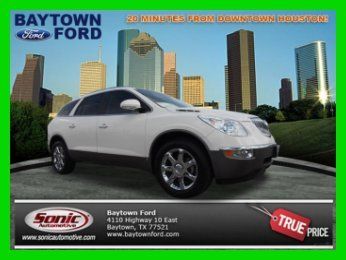

2011 Buick Enclave Fwd 4dr Cxl-2 Cruise Control Power Windows Alloy Wheels on 2040-cars

Tulsa, Oklahoma, United States

Transmission:Automatic

Body Type:Sport Utility

Vehicle Title:Clear

Fuel Type:GAS

Power Options: Air Conditioning, Cruise Control, Power Windows

Make: Buick

Vehicle Inspection: Vehicle has been Inspected

Model: Enclave

CapType: <NONE>

Trim: CXL Sport Utility 4-Door

FuelType: Gasoline

Listing Type: Pre-Owned

Drive Type: FWD

Certification: None

Mileage: 25,578

Sub Model: FWD CXL-2

BodyType: SUV

Exterior Color: White

Cylinders: 6 - Cyl.

Interior Color: Tan

DriveTrain: FWD

Warranty: Unspecified

Number of Cylinders: 6

Buick Enclave for Sale

2010 buick enclave cxl sport utility 4-door 3.6l

2010 buick enclave cxl sport utility 4-door 3.6l 2011 buick enclave cxl 1 owner new car trade(US $21,200.00)

2011 buick enclave cxl 1 owner new car trade(US $21,200.00) 2008 cxl used 3.6l v6 24v automatic fwd suv onstar

2008 cxl used 3.6l v6 24v automatic fwd suv onstar 2009 buick enclave cxl sport utility 4-door 3.6l(US $25,000.00)

2009 buick enclave cxl sport utility 4-door 3.6l(US $25,000.00) Buick enclave awd 4x4 black heated leather navigation sunroof chrome wheels

Buick enclave awd 4x4 black heated leather navigation sunroof chrome wheels Entertainment - leather - quad buckets - pwr gate

Entertainment - leather - quad buckets - pwr gate

Auto Services in Oklahoma

U-Haul ★★★★★

Tulsa Auto Service & Sales ★★★★★

Topline Autoworks ★★★★★

Tobler`s Automobile Service Center ★★★★★

Specialized Auto Sales ★★★★★

Smart Auto Wholesale ★★★★★

Auto blog

Is Buick's surprise Detroit concept a Camaro-sized coupe?

Sun, Jan 10 2016Tomorrow night marks the unofficial start of the 2016 Detroit Auto Show. Keep your eyes peeled for a number of reveals, including a surprise debut from Buick. Yes, Buick. And we think it's going to be something really hot. According to a report from Bloomberg, the Tri-Shield's secret car could be a Camaro-sized sport coupe concept. As Bloomberg explains, it'd certainly gel with the impression the company is trying to put out – that it's no longer a brand for those with one foot in the grave. Introducing a sports coupe, even as a concept, could certainly reinforce that message. And if it happens to make production – which is not a certainty, Bloomberg's secret source says – it could certainly help Buick drive its average buyer age down from 59. Bloomberg doesn't offer any speculation on Buick's new coupe, but we have no problem making educated guesses. Our most reliable conjecture is this: it will ride on General Motors' Alpha platform, which underpins both the Camaro and the Cadillac ATS. And with a certain twin-turbocharged V6 in the GM stable, we've got an idea of what kind of engine could be shown. That speculation will have to suffice for now. But don't worry, we'll have official details, live images, and video tomorrow when Buick unveils its new concept in Detroit's Eastern Market.

Buick Envision CUV displays full-frontal nudity

Tue, 22 Jul 2014Earlier this month, Shanghai GM gave us a glimpse of the production version of the Buick Envision concept revealed at the Shanghai Motor Show back in 2011. And now it's released the first unveiled shot and initial details of the crossover to slot in the considerable gap between the Encore and Enclave.

The new Envision is set later this year to reach Chinese showrooms, where it will be called the Ang Ke Wei, after which we're expecting it to arrive Stateside. The production-ready Envision is about the size of the Chevrolet Equinox or GMC Terrain, but is differentiated by a more upscale treatment and Buick's signature waterfall grille, flanked by Xenon headlamps and LED running lights and riding on 19-inch wheels.

Power comes from GM's familiar 2.0-liter turbo four with direct injection and stop/start ignition, driving 256 horsepower and 260 pound-feet of torque through a six-speed automatic transmission to all four wheels. That's about all that GM's Chinese operation has announced at this point - it's not even clear what platform the vehicle is on - but you can check out the press release for yourself below.

Frustrated GM investors ask what more Mary Barra can do

Mon, Oct 22 2018DETROIT — General Motors Co Chief Executive Mary Barra has transformed the No. 1 U.S. automaker in her almost five years in charge, but that is still not enough to satisfy investors. Ahead of third-quarter results due on Oct. 31, GM shares are trading about 6 percent below the $33 per share price at which they launched in 2010 in a post-bankruptcy initial public offering. The Detroit carmaker's stock is down 22 percent since Barra took over in January 2014. After hitting an all-time high of $46.48 on Oct. 24, 2017, the shares have declined 33 percent. In the same period, the Standard & Poor's 500 index has climbed 7.8 percent. Several shareholders contacted by Reuters said GM could face a third major action by activist shareholders in less than four years if the share price does not improve. "I've been expecting it," said John Levin, chairman of Levin Capital Strategies. "It just seems a tempting morsel to somebody." Levin's firm owns more than seven million GM shares. Barra has guided the company through the settlement of a federal criminal probe of a mishandled safety recall, sold off money-losing European operations, and returned $25 billion to shareholders through dividends and stock buybacks from 2012 through 2017. GM declined to comment for this story, but the company's executives privately express frustration with the market's reluctance to see it as anything more than a manufacturer tied mainly to auto market sales cycles. GM's profitable North American truck and SUV business and its money-making China operations are valued at just $14 billion, excluding the value of GM's stake in its $14.6 billion Cruise automated vehicle business and its cash reserves from its $44 billion market capitalization. The recent slump in the Chinese market, GM's largest, and plateauing U.S. demand are ratcheting up the pressure. GM is one of the few global automakers without a founding family or a government to serve as a bulwark against corporate raiders. In 2015, a group led by investor Harry Wilson pressed GM to launch a $5 billion share buyback, and commit to what is now an $18 billion ceiling on the level of cash the company would hold. In 2017, GM fended off a call by hedge fund manager David Einhorn to split its common stock shares into two classes. Einhorn, whose firm still owned more than 21 million shares at the end of June, declined to comment about GM's stock price. Other investors said there were no clear alternatives to Barra's approach.