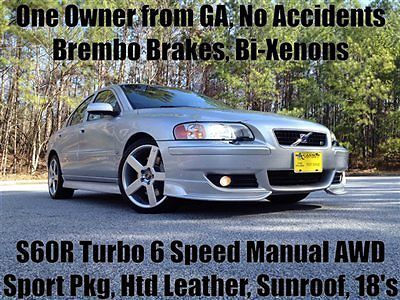

2004 Volvo S-60 R Sport Sedan 300 Hp! Loaded With Extras!! Really Fun To Drive!! on 2040-cars

Sherwood, Arkansas, United States

| ||||||||||||||||||||||

Volvo S60 for Sale

2012 volvo s60 t5 1-owner off lease sirius-xm

2012 volvo s60 t5 1-owner off lease sirius-xm One owner from ga rare 6 speed manual moonroof htd leather turbo awd brembo brks(US $12,981.00)

One owner from ga rare 6 speed manual moonroof htd leather turbo awd brembo brks(US $12,981.00) 2004 volvo s60, no reserve

2004 volvo s60, no reserve 2.5l turbo r cd awd turbocharged traction control stability control abs rear a/c

2.5l turbo r cd awd turbocharged traction control stability control abs rear a/c 2012 volvo s60 t5 luxury sedan heated leather sunroof warranty new tires

2012 volvo s60 t5 luxury sedan heated leather sunroof warranty new tires 2004 volvo s60 2.4 auto, superb condition, loaded, must see, no reserve !!

2004 volvo s60 2.4 auto, superb condition, loaded, must see, no reserve !!

Auto Services in Arkansas

Weber Automotive Repair ★★★★★

Riverdale Automotive Ltd ★★★★★

Pro Care Tire & Auto ★★★★★

Mustard Seed Mobile Auto Repair & Towing ★★★★★

Larry`s Mobile ★★★★★

Larry Hice Custom & Collision ★★★★★

Auto blog

Current-generation Volvo XC90 will be sold alongside its successor

Wed, Feb 16 2022Volvo's next-generation XC90 sounds like it will be more of a revolution than a simple evolution — even the name will change. The firm doesn't want to alienate buyers, so it will sell the current-generation model alongside its replacement for at least a couple of years. Allegedly called Embla, the XC90's successor will inaugurate an evolution of the existing SPA2 platform and a number of driver-assistance features. Some rumors claim that it will be offered exclusively with an electric powertrain. Keeping the second-generation model around is a way for Volvo to prevent buyers who don't want an electric car and who don't need the latest and greatest tech features from going to the competition. Making the two people-movers in separate factories will ensure that both can be built without creating logistical issues. "That is an advantage of building the new one in Charleston, South Carolina. Why should we close down the old one in Torslanda when you still have a market for hybrids, especially in America and in China?," said outgoing company boss Hakan Samuelsson in an interview with Automotive News Europe. He stopped short of saying precisely how long the current-generation XC90 will remain in production for, however. Far from worrying about internal competition, Volvo plans to give the XC90 at least one more update in order to help it fend off a growing list of rivals, especially in key markets like the United States. "We will even look into upgrading it so it looks a bit better," he told the publication. As of writing, it's the oldest member of the Volvo range: it spearheaded the brand's revival when it made its debut for the 2016 model year. More information about the XC90's replacement will emerge in the coming months, and we expect to see the model in late 2022. When it lands, it will be clearly positioned as Volvo's flagship, a spot that the XC90 has occupied since the first-generation model arrived in 2002. As new cars become more advanced and correspondingly more expensive, keeping an older model around as a budget-oriented option is a strategy that's slowly gaining ground. Porsche confirmed that the current- and next-generation versions of the Macan will coexist for a few years for reasons not unlike Volvo's. Ram keeps the last-generation 1500 in its range and charges $6,385 less for it than for the new model. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Recharge Wrap-up: video touts Volvo electric buses, Nissan and BMW build EV chargers in S. Africa

Wed, May 27 2015Volvo is touting the advantages of electric buses in a new video. The short film, called Route 55, promotes the ElectriCity Project for public transport, and, more specifically, the new electric bus route in Gothenburg, Sweden. The new route debuts June 15 using Volvo electric and hybrid buses. In the video, two teenagers are seen waiting for the bus. As one boards, the other asks her out from the sidewalk, but she can't hear him over the noise of the diesel bus, which then closes its doors and drives away. The film asks, "What if this bus had been silent?" See the video above, and read more in the press release below. BMW and Nissan will build an EV charging network across South Africa. Through 2017, the two automakers will build fast-charging and AC stations around the country in order to encourage the adoption of EVs. Nissan has been selling the Leaf in South Africa since 2013, and BMW introduced the i3 and i8 in March. "In order for the introduction and expansion of electric vehicles as well as plug-in hybrid electric vehicles to be successful in this market, we need to work together," says BMW South Africa Managing Director Tim Abbott. Read more at Automotive News Europe. The Renault-Nissan Alliance will provide the United Nations with 200 electric vehicles for the COP21 climate conference in Paris. The fleet of vehicles includes the Nissan Leaf and e-NV200, as well as the Renault ZOE, Kangoo ZE and Fluence ZE. The entire passenger car shuttle fleet will use all-electric vehicles as some 20,000 UN attendees descend upon Paris from November 30 to December 11. "Thanks to the Alliance's fleet of 100-percent electric vehicles, it will contribute to our goal of achieving a carbon neutral event," says French Minister of Foreign Affairs and International Development and COP21 President Laurent Fabius. "The technology of electric vehicles helps reduce greenhouse gases in the transportation sector efficiently." Read more from Renault. Visa will be the official title sponsor of the Formula E London ePrix. Officially called the "2015 FIA Formula E Visa London ePrix," the races on June 27 and 28 will be the last of the electric racing series's inaugural season. Visa Europe will award the Visa Fastest Lap trophy after the each round, and will have interactive activities at the race's eVillage.

Volvo will start testing wireless charging with XC40 taxis

Thu, Mar 3 2022Volvo announced it will start testing wireless charging systems with its Volvo XC40 Recharge electric SUVs. It's doing so by creating a small fleet of XC40 Recharge taxis for Cabonline, the largest cab operation in the Nordic nations. The testing in Volvo's hometown of Gothenburg, Sweden, will last for three years, and Volvo notes that the driving conditions will involve 12 hours a day of driving with cars racking up 100,000 kilometers (about 62,000 miles) per year. The charging stations come from American company Momentum Dynamics. They're embedded into the pavement of the Volvos' parking spaces and begin charging automatically when parked correctly (which is aided by the on-board surround-view camera). The charging speed is 40-kW, which is close to the maximum charging speed of many electric cars' on-board chargers when connected to a DC station. Interestingly, Momentum Dynamics lists systems capable of charging speeds as high as 450 kW on its website. Volvo did not make any announcements regarding future availability of wireless charging. We would imagine the results of this testing will affect whether the company intends to make it a factory offering. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.