2014 Tdi on 2040-cars

San Diego, California, United States

Transmission:Automatic

Fuel Type:Diesel

VIN (Vehicle Identification Number): WVGEP9BP8ED008746

Mileage: 118800

Model: Touareg

Drive Type: AWD

Exterior Color: Blue

Interior Color: Black

Number of Cylinders: 6

Warranty: Vehicle does NOT have an existing warranty

Make: Volkswagen

Volkswagen Touareg for Sale

2006 volkswagen touareg tdi 5.0(US $4,500.00)

2006 volkswagen touareg tdi 5.0(US $4,500.00) 2016 volkswagen touareg lux(US $16,998.00)

2016 volkswagen touareg lux(US $16,998.00) 2010 volkswagen touareg v6(US $2,500.00)

2010 volkswagen touareg v6(US $2,500.00) 2011 volkswagen touareg vr6 fsi(US $7,947.00)

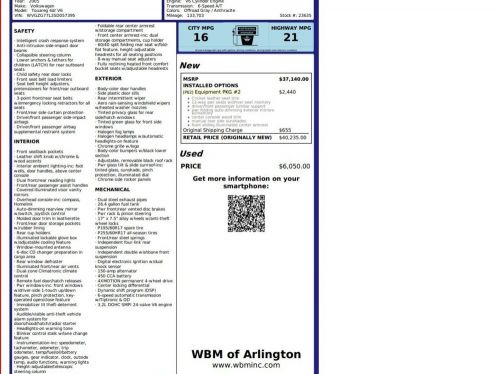

2011 volkswagen touareg vr6 fsi(US $7,947.00) 2005 volkswagen touareg v6 4wd(US $6,050.00)

2005 volkswagen touareg v6 4wd(US $6,050.00) 2016 volkswagen touareg vr6 sport(US $15,400.00)

2016 volkswagen touareg vr6 sport(US $15,400.00)

Auto Services in California

Yoshi Car Specialist Inc ★★★★★

WReX Performance - Subaru Service & Repair ★★★★★

Windshield Pros ★★★★★

Western Collision Works ★★★★★

West Coast Tint and Screens ★★★★★

West Coast Auto Glass ★★★★★

Auto blog

$1.4B hedge fund suit against Porsche dismissed

Wed, 19 Mar 2014Investors have canvassed courts in Europe and the US to repeatedly sue Porsche over its failed attempt to take over Volkswagen in 2008 (see here, and here and here), and they have repeatedly failed to win any cases. You can add another big loss to the tally, with Bloomberg reporting that the Stuttgart Regional Court has dismissed a 1.4-billion euro ($1.95B US) lawsuit, the decision explained by the court's assertion that the investors would have lost on their short bets even if Porsche hadn't misled them.

Examining the hedge funds' motives for stock purchases and the bets that VW share prices would fall, judge Carola Wittig said that the funds didn't base their decisions on the key bits of "misinformation," and instead were participating simply in "highly speculative and naked short selling," only to get caught out.

With other cases still pending, the continued streak of victories bodes well for Porsche's courtroom fortunes, since judges will expect new information to consider overturning precedent. If there is any new info, it could come from the potential criminal cases still outstanding against former CEO Wendelin Wiedeking and CFO Holger Härter, who were both indicted on charges of market manipulation.

Get ready to Camino-ize your fourth-generation VW Jetta with this kit

Tue, 05 Aug 2014Inexpensive, small pickup trucks used to be everywhere in the US, whether they were from Japanese brands like Datsun or Toyota, the truly weird Subaru Brat or even from Europe with the Volkswagen Caddy based on the Golf. These days that market has completely disappeared, but if you're willing to pick up some tools to build your own, there's a company out there bringing the Caddy back as a kit for the Jetta.

Mark Smith knows a thing about building a vehicle at home. He has over two decades in the DIY-car business as a co-founder of Local Motors and the company that became Factory Five Racing. His latest venture is Smyth Performance and already offers a mid-engine, VW-based kit called the G3F. His new product, though, started as a fluke. "I just wanted a shop truck," said Smith to Autoblog. He already had a Ford F-450 but found that he was driving around with the bed empty most of the time. The result was a pickup truck based on the fourth-generation Jetta that he dubbed the Ute.

The kit retails for $3,500 and ships in three, big boxes, and it's designed to be built and painted in a weekend. Buyers get fiberglass exterior panels, a fiberglass rear window surround, sliding rear window, an aluminum reinforced bed with a tubular steel subframe, taillights, a fully functional steel tailgate, and other parts. In the end, you get a vehicle with a six-foot bed and a payload of around 700-750 pounds. The Ute maintains all of the factory suspension, fuel tank and emissions equipment and requires just a few cuts in the body to complete. "We did a modern Caddy," admits Smith.

Interested, then not: Marchionne not 'chasing' a VW merger

Tue, Mar 14 2017Update (March 15, 2017) : Automotive News reports that FCA CEO Sergio Marchionne, regarding the suggested VW and FCA merger, said in a press conference "I have no interest." He also said that he "will not call Matthias," the CEO of VW. He did add that he would be willing to entertain anything VW brings up, but he has "no intention of chasing him." Despite this, Marchionne still took a moment to reinforce his favorable stance concerning mergers and consolidation. Last week, Volkswagen's CEO Matthias Mueller effectively shut down Fiat Chrysler CEO Sergio Marchionne's idea of the two automakers merging. However, it seems Mueller has softened, if only just, to the idea. According to Reuters, the CEO said in a press conference he is "not ruling out a conversation." However, he did say that he would like Marchionne to discuss with him directly the possibility rather than to the media. Though this statement certainly doesn't mean such a merger is happening, it's far more open than when he said outright the company isn't in any talks with anyone at the moment. His new stance also indicates that there may be people (lawyers, accountants, etc.) behind the scenes working out possible ways a merger could work. And even though this new development makes the prospect of a merger between the two companies a bit less bleak, it's still a long way from the "will they, won't they" relationship between GM and FCA. FCA's pursuit of GM involved emailing CEO Mary Barra and the threats of a hostile takeover, the latter of which resulted in some awkward statements about hugs. Only time will tell if VW becomes open enough for Marchionne to talk about hugs again. Related Video: