2000 Volkswagen Passat Gls Sedan 4-door 1.8l Clean Carfax on 2040-cars

North Canton, Ohio, United States

|

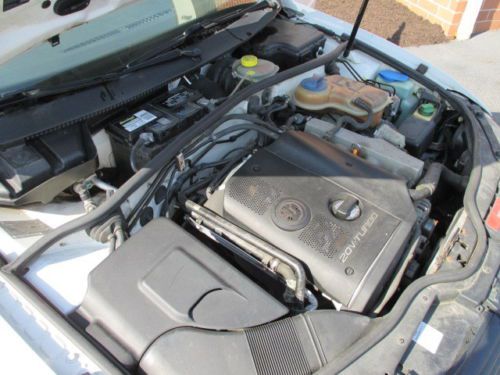

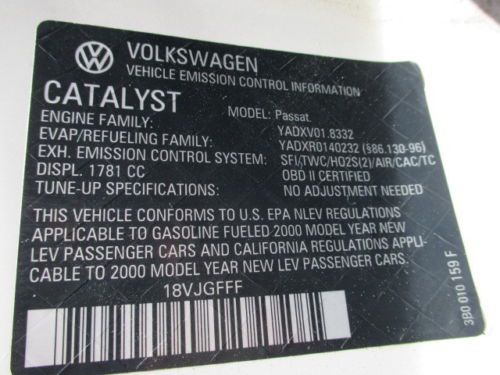

i 2000 Volkswagen Passat GLS, 1.8 Turbo motor, automatic, 133,100 miles. white with tan cloth interior. Power windows, locks, and mirrors. Keyless entry, cruise control, and cold air conditioning. Runs and drives great. No known mechanical problems. This vehicle is being sold as-is with no warranty expressed or implied. Buyer is responsible for any and all transportation costs. A $250 non-refundable deposit is due by Paypal. The balance is due within 72 hours of the buy it now purchase by cash or certified bank check unless other arrangements are agreed to by the seller. If paying by certified check the title will be held until the check clears my bank. 2 owner car with Clean Carfax If you would like to see this car or take it for a test drive call or text for an appointment, 330-323-6277 $3500 ncludes tax, title, and 30 day tag. NO DOCUMENT FEES!! |

Volkswagen Passat for Sale

2006 volkswagen passat with leatherette seat and six cd changer.(US $3,000.00)

2006 volkswagen passat with leatherette seat and six cd changer.(US $3,000.00) 2002 volkswagen passat glx sedan 4-door 2.8l

2002 volkswagen passat glx sedan 4-door 2.8l 05 passat wagon gls tdi diesel grey metallic grey leather nice condition(US $7,900.00)

05 passat wagon gls tdi diesel grey metallic grey leather nice condition(US $7,900.00) No reserve nr high bidder wins !!!

No reserve nr high bidder wins !!! 2.0t 2.0l cd turbocharged traction control stability control brake assist abs(US $9,488.00)

2.0t 2.0l cd turbocharged traction control stability control brake assist abs(US $9,488.00) 2007 volkswagen passat 2.0t sedan 4-door 2.0l(US $5,000.00)

2007 volkswagen passat 2.0t sedan 4-door 2.0l(US $5,000.00)

Auto Services in Ohio

Walt`s Auto Inc ★★★★★

Verity Auto & Cycle Repair ★★★★★

Vaughn`s Auto Svc ★★★★★

Truechoice ★★★★★

The Mobile Mechanic of Cleveland ★★★★★

The Car Guy ★★★★★

Auto blog

Volkswagen rolls out all-new Polo R WRC

Sat, Jan 17 2015Volkswagen may have ruled out producing a road-going Polo more potent than the new GTI, but on the rally stage, the Polo R WRC has proven absolutely dominant. Introduced to the World Rally Championship in 2013, the Polo R won ten out of the baker's dozen rallies in its debut season, and all but one last year to win both titles two years running. That's quite an act to follow, and the task falls to the machine you see here. The new second-generation Polo R WRC was just revealed at Autostadt in Wolfsburg. The rally machine has been substantially reworked for 2015, with a new livery, new bodywork and new oily bits. In fact, Volkswagen says it has revised three quarters of the components, and while it has not yet detailed the "many new ideas [implemented] under the bonnet," it has identified the hydraulic gearbox as "the biggest innovation." Further details are still to come, but this is our first look at the new machine with which Sebastien Ogier, Jari-Matti Latvala and Andreas Mikkelsen – who finished last year's championship in first, second and third, respectively – will tackle this year's championship, starting with the Rally Monte Carlo on January 22-25. FIA World Rally Championship (WRC) New technology, new design: presenting the second generation Polo R WRC - World premiere of the 318-hp Polo R WRC in Wolfsburg - Member of the Board, Dr. Heinz-Jakob Neusser, launches title defence - WRC kicks off with the iconic Rally Monte Carlo from 22–25 January Wolfsburg (15 January 2015). In top form, both technically and visually: Volkswagen presented the second generation of the Polo R WRC in Autostadt, Wolfsburg. The works team from Wolfsburg has its sights set firmly on another successful defence of its titles in the FIA World Rally Championship (WRC) with a new car and a new look. Volkswagen completed a clean sweep of all the World Championship titles when the Polo R WRC made its debut in 2013, before repeating this impressive feat last season. Continuity is the key to the driving line-up for 2015: double world champions Sebastien Ogier/Julien Ingrassia (F/F) and team-mates Jari-Matti Latvala/Miikka Anttila (FIN/FIN) and Andreas Mikkelsen/Ola Floene (N/N) will roll down the starting ramp and head onto the first special stage of the year for Volkswagen at the legendary Rally Monte Carlo on 22 January. "The new Polo R WRC has undergone intense further development, both on the inside and the outside," said Dr.

VW boss confirms Subaru-aping Golf Alltrack for US

Fri, Nov 21 2014Subaru needs to watch out, because the Japanese brand with a utilitarian image has a big bull's eye on its back. Not only is Acura considering going 100-percent all-wheel drive in a bid to mimic the successful automaker, Volkswagen has just confirmed that the Golf Alltrack is coming to the US as another competitor for Subaru's popular Outback crossover. Volkswagen Group of America CEO Michael Horn has confirmed the addition of the higher-riding, all-wheel drive version of the Golf SportWagen to Automotive News, indicating that the model will arrive in the US in 2016. "That's what our dealers, our customers, are asking us for," he said to the industry publication. The Golf Alltrack, which debuted at the Paris Motor Show in early October, has an extra 0.75 inches of ride height and protective black cladding all the way around. Its biggest mechanical differentiator from other Golfs is its Haldex all-wheel drive system, a setup that can completely unhook from the rear axle when not needed to save fuel. In Europe, the Alltrack is available with a turbocharged 1.8-liter with 178 horsepower and two diesels offering between 109hp and 182 hp. However, Horn made no mention of likely powertrains for the US. Horn tells Automotive News that all-wheel drive tooling is currently being installed at the Puebla, Mexico, factory where the standard Golf Sportwagen is built. VW might have tipped its hand about this possibility several months ago when press shots of the wagon were released for the US with TDI and 4Motion badges. Horn says he expects even the front-wheel drive version to be a sales hit here, suggesting it may eventually account for 50 percent of the Golf range's volume.

Bentley Bentayga bodies to be built in Bratislava

Sun, Apr 12 2015Volkswagen's plant in Bratislava, Slovakia, has come a long way. After getting its start in 1971 by subcontracting the production of Skoda-branded vehicles, the plant was purchased by VW in 1991, where it was quickly put to further good use as it began producing Volkswagen Passat models for export. More recently, Bratislava has become a bastion for SUVs, assembling the Audi Q7 and Porsche Cayenne, in addition to the VW Touareg. Color us unsurprised, then, to learn that the Bentley Bentayga, which will be built atop the same large SUV platform as its cousins from Audi, Porsche and VW, will also be used for at least part of the production of Bentley's first SUV. Surely, though, one of the hallmarks of the Bentley brand is that its cars are handmade in England. Won't the Bentley-buying populace feel slighted by production in Slovakia? Not to worry. As is the case with the Porsche Cayenne, all that will be produced in Slovakia is the Bentayga's body. According to a report from Automotive News, bodies for the Bentayga will be shipped from Bratislava to Crewe, England, where they will be finished into fully operational vehicles. In order to accommodate the additional work, VW will reportedly invest 500 million euros into the plant in Slovakia and hire hundreds of workers.