2004 Volkswagen Passat Glx V6 4motion on 2040-cars

2531 Dixie Hwy, Hamilton, Ohio, United States

Engine:2.8L V6 30V MPFI DOHC

Transmission:5-Speed Automatic

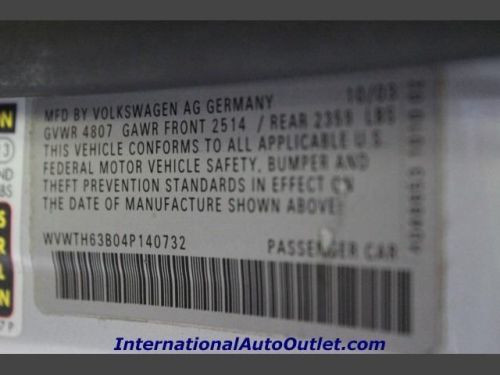

VIN (Vehicle Identification Number): WVWTH63B04P140732

Stock Num: 15902

Make: Volkswagen

Model: Passat GLX V6 4Motion

Year: 2004

Exterior Color: Silver

Interior Color: Gray

Options: Drive Type: AWD

Number of Doors: 4 Doors

Mileage: 73000

2004 Volkswagen Passat GLX 4Motion --IMMACULATE--LOW MILES--ALL WHEEL DRIVE--CLEAN HISTORY REPORT--LEATHER INTERIOR--POWER OPTIONS--MOST OF OUR VEHICLES ARE HIGH QUALITY, HAND PICKED, ONE OWNER IN A LIKE NEW CONDITION WITH A CLEAN CAR FAX. ALL ARE FULLY INSPECTED, SERVICED AND RECONDITIONED, THOSE THAT DO NOT MEET OUR MECHANICAL CRITERIA ARE NOT OFFERED FOR SALE. MOST OF OUR VEHICLES ARE COVERED WITH THE MANUFACTURER WARRANTY OR A 3 MONTHS/4500 MILE WARRANTY. FINANCING IS AVAILABLE AND TRADES ARE ALWAYS WELCOMED. FOR SIMILAR GREAT DEALS PLEASE VISIT OUR WEBSITE http://www.InternationalAutoOutlet.com At International Auto Outlet, we take pride in maintaining a large selection of fully reconditioned, inspected, certified vehicles. With over 200 quality certified cars, vans, and trucks from local dealer trades, overstocked inventory, off-lease manufacturer auctions, bank repossessions & open auctions, we have the perfect vehicle for you- and your budget. Call, email or visit our website today.

Volkswagen Passat for Sale

2005 volkswagen passat gls(US $7,495.00)

2005 volkswagen passat gls(US $7,495.00) 2014 volkswagen passat(US $17,995.00)

2014 volkswagen passat(US $17,995.00) 2014 volkswagen passat 1.8t se(US $27,750.00)

2014 volkswagen passat 1.8t se(US $27,750.00) 2014 volkswagen passat 2.0l tdi se(US $30,140.00)

2014 volkswagen passat 2.0l tdi se(US $30,140.00) 2014 volkswagen passat 1.8t sel premium(US $32,385.00)

2014 volkswagen passat 1.8t sel premium(US $32,385.00) 2014 volkswagen passat 2.0l tdi sel premium(US $34,860.00)

2014 volkswagen passat 2.0l tdi sel premium(US $34,860.00)

Auto Services in Ohio

Whitesel Body Shop ★★★★★

Walker`s Transmission Service ★★★★★

Uncle Sam`s Auto Center ★★★★★

Trinity Automotive ★★★★★

Trails West Custom Truck 4x4 Super Center ★★★★★

Stone`s Auto Service Inc ★★★★★

Auto blog

VW stock plummets as Euro markets open

Mon, Sep 21 2015The fallout from Volkswagen's installation of an emissions "defeat device" on nearly 500,000 diesel-fueled models in the US is already hitting the automaker hard on the German stock exchange. At one point, the share price plummeted 23 percent to erase the equivalent of $17.6 billion in value. Things eventually bounced back slightly to a still severe 19.23 percent loss, according to Bloomberg as of this writing. The scandal couldn't come at a worse time for chairman Martin Winterkorn. The VW supervisory board takes up the issue of renewing his contract on September 25, Bloomberg reports. If things get bad enough, the door could be open for a new boss to step in. Dealers in the US might start feeling the pain from this, as well. Affected 2015 VWs that are still at showrooms are now under a stop sale. Until the issue is straightened out, the Environmental Protection Agency isn't certifying the company's 2016 diesel models with the 2.0 TDI, either. The diesel emissions problem was first discovered by research from West Virginia University and the International Council on Clean Transportation. In some cases, the engines can produce 40 times more nitrogen oxides than allowed. The automaker could be on the hook for $18 billion in fines for the breach, but the actual figure is expected to be lower. In response, Winterkorn has issued a public apology and ordered an independent investigation into what happened. The EPA and California Air Resources Board have also been looking into the situation. This could become an international problem, though. According to The Detroit News, European authorities might begin similar inquires to check the automaker's diesel emissions there.

Volkswagen and Funny or Die take humorous spin in 2015 Golf

Wed, 10 Sep 2014Volkswagen is partnering with Target and Funny or Die in a bizarre ad for the latest Golf starring comedian Rob Huebel, probably best known for his work on Childrens Hospital on Adult Swim.

The commercial is titled The Way Too Helpful Neighbor and stars Huebel as the eponymous neighbor. The challenge is for Huebel to help improve his buddy's apartment before the guy meets his girlfriend's parents for the first time. The obvious way to do that is to slide a new Golf through an actual Target in Texas, while simultaneously showcasing the store's goods and the car's features.

The commercial is airing online now and on TBS during breaks in Conan O'Brien's show, with sneak peaks during other programs on the network. Auto advertising is becoming pretty normal for Funny or Die at this point, though, with the site previously partnering with Fiat for several videos. Check out the ad above and see if you think it works. Scroll down for VW's announcement.

Volkswagen Golf Variant Concept R-Line puts the sport in SportWagen

Wed, 06 Mar 2013With the introduction of the newest Volkswagen Golf Variant, we get an early look at what will most likely be the next-generation Jetta SportWagen here in the US. To further wet our appetities, VW is now teasing something a little sportier with the Concept R-Line. Looking the part of a GTI wagon (or a stretched Golf R), the Golf Variant Concept R-Line has a production-ready appearance that has us hoping we'll see this sporty wagon sooner rather than later.

The R-Line starts off with a new fascia that isn't quite as aggressive as the recently introduced GTI, but it gives the new styling some extra punch. Below the fascia is a lower splitter that visually carries back into the rocker panel extensions, and the rear of the car gets some bright exhaust tips and a rear diffuser. The Lapis Blue Metallic paint job probably does enough on its own to add a sporty flair to the Golf wagon, and it's all finished off with 18-inch split-spoke wheels. Inside, the Concept R-Line shows off sport seats wrapped in carbon leather featuring blue nappa inserts in the middle.

Rightfully so, VW brought the Concept R-Line to Geneva with its TDI and 4Motion all-wheel-drive system. A sporty, all-wheel-drive diesel wagon? Yes, please. Scroll down for the full press blast with all the details.