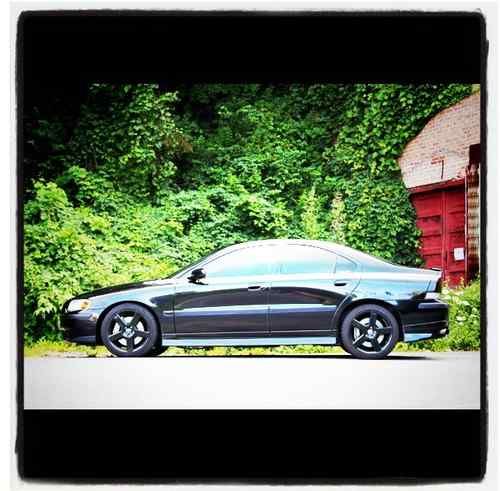

2006 Volvo S60 on 2040-cars

Durham, North Carolina, United States

Engine:2.5L 2521CC l5 GAS DOHC Turbocharged

Body Type:Sedan

Transmission:Automatic

Fuel Type:GAS

Vehicle Title:Clear

Make: Volvo

MPGHighway: 27

Model: S60

BodyStyle: Sedan

Trim: 2.5T Sedan 4-Door

MPGCity: 20

FuelType: Gasoline

Drive Type: AWD

Mileage: 81,000

Sub Model: 2.5T AWD

Number of Doors: 4

Exterior Color: TITANIUM GRAY

Interior Color: Beige

Number of Cylinders: 5

Volvo S60 for Sale

07 volvo s60! warranty! 80k miles! wood steering wheel! no accidents! (s80)(US $11,975.00)

07 volvo s60! warranty! 80k miles! wood steering wheel! no accidents! (s80)(US $11,975.00) Awd se heated leather moonroof warranty 1-owner(US $19,900.00)

Awd se heated leather moonroof warranty 1-owner(US $19,900.00) Premier fwd loan car w/ heated seats(US $32,800.00)

Premier fwd loan car w/ heated seats(US $32,800.00) 2004 volvo s60 with 44,000 miles(US $9,250.00)

2004 volvo s60 with 44,000 miles(US $9,250.00) Make offer non turbo stunning condition moonroof htd leather 8 airbags(US $4,995.00)

Make offer non turbo stunning condition moonroof htd leather 8 airbags(US $4,995.00) 2004 volvo s60r 6speed manual awd turbo fast safe luxurious

2004 volvo s60r 6speed manual awd turbo fast safe luxurious

Auto Services in North Carolina

Wheelings Tire ★★★★★

Wasp Automotive ★★★★★

Viewmont Auto Sales 2 Inc ★★★★★

Tire Kingdom ★★★★★

Thomas Auto World ★★★★★

The Speed Shop ★★★★★

Auto blog

Volvo racks up the most IIHS Top Safety Pick+ awards of any 2022 carmaker

Fri, Apr 8 2022It should not come as any surprise, but Volvo has won the most IIHS Top Safety Pick+ awards of any automaker in 2022. Top Safety Pick+ is the Insurance Institute of Highway Safety's top prize. Volvo has accumulated 13 of the awards, spanning its entire lineup. IIHS and Volvo separates models between gasoline and electrified versions of the same car, even though the tests may have been conducted only on one variant. For example, the XC60 Recharge earns an TSP+ even though tests were conducted using gasoline-powered XC60 T5 and T6 models. Similarly, a C40 Recharge gets the award even though the actual test was conducted on a similar XC40 Recharge. Also, as with Mazda's lineup TSP+ rankings from earlier this year, some are carried over to 2022 model year cars from tests on previous model year cars. This is only when the model has not changed significantly. For example, the XC60's 2022 ranking was based on a 2018 model year's crash test. The IIHS conducts six tests on each car — a moderate overlap front crash, two small overlap front crashes for both driver and passenger, a side impact crash, a roof strength crush evaluation, and a head restraint test using just the car seat. The results are ranked out of four levels, with a green "Good" marker indicating the top tier. Beyond the crashes, Volvo earned top marks for standard safety features such as forward collision warning, automatic emergency braking, and pedestrian and cyclist detection. It should be noted that most Volvo models earned an "Acceptable" rating for ease of use of the LATCH safety seats. This is the second best rating, but does not affect crash worthiness, and won't matter if you don't use child seats. XC40 models received a "Poor" rating for its safety belt reminders, which IIHS deemed not loud or long enough. Some models like the S90 and XC60 received "Acceptable" ratings on headlights, with IIHS wishing the beams were brighter on turns. Despite these minor quibbles, the overall ratings are still very impressive. It should be noted that even the V60 and V90 wagons, which are (achingly beautiful but tragically) discontinued in America, also got TSP+ ratings though were not included in the 13-model 2022 count. Related Video This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Volvo XC90 Earns IIHS Top Safety Pick+ Crash Test Rating

Volvo EX30 endures a side impact crash test with an EX90

Mon, Apr 29 2024Before Volvo launched the EX90, the Swedish automaker — already known as a pioneer in safety — repeatedly stressed how much work it had done to raise the bar for safety in its new electric SUV. Almost every new release included lines like, "The standard safety in the Volvo EX90 is also higher than any Volvo car before it," and "The Volvo EX90 has an invisible shield of safety enabled by our latest sensing technology, inside and outside." But these focused on the car's electronic suite of sensors and cameras watching everything from the road ahead and behind to the driver's state of fatigue. The company did the same during the launch of the EX30, writing that its new compact electric vehicle protects all occupants "through state-of-the-art restraint technology, as well as top-notch structural design that fulfills our ambitious in-house safety requirements — designed to prepare our cars for various real-world scenarios." To prove a point about the safety of the EX30, Volvo's in-house crash-test lab performed a side impact test, running its largest car, the EX90, into the side of its smallest, the EX30. We don't get to see any interior view of the EX30 during the test or afterward. In an Automotive News Europe video about the crash and the results, Lotta Jakobsson from the Volvo Cars Safety Center says the data showed that the two "small-sized females" sitting on the struck side "were well protected" in the crash, with minimal infliction of injury. The physical design of both cars helps make this happen. The EX30 was designed to disperse all of its forces around the structure of the car for "balanced interaction" during an event. That's pretty standard stuff. On the EX90, a piece of the lower front structure juts ahead of the vehicle's primary safety structure. As ANE Managing Editor Doug Bolduc puts it, that lower structure is "specifically designed to help it absorb a lot of the power of a crash with a smaller vehicle ... that is to not only provide protection to the passengers of the EX90 but also to provide protection to the passengers of the EX30." The result is "less damage than you might have expected from the larger car onto the smaller car." Check out the vid and for Jakobsson's take on how current trends in structural, passive, and active safety won't rid the world of crashes, but they are reducing injuries while at the same time making crashes less common.

Volvo recalls 27,457 new vehicles over a brake-by-wire issue

Wed, Jan 25 2023Eight Volvos from the 2023 model year have been drawn into a recall over software in their brake-by-wire systems. The models at issue are everything Volvo sells — the C40, XC40, S60, XC60, V60, V60 Cross Country, V90 Cross Country, and XC90. The combined recall population numbers 27,457 cars. The problem is that an in-vehicle diagnostic test to check the grounding of the system can trigger a fault in the vehicle's Brake Control Module 2. The fault doesn't always occur, but when it does, the vehicle reverts to its hydraulic system so the car can still stop. However, without the brake-by-wire system, the driver doesn't get the benefit of software-defined safety systems like ABS, ESC, Traction Control as well as convenience features like Pilot Assist, adaptive cruise control and one-pedal driving. Drivers might be alerted to the situation with a warning message and malfunction lamp in the gauge cluster, or a stiff brake pedal. The automaker says it has had no reports of accidents, injuries or fatalities because of the problem. If the car is turned off and able to enter what Volvo calls "deep sleep," the electronics will clear the fault. To fix the issue, Volvo will send an over-the-air update with logic that's a better fit for the Brake Control Module 2 hardware. The automaker says the new code "will be implemented on February 20" of this year, but in another example of the digital world outpacing regulatory processes, Volvo will begin notifying owners on March 15. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.