Se Ethanol - Ffv 3.6l Cd Front Wheel Drive Power Steering Abs Aluminum Wheels on 2040-cars

San Antonio, Texas, United States

Body Type:Minivan, Van

Vehicle Title:Clear

Fuel Type:Ethanol - FFV

For Sale By:Dealer

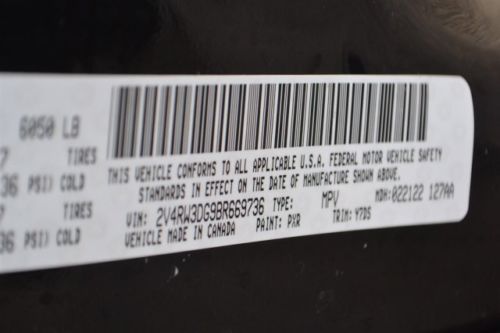

Year: 2011

Make: Volkswagen

Model: Routan

Warranty: Unspecified

Mileage: 34,035

Sub Model: SE

Options: CD Player

Exterior Color: Black

Power Options: Power Windows

Interior Color: Gray

Number of Cylinders: 6

Volkswagen Routan for Sale

2012 se used 3.6l v6 24v fwd(US $24,991.00)

2012 se used 3.6l v6 24v fwd(US $24,991.00) 2009 volkswagen routan se dvd navigation moonroof bluetooth power doors(US $12,900.00)

2009 volkswagen routan se dvd navigation moonroof bluetooth power doors(US $12,900.00) 2009 volkswagen routan se mini passenger van 4-door 3.8l(US $13,600.00)

2009 volkswagen routan se mini passenger van 4-door 3.8l(US $13,600.00) 2009 volkswagen s

2009 volkswagen s 2010 black se handicap wheelchair van rear entry!(US $26,900.00)

2010 black se handicap wheelchair van rear entry!(US $26,900.00) This one owner local trade-in is extra clean and has rear dvd, & alloy wheels(US $15,900.00)

This one owner local trade-in is extra clean and has rear dvd, & alloy wheels(US $15,900.00)

Auto Services in Texas

XL Parts ★★★★★

XL Parts ★★★★★

Wyatt`s Towing ★★★★★

vehiclebrakework ★★★★★

V G Motors ★★★★★

Twin City Honda-Nissan ★★★★★

Auto blog

Here are 12 electric pickups in the works

Wed, Oct 21 2020With the unveiling of the GMC Hummer EV, the list of planned electric pickups is expanding. Legacy automakers like Ford and Chevy have theirs coming, as do startups like Tesla, Rivian and Bollinger, as well as some lesser known brands. Here are all the electric pickup trucks we know to be in the works, along with a few that are being discussed or mulled over. GMC Hummer EV The 2022 GMC HUMMER EV is a first-of-its kind supertruck develop View 40 Photos We’ve seen it now, and itÂ’s the business. The GMC Hummer EV comes out swinging with 1,000 horsepower from GMÂ’s new Ultium electric powertrain program, a wealth of off-road features, a removable roof, Super Cruise and the revival of the Hummer name. WeÂ’ll see the first ones on the road next fall. Tesla Cybertruck Tesla Cybertruck at the Petersen Museum View 14 Photos Tesla revealed the Cybertruck last year with, ahem, unique styling, a number of powertrain options and a claimed range of up to 500 miles. It has a compressed paper dash, a ramp for the bed, and “shatterproof” windows. It has already racked up hundreds of thousands of reservations. It will be built in Texas. Rivian R1T 2021 Rivian R1T View 15 Photos EV startup Rivian revealed its R1T electric pickup toward the end of 2018 with a claimed 0-60 time of 3 seconds and a towing capability of 11,000 pounds. Preproduction began in September 2020 at RivianÂ’s factory in Normal, Illinois. Bollinger Motors B2 Bollinger Motors B2 side outdoors View 31 Photos BollingerÂ’s B2 electric pickup is a Class 3 off-roader with retro styling, removable roof panels, and a unique “frunkgate” with a pass-through down the center of the vehicle. It was created with both enthusiasts and workers in mind, with features that can get it to remote places (portal axles, hydro-pneumatic suspension) and to get things done (room for 40 2x4s, equipped with eight 110-volt outlets and one 220-volt outlet). Bollinger also plans to make the B2 Chassis Cab available for fleet customization. Ford F-150 Electric Electric Ford F-150 Towing View 9 Photos WeÂ’ve known this to be in the works since early 2019. Since then, details have trickled out. Back in June, Ford announced its F-150 Electric would be coming within two years. WeÂ’ve seen it pull a million pounds worth of train and trucks, heard it will have more power than any other F-150, and seen its LED-laden front end.

2015 VW Passat Limited Edition priced from $23,995*

Sun, Mar 8 2015Volkswagen is doing some rearranging of its lineup for the Passat sedan, ditching a pair of trims on the entry level, 1.8-liter, turbocharged four-cylinder and replacing them with a new Limited Edition trim level. Gone are the Wolfsburg and SE trims from model year 2014, which rung up at $24,375 and $26,280, respectively. The new Limited Edition will start at $23,995, not including $820 in destination charging. According to VW, the new trim level packages $2,755 of extras over the base Passat S, but only demands an extra $1,555 of cash. Not a bad bargain, particularly as the Limited Edition adds some desirable features. An intelligent key with push-button start, 17-inch alloy wheels, a rear-view camera, heated leatherette seats with power controls on the driver's side and a touchscreen radio with an eight-speaker stereo, along with a few lesser options, like fog lights, chrome window trim and a leather-wrapped steering wheel. Beyond the new list of standard equipment, this is still the same competent German sedan. The 1.8-liter, turbocharged four-cylinder is paired up with a smooth shifting six-speed automatic, as with other trim levels. Check out VW's press release on the new Passat Limited Edition, available below. VOLKSWAGEN RELEASES PRICING ON 2015 PASSAT LIMITED EDITION MODEL Mar 6, 2015 Passat Limited Edition model starts at $23,995 Fuel-efficient 1.8-liter TSI® engine and six-speed automatic transmission standard Value-laden model has a host of standard features, including KESSY® keyless access with push-button start, V-tex leatherette seating surfaces, heatable front seats,17-inch aluminum-alloy wheels, touchscreen radio and rearview camera Herndon, VA – Volkswagen of America, Inc., today, announced pricing on the 2015 Passat Limited Edition model. The Limited Edition model will have a starting MSRP of $23,995 (plus transportation) and supersedes the Wolfsburg and SE models from the current model year. The new Limited Edition model offers a great value: compared with the automatic transmission S model, it has $2,755 of additional equipment, but costs just $1,555 more.

VW builds 250,000th Passat in Chattanooga in just two years

Sun, 26 May 2013It hasn't been without incident or union organizing drive, but the Volkswagen plant in Chattanooga, TN has built its 250,000 Passat in just a little over two years. The Night Blue Passat TDI with black leather has come just two years and five weeks after the first customer car came off the line on April 18, 2011.

In the last year the plant operated at the 150,000-unit capacity that it was intended for, but the downturn in Passat sales and subsequent worker layoffs mean it will be a challenge to repeat the feat. The plant does have the world's largest solar park, though, and you can't take that away from them.

You'll find the official hand-clapping in the press release below.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.722 s, 7821 u