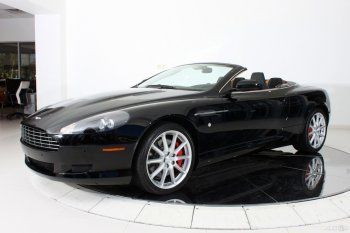

Garage Kept 2009 Db9 Roadster Rare White Tan Only 3k Miles New Condition on 2040-cars

Naples, Florida, United States

For Sale By:Dealer

Engine:6.0L 5935CC V12 GAS DOHC Naturally Aspirated

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Make: Aston Martin

Model: DB9

Disability Equipped: No

Trim: Volante Convertible 2-Door

Doors: 2

Drivetrain: Rear Wheel Drive

Drive Type: RWD

Number of Doors: 2

Mileage: 7,400

Exterior Color: White

Number of Cylinders: 12

Interior Color: Tan

Aston Martin DB9 for Sale

05 db9-21k-linn 950w audio system-mahogany trim-heated seats-nav-cruise control(US $64,995.00)

05 db9-21k-linn 950w audio system-mahogany trim-heated seats-nav-cruise control(US $64,995.00) 2011 aston martin db9 volante - blk/blk - only 600 miles! $214k window sticker!(US $139,999.00)

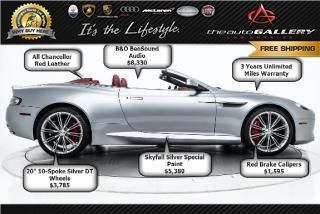

2011 aston martin db9 volante - blk/blk - only 600 miles! $214k window sticker!(US $139,999.00) High spec alarm red calipers mahogany parking sensors two tone interior auto nav(US $99,900.00)

High spec alarm red calipers mahogany parking sensors two tone interior auto nav(US $99,900.00) 2006 aston martin db9 volante convertible 2-door 6.0l

2006 aston martin db9 volante convertible 2-door 6.0l 2005 aston martin db9 base coupe 2-door 6.0l(US $48,900.00)

2005 aston martin db9 base coupe 2-door 6.0l(US $48,900.00) 2013 aston martin db9 2dr volante auto(US $189,995.00)

2013 aston martin db9 2dr volante auto(US $189,995.00)

Auto Services in Florida

Yow`s Automotive Machine ★★★★★

Xtreme Car Installation ★★★★★

Whitt Rentals ★★★★★

Vlads Autobahn LLC ★★★★★

Village Ford ★★★★★

Ultimate Euro Repair ★★★★★

Auto blog

Aston Martin owners rev up for possible sale or stock IPO

Sat, Dec 16 2017LONDON ó Aston Martin's owners have hired financial advisory firm Lazard to prepare for a stock market listing or sale of the British sports car maker made famous by fictional spy James Bond, sources familiar with the matter told Reuters. Italian private equity fund Investindustrial and a group of Kuwaiti investors, who together own more than 90 percent of the marque, are hoping to cash in on a recovery in sales and are in the initial stages of a strategic review. They have hired investment bank Lazard to work on a preliminary plan and could either opt for an initial public offering (IPO) in the third or fourth quarter of 2018 or a trade sale, two of the sources said on Friday. A deal could value the maker of the sports car driven by Britain's Prince William on his wedding day at between 2 billion and 3 billion pounds ($4 billion), one of the sources said, adding a listing was the most likely option. However, no final decision had been taken and the investors could decide to retain control, the sources added. Investindustrial declined to comment while Aston Martin and Lazard did not return requests for comment. Adeem Investment, one of the Kuwaiti investors, was not immediately available. If successful, a float of Aston Martin would be a milestone deal for the 104-year-old car manufacturer and would follow the IPO of Italian sportscar maker Ferrari which made its Wall Street debut in 2015 amid strong investor demand. Investindustrial, led by founder Andrea Bonomi, bought 37.5 percent of Aston Martin in 2012 in what was the fund's best-known investment in Britain. The fund, which has clinched a number of Southern European investments since its launch in 1990, is Aston Martin's single biggest investor and is driving the plans, the sources said. Beside Lazard, other investment banks have approached the private equity fund in recent weeks offering advice ahead of a possible IPO, another source said. Yet no other mandates will be awarded this year for the Gaydon-based firm, which is in the midst of a turnaround plan that aims to restore the business to profitability following six years of losses. Aston Martin, which recently unveiled its new Vantage model, is on course to post its first annual pre-tax profit since 2010 as strong demand for the luxury automaker's DB11 sports car boosts its performance.

The Rolls-Royce Dawn leads this month's list of discounts

Wed, Jul 8 2020If you're one of the few readers of this site who is in the market for a $350,000 Rolls-Royce Dawn, well, first of all, good for you. And you should be prepared to keep some extra money in your pocket, too, as the drop-top Roller leads this month's list of the largest monetary discounts with an average of $14,733 taken off the machine's $359,250 sticker price. That means buyers are paying an average transaction price of $344,517 for the 2020 Rolls-Royce Dawn this month, according to data provided to Autoblog by TrueCar, which equals about 4.1% off the price on the sticker. An intriguing pair of supercars land in second and third positions this month. The 2019 Acura NSX is selling for an average of $145,174 this month, which represents a 9% discount, or $14,373. With an eerily similar 9% discount of $14,079 comes the 2020 Aston Martin Vantage, which has an average transaction price of $142,002 this month. The Maserati Quattroporte is up next with an average discount of $13,634. Another Rolls-Royce model lands in the fifth spot, but instead of the aging Dawn it's the brand-new Cullinan SUV. Although the luxury 'ute boasts a large discount of $12,427, its staggeringly high retail price of $332,750 means buyers are getting a little less than 4% off the sticker. More interesting to most buyers will be the 2019 Lincoln Navigator, which is one of our favorite full-size SUVs in America. Buyers of Lincoln's range-topping vehicle are getting average discounts of $11,761. That represents a 13.4% savings for a final price of $75,940. For a look at the best new car deals in America based on the percentage discount off their suggested asking prices, check out our monthly recap here. And when you're ready to buy, click here for the Autoblog Smart Buy program, which brings you a hassle-free buying experience with over 9,000 Certified Dealers nationwide. Related Video:

Lotus and Aston Martin to hook up?

Tue, 30 Oct 2012This has been a tumultuous year for Lotus - to say the least - from the company being sold off back in January to its CEO Dany Bahar being fired in June to its questionable financial status and rumors of the British automaker being sold off to another automaker. First, we heard that Volkswagen was interested in acquiring Lotus and parent company Proton, a rumor that was later dismissed. Now Automobile is reporting that fellow Brit Aston Martin could be in the market to work with or possibly even merge with Lotus.

While this is pure speculation at this point, such a venture could prove to be beneficial for both independent companies. That's because with Lotus focused on lightweight, relatively affordable sports cars and Aston Martin producing high-end performance cars, there is virtually no product overlap between the companies. The article suggests that a person or company wanting to merge these two automakers would have to raise between $1.1 billion and $1.6 billion in order to make a go of it, however.

We're not sure what to think of this latest rumor, but anything that can help get the struggling brand back to health at least has our interest.