2014 Buick Lacrosse Leather on 2040-cars

2603 Broadway St, Anderson, Indiana, United States

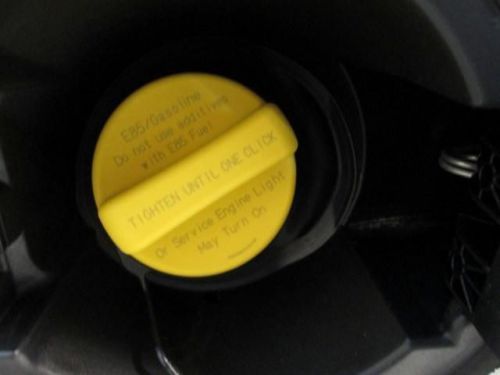

Engine:3.6L V6 24V GDI DOHC

Transmission:6-Speed Automatic

VIN (Vehicle Identification Number): 1G4GB5G36EF177495

Stock Num: 10258

Make: Buick

Model: LaCrosse Leather

Year: 2014

Exterior Color: Mocha

Options: Drive Type: FWD

Number of Doors: 4 Doors

Hey!! Look right here!!! Need gas? I don't think so. At least not very much! 28 MPG Hwy* Take a road, any road. Now add this Sedan and watch how that road begins to look like a racetrack... Priced below MSRP!!! This hot Leather Group is available at just the right price, for just the right person - YOU.. Safety equipment includes: ABS, Traction control, Curtain airbags, Passenger Airbag, Stability control...It is nicely equipped: Leather seats, Bluetooth, Power locks, Power windows, Heated seats... Our name means a GREAT deal!

Buick Lacrosse for Sale

2014 buick lacrosse premium 2(US $39,999.00)

2014 buick lacrosse premium 2(US $39,999.00) 2014 buick lacrosse premium 2(US $40,586.00)

2014 buick lacrosse premium 2(US $40,586.00) 2013 buick lacrosse base(US $30,360.00)

2013 buick lacrosse base(US $30,360.00) 2013 buick lacrosse base(US $30,614.00)

2013 buick lacrosse base(US $30,614.00) 2014 buick lacrosse base(US $31,749.00)

2014 buick lacrosse base(US $31,749.00) 2014 buick lacrosse base(US $32,062.00)

2014 buick lacrosse base(US $32,062.00)

Auto Services in Indiana

Zamudio Auto Sales ★★★★★

Westgate Chrysler Jeep Dodge ★★★★★

Tom Roush Lincoln Mazda ★★★★★

Tim`s Wrecker Service & Garage ★★★★★

Superior Towing ★★★★★

Stan`s Auto Electric Inc ★★★★★

Auto blog

GM recalling 1.5M cars in China for faulty bracket

Fri, 27 Dec 2013General Motors and its Chinese partners have announced their second recall in the People's Republic this year, following a 2,653-unit recall of the Cadillac SRX earlier this year. This latest recall affects nearly 1.5 million cars built between 2006 and 2012. It's not explicitly stated, but as there's no movement from the US NHTSA, we suspect that the cars in question were all Chinese-built rather than imports.

The vast majority of the affected vehicles are Buick Excelles (pictured), with 1.2 million units being recalled over a faulty bracket that's meant to secure the fuel pump. The Excelles in question were built between 2006 and 2012, while an additional 250,000 Chevrolet Sail superminis, built between April 2009 and October 2011, are being recalled for a similar reason.

According to the PRC's Administration for Quality Supervision, Inspection and Quarantine, the faulty bracket could crack and potentially cause a fuel leak.

Submit your questions for Autoblog Podcast #310 LIVE!

Mon, 26 Nov 2012We record Autoblog Podcast #310 tonight, and you can drop us your questions and comments regarding the rest of the week's news via our Q&A module below. Subscribe to the Autoblog Podcast in iTunes if you haven't already done so, and if you want to take it all in live, tune in to our UStream (audio only) channel at 10:00 PM Eastern tonight.

Discussion Topics for Autoblog Podcast Episode #310

Buick GN and GNX will return

Honda and Chrysler EV news, and talking with GM's charging ecosystem boss | Autoblog Podcast #781

Fri, May 19 2023In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. They're excited about the news of the possibility of an electric sports car being revealed for Honda's 75th anniversary, as well as the completely revamped — redesigned and renamed — Chrysler Airflow. They've been driving the Bentley Bentayga EWB, Range Rover, Toyota GR Corolla and the refreshed Buick Encore GX. We listen to a interview Greg conducted with GM's EV charging boss, Hoss Hassani. Finally, a reader is looking to help his in-laws choose an SUV, possibly a hybrid or EV, to replace a BMX X3. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast # 781 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown News Honda electric sports car could be unveiled this year Chrysler Airflow being redesigned and renamed for production Cars we're driving 2023 Bentley Bentayga EWB Azure First Edition 2023 Land Rover Range Rover SE LWB 2023 Toyota GR Corolla Morizo 2024 Buick Encore GX Avenir Interview with Hoss Hassani, General Motors Vice President and EV Charging Ecosystem Spend my Money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Green Podcasts Bentley Buick Chrysler GM Honda Land Rover Toyota Green Automakers Crossover Hatchback SUV Electric Future Vehicles Luxury Performance Sedan