4dr Hb Auto 2.5l Cd Front Wheel Drive Seat-heated Driver Power Driver Seat Clock on 2040-cars

Buford, Georgia, United States

Volkswagen Rabbit for Sale

Auto Services in Georgia

ZBest Cars ★★★★★

Youmans Chevrolet Co ★★★★★

Wren`s Body Shop ★★★★★

Wholesale Tire & Wheel Co ★★★★★

Walton Tire Co ★★★★★

TJ Custom Muffler & Brake ★★★★★

Auto blog

2015 Volkswagen Golf: Green Car of the Year?

Wed, Apr 1 2015As you may recall, VW's compact Golf was voted 2015 North American Car of the Year by a jury of 57 veteran automotive journalists (including this one) and named Car of the Year by Motor Trend and Yahoo Autos and Best Car to Buy 2015 by Green Car Reports. "The range of green options in the 2015 Volkswagen Golf range is hard to beat," says Green Car Reports editor John Voelcker. "With more fuel-efficient gasoline engines, a new TDI diesel option that comes close to real-world hybrid mileage levels, and the all-electric VW e-Golf, the 2015 Golf gives buyers a good-better-best menu of options for driving green." The car was also a finalist for Green Car Journal's "Green Car of the Year," but ultimately lost to the BMW i3 EV. When I saw GCJ editor Ron Cogan at last November's Los Angeles Auto Show, he asked me to guess which finalist would win. Based on its efficiency and versatility, I guessed the Golf. He smiled but the next day, he named the i3 the winner. Okay, the technically impressive, carbon-fiber-bodied i3 is a formidable green machine wearing a prestige German label at a semi-affordable ($43,000) price. But it comes in just one (somewhat odd-looking) body style with a choice of all-electric or range-extending electric powertrains, and its EPA-official ranges are 81 miles for the former and just 150 for the latter, costlier version, which totes a tiny (647cc) 34-hp two-cylinder BMW motorbike engine in its tail. By contrast, the 2015 Golf comes in 3- and 5-door hatchback and even more practical Sportwagen body styles and offers a wide range of eager yet fuel-thrifty turbocharged gas and clean-diesel engines, most with a choice of manual or automatic transmission. An all-electric e-Golf, one of the best EVs we've yet driven, is also available in some areas, and that will be followed, VW says, by a hybrid, a plug-in hybrid and even a CNG-powered model. No question this all-new seventh-generation 2015 VW Golf is easily the best ever. A bit larger, roomier, aerodynamically slicker and more fuel efficient than the Gen VI Golf it replaces, it's built on an all-new modular platform and boasts an amazing range of models, powertrains and features.

VW Beetle R is one mean bug

Wed, 02 Oct 2013Volkswagen's R lineup currently consists of the Golf R in North America, and the too-cool-for-school Scirocco R in Europe. It hasn't exactly been a secret as to which VW would next get the R treatment; the German manufacturer reportedly confirmed that a hotter Beetle would be coming to the US. That announcement, in August 2011, was followed up by a production-ready Beetle R Concept at the 2011 Frankfurt Motor Show.

After some wait, we're finally seeing spy shots of the Beetle R in Germany. The mule shown in the images here is wearing the R-Line bodykit, which adds sportier front and rear fascias, side skirts, dual exhausts and a not-so-subtle spoiler. Topped off with Volkswagen's traditional, five-spoke R wheels, we'd be just fine with the Beetle R coming to market as is.

Our spy photographer, though, seems to think that the production R will get even sportier sheetmetal, which we take to mean the more assertive look shown on the Frankfurt show car. Larger intakes on the front fascia, a bigger rear spoiler and vertical vents on the rear bumper could all be upcoming. Whether a production model will include the concept's polished wheels (R cars haven't traditionally embraced that look), vented hood and the quad-tipped exhausts remains to be seen.

Volkswagen planning Up! hybrid model using XL1 powertrain

Sun, 24 Feb 2013Even though we've finally gotten a look at the production version of the 261-mile per gallon Volkswagen XL1, this aero-shaped two-seater was never intended for high-volume sales. Fortunately, it sounds like the same isn't true for the car's diesel plug-in hybrid powertrain, which, according to a report from AutoCar, could make its way under the hood of another Volkswagen model: the Up! minicar (shown above).

A potential Up! Hybrid would likely be able to return some of the same impressive fuel economy numbers as the XL1, but it would be a more realistic car with more passenger space and greater production capacity. The hand-built XL1 will use a 47-horsepower, two-cylinder TDI engine paired to a seven-speed dual-clutch transmission, and the 27-hp electric motor and lithium-ion battery helps deliver an all-electric driving range of 31 miles.

One of the core pillars of the XL1's design is its lightweight construction with a 1752-pound curb weight, which makes the Up! a perfect recipient for using this powertrain since it weighs just 300 pounds more. The report says that the Up! Hybrid is still in the developmental phase, so a production version isn't expected for at least another 18 months.

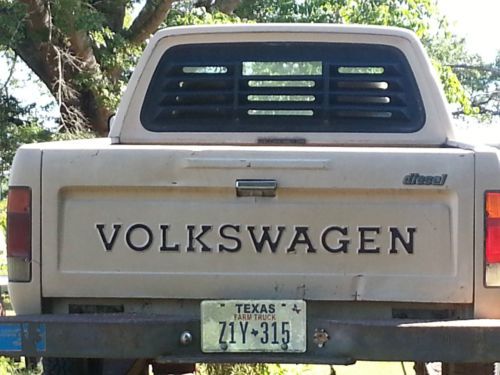

1981 vw rabbit pick up truck diesel

1981 vw rabbit pick up truck diesel Vintage rare mint green 1980 volkswagen rabbit

Vintage rare mint green 1980 volkswagen rabbit 2008 vw rabbit 5 speed

2008 vw rabbit 5 speed 1980 volkswagen hatchback diesel parts car

1980 volkswagen hatchback diesel parts car 1981 volkswagon rabbit pickup diesel

1981 volkswagon rabbit pickup diesel 2008 vw rabbit s 2.5

2008 vw rabbit s 2.5