auctioned off on Saturday included some of Young's guitars, amplifiers and microphones. A portion of the proceeds will benefit the Bridge School in California, which Young's ex-wife Pegi Young co-founded in 1986 for children with severe speech and physical impairments.Reporting by Joseph AxRelated Video: