1968 Buick Electra 225 Custom Hardtop 4-door 7.0l on 2040-cars

Lowell, Indiana, United States

|

This four door Buick is pretty clean for all original condition. Has about perfect inside. Outside has some digs and scratches from being stored for over 40 years in garage. Everything works inside

|

Buick Electra for Sale

1972 buick electra 225 hardtop 4-door 7.5l harvest gold 69k miles great cond

1972 buick electra 225 hardtop 4-door 7.5l harvest gold 69k miles great cond 1964 buick electra 225 convertible 401/445 wildcat motor, auto,(US $18,999.00)

1964 buick electra 225 convertible 401/445 wildcat motor, auto,(US $18,999.00) 1981 white buick electra limited 2 door coupe with half vinyl top, 70,094 miles(US $7,800.00)

1981 white buick electra limited 2 door coupe with half vinyl top, 70,094 miles(US $7,800.00) 1990 buick lesabre estate wagon rear facing rear seat leather v good cond. !!

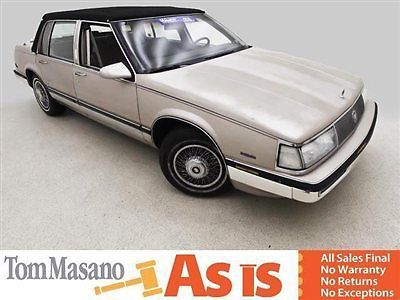

1990 buick lesabre estate wagon rear facing rear seat leather v good cond. !! 1989 buick electra park avenue (40671e) ~~ as is special!

1989 buick electra park avenue (40671e) ~~ as is special! 1973 buick electra 225 deuce and a quarter 2-door 7.5l(US $6,500.00)

1973 buick electra 225 deuce and a quarter 2-door 7.5l(US $6,500.00)

Auto Services in Indiana

Williams Auto Parts Inc ★★★★★

Williams Auto Parts Inc ★★★★★

Webb Hyundai ★★★★★

Trusty & Sons Tire Co ★★★★★

Tom Roush Lincoln Mazda ★★★★★

Tire Barn Warehouse ★★★★★

Auto blog

Man arrested after teaching his dog to drive a Buick 100 mph

Mon, Mar 30 2020A Washington state man riding shotgun in an old Buick was arrested after fleeing a hit-and-run incident and leading police on a high-speed chase on an Interstate freeway. Meanwhile, the driver, his pet pit bull, got off scot-free. Such was the scene Sunday near Seattle, where police arrested a 51-year-old man from Lakewood, Wash., who told them he was teaching his dog how to drive. The man was apparently steering the car from the passenger seat. Reports say the man, whose name was not released, was driving his 1996 Buick on Interstate 5 when he allegedly struck two vehicles in South Seattle near the Boeing Access Road and then fled north on I-5. The car was spotted on the interstate near the Snohomish River in Everett, and officials told KOMO-TV the vehicle was driving more than 100 miles per hour when they began pursuit. The vehicle left the freeway near the Stanwood exit — 57 miles north of the hit-and-run — and then drove onto the nearby Centennial Trail, a rails-to-trail bike path. The chase finally ended after police were able to deploy spike strips. Police found the man seated in the passenger seat and his dog behind the wheel. The man appeared to have been steering for the canine. The man was arrested on suspicion of DUI, reckless driving and hit-and-run feeling eluding. Weird Car News Buick

GM sweetens military discount for Buick, Chevy and GMC

Sun, 06 Oct 2013American servicemen and women interested in a new vehicle from Chevrolet, Buick or GMC now have a bit more incentive to head down to their local dealer, as General Motors has announced plans to improve its military discount program.

The new GM Military Discount Program offers eligible consumers a new Chevy, Buick or GMC at invoice pricing, which in some cases can take very large chunks out of a car's retail price. When factored in with other incentives, most of which are available with the Military Discount, the bargains are thick on the ground for members of the US armed forces.

GM's Retail Sales and Marketing Support general manager, Chuck Thomson, said, "GM has long supported the military and military families, and we hope this simplified and enhanced discount will show our appreciation for their service and help make it easier for them to own one of our great new vehicles." The program is open to all active duty and reserve members in the Army, Navy, Marines, Air Force, National Guard and Coast Guard, as well as veterans that have been out of the service for less than a year. Military retirees and their spouses are also eligible for the discount.

Buick Electra-X SUV Concept is a sporty-looking electric crossover

Thu, Jun 2 2022We all saw the gorgeous Buick WIldcat EV concept yesterday, but slipping under the radar was another Buick concept revealed in China: the Electra-X Concept SUV. Buick is planning on using “Electra” to name its future EVs, and this is our first look at a concept with the name attached to it. Specifically, Buick says that this concept “previews the production version of BuickÂ’s new generation of electric vehicles in China, underpinned by GMÂ’s revolutionary Ultium platform.” Nowhere in BuickÂ’s announcement does the brand say this concept will transfer to future Buicks in the U.S., but itÂ’s an interesting thought to entertain. The Electra-X Concept SUV looks like a fastback SUV, or crossover coupe, which is already a common bodystyle here in North America. Seeing that BuickÂ’s intention is to use the Ultium platform, that gives even more reason that something along these lines could find its way into U.S. showrooms. This specific concept is all about design, and itÂ’s easily the most attractive Buick SUV weÂ’ve seen. Buick says the carÂ’s “fresh and youthful” expression is meant to appeal to younger customers. It certainly looks far more sporty than what weÂ’re used to seeing from Buick, which is a good thing. YouÂ’ll notice itÂ’s wearing a new Buick badge up front. The light design in front and back is meant to resemble what weÂ’ll see on future production cars, and like many lights these days, they flash an animation at you as you approach the car. The four-seat interior is meant to look sporty and clean. Plus, it shows off the flat floor capabilities of the Ultium platform. It has an airy feel thanks to a wraparound windshield and glass roof. The seats are wrapped in fabric made from recycled water bottles. YouÂ’ll also see “GS” etched inside the cabin meant to hint that there will be electric GS models in the future. Its main display is a 30-inch 6K screen, and the car features 5G connectivity for the speediest-possible connection to the internet. Super Cruise in its most advanced, current form is also onboard, which is great to see for the Buick brand. Related video: