2006 Volvo Ocean Race Edition Used 4.4l V8 32v Automatic Suv Premium on 2040-cars

Philadelphia, Pennsylvania, United States

Volvo 940 for Sale

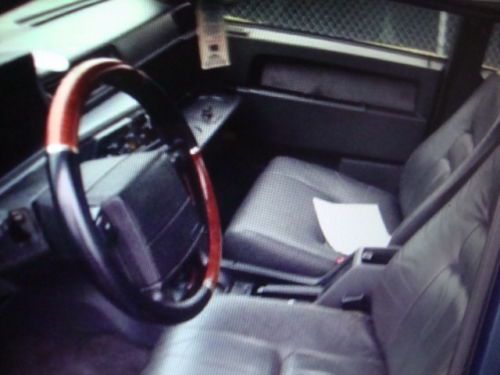

1991 volvo 940 turbo 4dr 16k original mi,auto,4cyl,1 owner,garaged,museumquality(US $10,900.00)

1991 volvo 940 turbo 4dr 16k original mi,auto,4cyl,1 owner,garaged,museumquality(US $10,900.00) 1999 volvo v70 xc cross country excellent condition xc70 awd auto(US $4,950.00)

1999 volvo v70 xc cross country excellent condition xc70 awd auto(US $4,950.00) 2004 volvo s80 t6 sedan 4-door 2.9l turbocharged(US $5,000.00)

2004 volvo s80 t6 sedan 4-door 2.9l turbocharged(US $5,000.00) 2011 volvo xc60 3.2 r-design leather pano roof 20's 44k texas direct auto(US $24,980.00)

2011 volvo xc60 3.2 r-design leather pano roof 20's 44k texas direct auto(US $24,980.00) 2001 volvo s80, no reserve

2001 volvo s80, no reserve 1992 volvo 940 gle sedan 4-door 2.3l

1992 volvo 940 gle sedan 4-door 2.3l

Auto Services in Pennsylvania

Wrek Room ★★★★★

Wolbert Auto Body and Repair ★★★★★

Warren Auto Service ★★★★★

Ultimate Auto Body & Paint ★★★★★

Ulrich Sales & Service ★★★★★

Tower Auto Sales Inc ★★★★★

Auto blog

2015 Volvo XC90 is the Swedish future

Tue, 26 Aug 2014It's been months since the Concept XC Coupe debuted at the Detroit Auto Show, Volvo's last show car previewing its all-new 2015 XC90. But the production model is finally here after years of development, and it signals the future of the Swedish automaker with its Scalable Product Architecture modular platform and cutting-edge new engine family.

The 2015 XC90 carries all-new styling, but is still familiar up front, with the company's logo slashing diagonally through its prominent, upright grille. Like the concept, it carries T-Shaped LED running lights through the headlights. The company calls them the "Thor's Hammer" design, an evocative designation that we think is fantastic. Under that new front end is a choice of two quite powerful, but very efficient powertrains. The standard XC90 gets a 2.0-liter turbocharged and supercharged engine with all-wheel drive making an impressive 316 horsepower. Or if buyers want to be a little greener and more powerful, there is the XC90 Twin Engine plug-in hybrid with the same engine, albeit augmented with an electric motor to produce a staggering 400 hp.

The exterior styling is crisp, if not quite as sensual as Volvo's latest concepts, but we think the interior is the real star here, with a dashboard that looks like it came out of a Herman Miller catalog and a unique vertically oriented infotainment screen integrated into its center stack, perhaps taking a cue from Tesla. If the cabin feels as good as it looks, we think a lot of sales are going to be won inside.

Watch this Volvo truck drive up a quarry road using hamster-powered steering

Fri, 13 Sep 2013Volvo Trucks has been producing some of the most interesting and thrilling commercials around as of late, and this new one involves a live hamster. While you may wonder how could a hamster and a dump truck could be exciting, just know this ain't a Kia Soul commercial: the Swedish truck company enlists the help of a hamster named Charlie to steer an FMX construction truck up a winding road in Ourence, Spain. From the bottom of a quarry. We are not kidding you.

All we ask is that you watch the commercial below to see how it all goes down. If you like what you see, you can then check out a bonus 'behind the scenes' video and press release for details about how Volvo Trucks prepared for the stunt.

Volvo Trucks makes some pretty strong brakes

Mon, 05 May 2014Often dashcam footage from Russia shows some of the worst driving imaginable, but this is an exception. The Volvo truck driver in this video definitely earned himself a drink or two at the end of the day after making it through this potentially horrific crash. As do the folks at Volvo that engineered those brakes.

The truck driver shows some fantastic reaction time as the silver hatchback suddenly pulls out of an intersection. It looks like he only has a few yards to bring the behemoth to a stop before demolishing the little car. While it's an impressive feat, the best part of the video has to be the driver's bow when he gets out of the truck. He looks like a maestro who just finished conducting a symphony asking for a round of applause.

Scroll down to check out this truck driver's skills and see if he earns his bow afterward.