2021 Aston Martin Other on 2040-cars

Transmission:Automatic

Body Type:SUV

Engine:8

Fuel Type:Gas

Vehicle Title:Clean

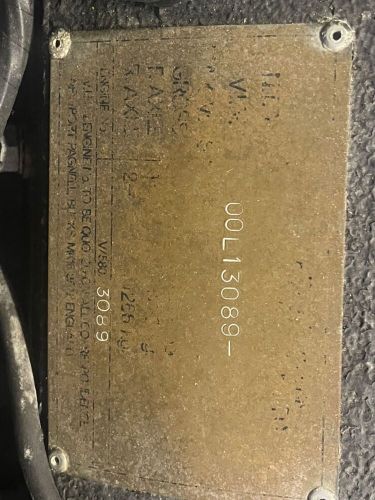

VIN (Vehicle Identification Number): SCFVUJAW8MTV03011

Mileage: 23734

Make: Aston Martin

Disability Equipped: No

Interior Color: Black

Doors: 4

Drivetrain: All Wheel Drive

Exterior Color: Black

Model: Other

Aston Martin Other for Sale

1981 aston martin other(US $22,522.00)

1981 aston martin other(US $22,522.00)

Auto blog

Aston Martin investor says demand is 'phenomenal,' returned first in China

Sun, Dec 6 2020LONDON - Carmaker Aston Martin is seeing "phenomenal" demand, boosted by a rebound in China, the company's executive chairman and billionaire investor Lawrence Stroll said on Friday. "Demand right now is phenomenal," he told the Financial Times' "The Future of the Car" digital conference. "China really returned first and strongest, and is gangbusters." Stroll led a consortium which invested in Aston earlier this year as the carmaker struggled following its 2018 stock market flotation, after which its share price slumped. Since then a new chief executive has taken over and the 107-year company, famed for being fictional agent James Bond's car of choice, did a deal in October which sees German carmaker Daimler up its stake in the firm. Shareholders approved the latest capital injection plan on Friday. Stroll said Aston's current growth trajectory meant "the public markets are the right place" for the firm whilst eying an increase in the value of its shares, which stand at 79 pence ($1.06). "They'll be significantly worth more than they are today," he said. Reporting by Costas Pitas, editing by David Milliken and Louise Heavens

Aston Martin reveals hardcore Vantage GT3 special edition

Wed, Feb 18 2015If there are two things of which we've seen a lot in recent years, they're versions of the Aston Martin Vantage, and road-going sports cars wearing the name GT3. And you know what? We're not tired of either just yet. So we're pleased to report that the two have come together with the release of the new Aston Martin Vantage GT3. The ultimate evolution of Gaydon's nimble little sports car, the Vantage GT3 is lighter and more extreme than any version to date. Envisioned as a street-legal mid-point between Aston's successful racing cars and its coveted luxury GTs, the Vantage GT3 packs a number of key upgrades to make it lighter, more powerful and more hard-core than its stablemates. For starters, the company's ubiquitous 6.0-liter V12 has been upgraded with a new intake manifold and torque tube made from magnesium and a full titanium center-exit exhaust system. Although final figures are yet to be announced, Aston Martin figures it'll crank out around 600 metric horsepower – 592 by our standards, more than any iteration of the engine to date (including the flagship Vanquish) or any road-going Aston this side of the One-77. The other side of the power-to-weight ratio is optimized through the extensive use of carbon fiber. Aston has replaced the front fenders, hood and doors with the lightweight weave, as well as the center stack and Alcantara-trimmed racing buckets. Customers can even opt for a carbon-fiber roof and the rear glass to be replaced by plexi. The result is a projected curb weight of around 3,450 pounds, or a good 220 pounds lighter than the V12 Vantage S. A more extreme aero kit (also made of carbon, naturally) includes a splitter jutting out from under the nose and a big rear wing, and Michelin Pilot Super Sport tires sit at the edges of a wider track. Only 100 examples of the Vantage GT3 will be offered after its debut at the Geneva Motor Show next month, with deliveries slated to begin later this year as Aston prepares its next generation of Mercedes-powered sports cars. INSPIRED BY RACING: THE ASTON MARTIN VANTAGE GT3 SPECIAL EDITION - Lightweight and extreme Vantage special edition limited to 100 cars - Motorsport-derived chassis, aerodynamics and handling - Bridges the gap between road and race track driving 18 February 2015, Gaydon: Aston Martin is today revealing the first details of its most potent and uncompromising Vantage to date: the track-inspired Vantage GT3 special edition.

Bond, junk bond? Aston Martin financial ratings go south as it awaits DBX

Sat, Sep 28 2019Ratings agencies Standard & Poor's and Moody's have taken a dim view of Aston Martin Lagonda. S&P cut its credit rating on the storied carmaker deeper into junk territory this week, and Moody's revised its credit outlook to "negative" after the company raised $150 million in debt from a bond issue at 12% interest, with the option to raise another $100 million at 15%. The Standard & Poor's rating was trimmed by one notch to 'CCC+', which reflects substantial risks and takes it close to default territory after a faster-than-expected cash burn this year. The outlook is negative. The negative outlook reflects ongoing pressure on profits, a high cash burn, and very high leverage in the face of heightened risks linked to a potential no-deal Brexit and new tariffs on car imports threatened by the United States. The potential salvation for the company is its new DBX luxury SUV, the success of which is critical to its ambitious growth strategy and ongoing creditworthiness, S&P said. But Moody's noted that it's burning cash at a high rate as it nears the launch of the DBX. The British carmaker, known as James Bond's favorite marque, has been hit by falling demand in Europe, the Middle East and Africa. It slumped to a first-half loss in July. Chief Executive Andy Palmer said concerns around Brexit and U.S.-China trade relations were skewing the outlook to the downside, so it was prudent to address investor concerns about its balance sheet. "Taking this debt on — short-term debt — is we think the correct tool to completely remove that thesis that we don't have sufficient liquidity," he told Reuters. "In every substantial and material way, this ensures that we can get through to DBX in spite of what all of those global uncertainties might throw at us." The main tranche comprises notes with an interest rate of 12% due in 2022, while the additional notes could be issued under the same terms if permitted, or could be issued as unsecured notes with an interest rate of 15%, Aston Martin said. Shares of stock in the company, which have had a precipitous fall since they listed in London in October 2018 at 19 pounds, were trading down 5% at 545 pence in early deals. Broker AJ Bell said Aston Martin was known for its high end prices and that situation now also applied to its debt. "These rates are very high and are a major red flag that investors consider the car company to be a high risk entity," it said.