Cx 3.6l V6 Front Wheel Drive Aluminum Wheels Hid Headlights Warranty 3rd Row on 2040-cars

Merrillville, Indiana, United States

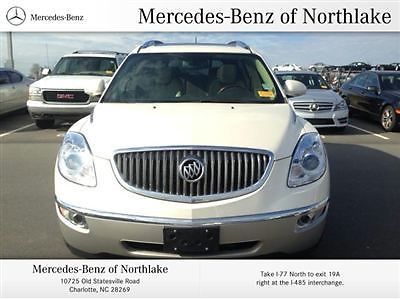

Buick Enclave for Sale

6,330 miles awd leather navigation rear dvd moonroof 7-passenger(US $38,900.00)

6,330 miles awd leather navigation rear dvd moonroof 7-passenger(US $38,900.00) Diamond white, very clean, local trade, good history..(US $22,990.00)

Diamond white, very clean, local trade, good history..(US $22,990.00) 2009 buick enclave awd 4dr suv 3.6l third row seat cd 6-speed a/t

2009 buick enclave awd 4dr suv 3.6l third row seat cd 6-speed a/t 2009 buick enclave cx sport utility 4-door 3.6l

2009 buick enclave cx sport utility 4-door 3.6l 09 heated leather back up camera dual climate controls tint tow onstar sunroof

09 heated leather back up camera dual climate controls tint tow onstar sunroof Certified pre owned carolina car 1 owner zero percent apr finance offer

Certified pre owned carolina car 1 owner zero percent apr finance offer

Auto Services in Indiana

Xtreme Precision ★★★★★

Whetsel`s Automotive ★★★★★

USA Auto Mart ★★★★★

Tony Kinser Body Shop ★★★★★

Tire Barn Warehouse ★★★★★

The Tire Store ★★★★★

Auto blog

Reuss says Cadillac CT6-based Buick could happen

Wed, Apr 15 2015Could the upcoming Cadillac CT6 and its Omega platform spawn a Buick variant? According to General Motors' product chief Mark Reuss, it could potentially be in the cards, but "not yet." "We're working on that," Reuss told Automotive News at the 2015 New York Auto Show. While there hasn't been a large, rear-drive Buick on dealerships since the Roadmaster in 1996, the company gave a big hint that it could head in that direction with the Avenir Concept, shown earlier this year at the Detroit Auto Show. As Automotive News explains, a rear-drive Omega-platform Buick could be a real hit in China, where consumers buy 13 Buicks for every one Cadillac. That move would be a big help to GM's bottom line, too, as it'd significantly increase the Omega platform's economy of scale. If a large Buick based on the CT6 were to head to China, though, it likely wouldn't be a simple case of badge engineering (thank God). Reuss hinted to Automotive News that while the mixed-material construction of the CT6 platform "is very flexible," doing an "identical version of that platform or not is a different conversation." What are your thoughts? Should Buick adopt the Omega platform for an Avenir-based sedan? Should that vehicle be sold here in the US, or should it be a China-only offering? Have your say in Comments. Related Video:

Meet the Buick Velite 7, the Chevy Bolt's Chinese cousin

Wed, Jun 17 2020The Buick Velite 7 has officially been revealed after having been leaked and spied a few months ago. The name derives from Buick's line of electrified models it sells in China, of course the design shows it's most closely related to the Chevy Bolt EV. Buick hasn't revealed many details about it, and only one photo, but we do get to see it and we also have a range estimate. The range estimate is 500 kilometers on the NEDC cycle, which translates to 311 miles. That's actually less than the NEDC estimate for the Bolt EV, which is 565 kilometers or 351 miles, which increased for the 2020 model year from 520 kilometers or 323 miles. Of course NEDC figures tend to be much higher than EPA numbers, which rated the current Bolt EV at 259 miles and the previous version at 238. As such, we would expect this Buick to have an EPA range closer to 210 to 220 miles. We don't know what resulted in the lower range, but it could have something to do with additional weight or slightly worse aerodynamics. It could be both. Design-wise, the Buick is clearly based on the Bolt, but has a more aggressive front bumper and a trendy partially floating roof. It also seems to have a slightly boxier, taller profile, mainly because of the nose. Buick hasn't released any other details about the crossover, preferring to save them for the car's launch later this year. Since it seems so closely related to the Bolt, it probably has the same drivetrain: a single electric motor sending 200 horsepower and 266 pound-feet of torque to the front wheels via a single-speed transmission. Related Video: Â Â

General Motors posts record earnings, but global sales fall

Thu, Apr 21 2016General Motors started the year with record success. The automaker's $2.7 billion in adjusted earnings before interest and taxes was its highest ever in in the first quarter of 2016, up from $2.1 billion in from the same time period a year earlier. Net income grew to $1.95 billion, which was more than double the $953 million in the same period last year. The company's figures also beat analysts' predictions, according to the Detroit Free Press. Despite the financial growth, global sales actually decreased by 2.5 percent to 2.36 million vehicles. "We're growing where it counts, gaining retail share in the US, outpacing the industry in Europe and capitalizing on robust growth in SUV and luxury segments in China," CEO Mary Barra said in the company's financial announcement. GM did well in North America with an adjusted EBIT of $2.3 billion, up from $2.2 billion last year. Sales in the region also grew 1.2 percent to 800,000 vehicles. According to The Detroit Free Press, the company has been especially successful at selling more expensive models in the US. The company's average vehicle was $34,600 in Q1, about $3,000 more than the industry average. Elsewhere in the world, GM also showed improvement. Europe practically broke even after losing about $200 million last year, and Opel and Vauxhall sales grew 8.4 percent to more than 300,000 vehicles for the quarter. South America only lost $100 million, which was half as much as Q1 2015's $200 million loss. China remained flat at $500 million of income. Cadillac volume jumped 6.1 percent there, and Buick's deliveries increased 22 percent, thanks to the Envision crossover's success. GM Reports First-Quarter Net Income of $2.0 Billion 2016-04-21 EPS diluted of $1.24; First-quarter record EPS diluted-adjusted of $1.26 First-quarter record EBIT-adjusted of $2.7 billion GM Europe posts break-even performance DETROIT – General Motors Co. (NYSE: GM) today announced first-quarter net income to common stockholders of $2.0 billion or $1.24 per diluted share, compared to $0.9 billion or $0.56 per diluted share a year ago. Earnings per share diluted-adjusted for special items was a first-quarter record at $1.26, up 47 percent compared to the first quarter of 2015. The company set first-quarter records for earnings and margin, with earnings before interest and tax (EBIT) adjusted of $2.7 billion and EBIT-adjusted margin of 7.1 percent.