2006 Audi Tt 180hp Automatic 2-door Convertible on 2040-cars

Stuart, Florida, United States

For Sale By:Dealer

Engine:1.8L 1781CC l4 GAS DOHC Turbocharged

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Year: 2006

Warranty: Limited

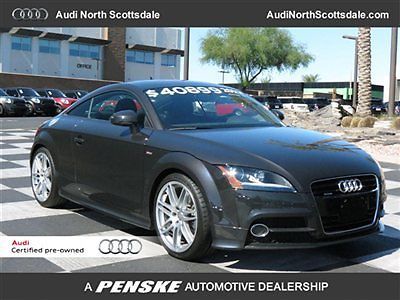

Make: Audi

Model: TT

Trim: Base Convertible 2-Door

Doors: 2

Fuel: Gasoline

Drive Type: FWD

Drivetrain: FWD

Mileage: 77,684

Number of Doors: 2

Sub Model: 180hp

Exterior Color: Black

Number of Cylinders: 4

Interior Color: Black

Audi TT for Sale

2002 audi tt quattro base coupe 2-door 1.8l

2002 audi tt quattro base coupe 2-door 1.8l Black 6 speed awd quattro 225 hp power top cabrio black leather dealer trade(US $6,688.00)

Black 6 speed awd quattro 225 hp power top cabrio black leather dealer trade(US $6,688.00) 2012 audi tt rs 2.5 tfsi quattro tech titaniumsportexhaustpkg carbonfibermirrors(US $52,888.00)

2012 audi tt rs 2.5 tfsi quattro tech titaniumsportexhaustpkg carbonfibermirrors(US $52,888.00) 2012 audi tt-awd-certified-prestige package-6500 k miles-leather-navigation

2012 audi tt-awd-certified-prestige package-6500 k miles-leather-navigation 2001 audi tt quattro base coupe 2-door 1.8l(US $12,000.00)

2001 audi tt quattro base coupe 2-door 1.8l(US $12,000.00) 2004 audi tt quattro convertible 3.2l(US $14,999.00)

2004 audi tt quattro convertible 3.2l(US $14,999.00)

Auto Services in Florida

Zip Automotive ★★★★★

X-Lent Auto Body, Inc. ★★★★★

Wilde Jaguar of Sarasota ★★★★★

Wheeler Power Products ★★★★★

Westland Motors R C P Inc ★★★★★

West Coast Collision Center ★★★★★

Auto blog

Cars with the worst resale value after 5 years

Tue, Nov 7 2023While the old saying that cars lose a massive chunk of their value as soon as they’re driven off the dealerÂ’s lot might not be entirely true these days, most new vehicles steadily lose value as they age and are used. iSeeCars recently released its latest study on depreciation, finding the models that lose value the fastest, and the list is packed with high-end nameplates. The vehicles that lost value the fastest over five years include: Maserati Quattroporte: 64.5% depreciation BMW 7 Series: 61.8% Maserati Ghibli: 61.3% BMW 5 Series Hybrid: 58.8% Cadillac Escalade ESV: 58.5% BMW X5: 58.2% Infiniti QX80: 58.1% Maserati Levante: 57.8% Jaguar XF: 57.6% Audi A7: 57.2% While sports cars, hybrids, and trucks dominated the list of slowest-depreciating vehicles, luxury brands accounted for all of the top ten fastest-depreciating models. iSeeCars executive analyst Karl Brauer also pointed out EVsÂ’ lack of representation on the slow-depreciating vehicles list, saying that thereÂ’s a disconnect between what automakers are building and what people actually want. The average five-year depreciation for all vehicles in the iSeeCars study was 38.8 percent. ThatÂ’s an almost 11% improvement over 2019Â’s figures, but some vehicle types perform worse than others. EVs depreciated 49.1 percent over five years, while SUVs dropped 41.2%. Trucks only fell 34.8% and hybrids 37.4%. Brauer noted that all vehicles depreciate slower than they did five years ago. Even so, EVs are not the best choice if youÂ’re looking for a vehicle that wonÂ’t feel like a ripoff when itÂ’s time to trade in. On the flip side, used EVs can present a stellar value, saving thousands over their new counterparts. Charging times and availability remain concerns for buyers in large parts of the country, but a heavily depreciated EV could be the used car value youÂ’ve been looking for. The same wisdom applies to used luxury vehicles, as the list above indicates. While new-car buyers shopping for luxury cars are set to see big depreciation during their ownership, that means the used car market is flooded with inexpensive used luxury cars. High repair costs and costly maintenance schedules are real issues that used luxury models face, however. Green Audi BMW Cadillac Infiniti Jaguar Maserati Car Buying Used Car Buying

Despite premium carmakers going downmarket, luxury auto sales stick at 10-11%

Thu, 16 Jan 2014According to research conducted by global information company IHS Automotive, the leporine birthing of new models by luxury manufacturers over the past six years hasn't increased their market share in the US. Even as car sales reached 15.6 million units, IHS says what's happened instead is that luxury buyers are merely moving from one brand to another, moving from larger luxury vehicles into hot segments like compact luxury crossovers or leaving the market at the same rate as other buyers enter.

Whether broken out by makes or by segment, market share has rollercoastered inside a narrow band from 10.5 to 11.5 percent since "at least" 2008. Closer investigation reveals the shifting boundaries in the aspirational pond, with brands like Mercedes-Benz and Audi gaining territory as Lexus and Lincoln lost it, and Saab and Hummer were buried, dead, under it. One neat note is that Tesla has gone from a share of zip to .12 percent.

The subcompact and compact crossover segments show growth, with those little high-riders jumping from .3 percent to 1.16 percent of overall industry sales. Their rise, though, is concomitant with the decline of four other segments: compact and midsize cars and fullsize cars and SUVs. We think the next few years that will tell if the small-car expansion can overcome the large-car retraction, with a phalanx of smaller offerings like the CLA only recently hitting the market and others like the GLA, Macan and Q1 doing so in the near future.

VW, Rivian, Nissan, BMW, Genesis, Audi and Volvo lose EV tax credits starting tomorrow

Mon, Apr 17 2023The U.S. Treasury said Monday that Volkswagen, BMW, Nissan, Rivian, Hyundai and Volvo electric vehicles will lose access to a $7,500 tax credit under new battery sourcing rules. The Treasury said the new requirements effective Tuesday will also cut by half credits for the Tesla Model 3 Standard Range Rear Wheel Drive to $3,750 but other Tesla models will retain the full $7,500 credit. Vehicles losing credits Tuesday are the BMW 330e, BMW X5 xDrive45e, Genesis Electrified GV70, Nissan Leaf , Rivian R1S and R1T, Volkswagen ID.4 as well as the plug-in hybrid electric Audi Q5 TFSI e Quattro and plug-in hybrid (PHEV) electric Volvo S60. The Swedish carmaker is 82%-owned by China’s Zhejiang Geely Holding Group. The rules are aimed at weaning the United States off dependence on China for EV battery supply chains and are part of President Joe Biden's effort to make 50% of U.S. new vehicle sales by 2030 EVs or PHEVs. Hyundai said in a statement it was committed to its long-range EV plans and that it "will utilize key provisions in the Inflation Reduction Act to accelerate the transition to electrification." Rivian declined to comment and the other automakers could not immediately be reached for comment. Treasury also disclosed General Motors electric Chevrolet Bolt and Bolt EUV will qualify for the full $7,500 tax credit. GM said earlier it expected at least some of its EVS would qualify for the $7,500 tax credit under the new rules, including the 2023 Cadillac Lyriq and forthcoming Chevrolet Equinox EV SUV and Blazer EV SUV. Treasury said all GM EVs will qualify. Earlier, Ford Motor and Chrysler-parent Stellantis said most of their electric and PHEV models would see tax credits halved to $3,750 on April 18. Treasury confirmed the automakers' calculations. The rules were announced last month and mandated by Congress in August as part of the $430 billion Inflation Reduction Act (IRA). The IRA requires 50% of the value of battery components be produced or assembled in North America to qualify for $3,750, and 40% of the value of critical minerals sourced from the United States or a free trade partner for a $3,750 credit. The law required vehicles to be assembled in North America to qualify for any tax credits, which in August eliminated nearly 70% of eligible models and on Jan. 1 new price caps and limits on buyers income took effect.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.733 s, 7902 u