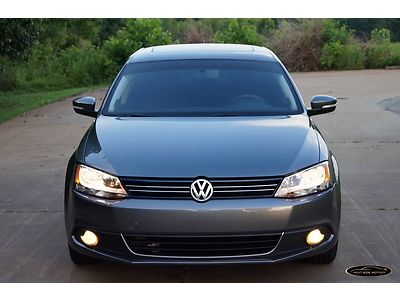

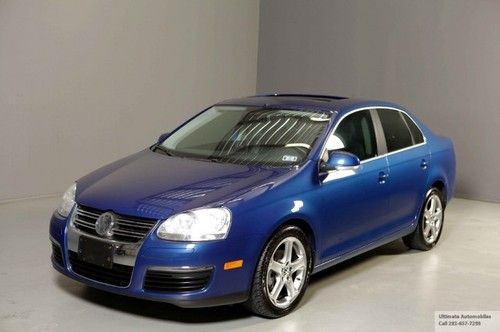

5-days *no Reserve* '12 Volkswagen Jetta Tdi Nav 6-spd Manual *diesel* 1-owner on 2040-cars

Mount Juliet, Tennessee, United States

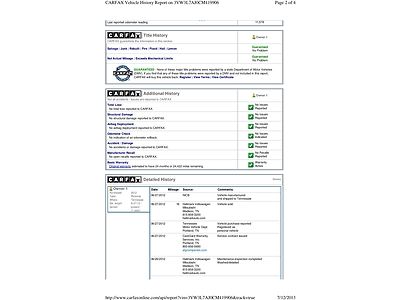

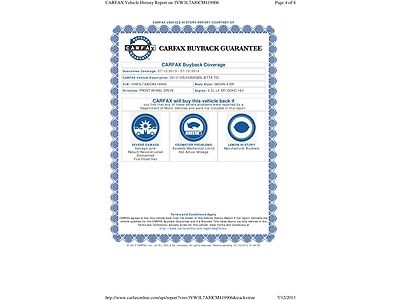

Vehicle Title:Clear

Fuel Type:Diesel

For Sale By:Dealer

Transmission:Manual

Make: Volkswagen

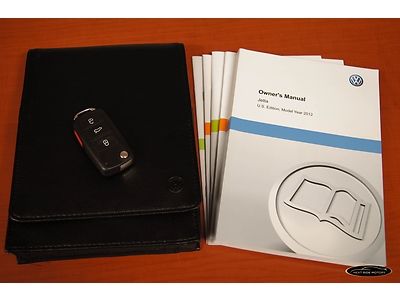

Warranty: Vehicle has an existing warranty

Model: Jetta

Mileage: 18,964

Options: Sunroof

Sub Model: TDI 6-SPD

Safety Features: Side Airbags

Exterior Color: Gray

Power Options: Power Windows

Interior Color: Black

Number of Cylinders: 4

Vehicle Inspection: Inspected (include details in your description)

Volkswagen Jetta for Sale

2004 silver gls tdi wagon 138k looks and runs great no reserve

2004 silver gls tdi wagon 138k looks and runs great no reserve 2011 volkswagen jetta, 1 owner, beautiful!

2011 volkswagen jetta, 1 owner, beautiful! Tdi diesel 2.0l cd turbocharged traction control leather extra clean car(US $18,500.00)

Tdi diesel 2.0l cd turbocharged traction control leather extra clean car(US $18,500.00) 2010 volkswagen jetta

2010 volkswagen jetta 2008 volkswagen jetta sel navigation sunroof leather heatseats ipod alloys sedan(US $10,980.00)

2008 volkswagen jetta sel navigation sunroof leather heatseats ipod alloys sedan(US $10,980.00) 2008 volkswagen jetta se sedan 4-door 2.5l *clean* *serviced*

2008 volkswagen jetta se sedan 4-door 2.5l *clean* *serviced*

Auto Services in Tennessee

Wurster`s Foreign Car Repair ★★★★★

Wheel Tek ★★★★★

Wheel Tek ★★★★★

Wheel 1 ★★★★★

West End Tire Sales Inc ★★★★★

Tullahoma Tire & Brake Inc ★★★★★

Auto blog

Volkswagen forced to sell stake in Suzuki

Mon, Aug 31 2015The six-year-long failed marriage between Volkswagen and Suzuki has finally come to an end. Almost. An arbitration panel in London issued its final verdict which, according to a VW press release, cleared Suzuki in terminating the agreement, so VW now needs to get rid of its 19.9-percent share. However, the tribunal's decision said VW performed all of its obligations and Suzuki didn't – the Japanese carmaker should have given VW last-call rights for a delivery of diesel engines, but failed to. The breach opens Suzuki up to damage claim, but so far VW only says it reserves the right to sue. Now that Suzuki has an outside investor to provide funds it meant to get from VW, perhaps both can get back to their reasons for being. The press release is below. Ruling in arbitration proceedings: Cooperation between Volkswagen and Suzuki deemed terminated - Arbitral tribunal confirms Volkswagen met contractual obligations and finds that Suzuki has ordinary right to terminate agreement based on reasonable notice - Volkswagen to dispose of its 19.9 percent stake in Suzuki and expects positive effect on Company's earnings and liquidity from transaction - Arbitrators also find that Suzuki breached its contractual obligations to Volkswagen under the agreement and that Volkswagen has right to claim damages Wolfsburg, 30 August 2015 - An arbitral tribunal in London has announced its ruling in the dispute between Suzuki Motor Corporation and Volkswagen Aktiengesellschaft. As a result, cooperation between the two parties is deemed terminated. The arbitrators confirmed that Volkswagen met its contractual obligations under the cooperation agreement and found that Suzuki has terminated the agreement upon reasonable notice. Volkswagen will therefore now dispose of its 19.9 percent stake in Suzuki and expects a positive effect on the Company's earnings and liquidity from the transaction. The arbitral tribunal also confirmed that Suzuki breached its contractual obligations to Volkswagen under the agreement and that Volkswagen has the right to claim damages. "We welcome the clarity created by this ruling. The tribunal rejected Suzuki's claims of breach and found that Volkswagen met its contractual obligations under the cooperation agreement. Nevertheless, the arbitrators found that termination of the cooperation agreement by Suzuki on reasonable notice was valid, and that Volkswagen must dispose of the shares purchased.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.

Mixed sales results, but automaker stocks rise on need for cars in Houston

Fri, Sep 1 2017DETROIT — The Big Three Detroit automakers on Friday reported better-than-expected August sales and issued optimistic outlooks for demand as residents of the Houston area replace flood-damaged cars and trucks after Hurricane Harvey, sending their stocks higher. General Motors, Ford and Fiat Chrysler posted mixed August U.S. sales, with GM up 7.5 percent and Ford and Fiat Chrysler down. Japanese automaker Toyota improved sales by nearly 7 percent, while Honda fell 2.4 percent. Still, analysts focused on the potential for Detroit automakers to cut inventories and stabilize used vehicle prices as residents of Houston, the fourth largest city in the United States, are forced to replace tens of thousands, perhaps hundreds of thousands, of vehicles after the devastation from Hurricane Harvey. Mark LaNeve, Ford's U.S. sales chief, told analysts on Friday that following Hurricane Katrina in 2005 "we saw a very dramatic snapback" in demand. That said, Ford sales fell 2.1 percent in August. It sold 209,897 vehicles in the United States, compared with 214,482 a year earlier. Sales were down 1.9 percent in the Ford division and off 5.8 percent at Lincoln. Demand was down for cars, crossovers and SUVs. It was not clear how many vehicles in the Houston area will be scrapped, LaNeve said, saying he had seen estimates ranging from 200,000 to 400,000 to 1 million. Ford's Houston dealers may have lost fewer than 5,000 vehicles in inventory, he said. Ford is the No. 1 automaker in the Houston market, with 18 percent share, according to IHS Markit. The company plans to ship used vehicles to Houston dealers and has "every indication we would have to add some production" of new vehicles to meet demand, LaNeve said. Investor concerns about inventories of unsold vehicles and falling used car prices have weighed on Detroit automakers' shares most of this year. Now, automakers can anticipate a jolt of demand from a big market that is a stronghold for Detroit brand trucks and SUVs. "It's got to be a positive for the industry," LaNeve said. Investors appeared to agree. GM shares rose as much as 3.3 percent to their highest since early March. Ford increased 2.8 percent at $11.34, and Fiat Chrysler's U.S.-traded shares were up 5.2 percent $15.91, hitting their highest in more than five years. GM reported a 7.5 percent increase in U.S. auto sales in August, helped by robust sales of crossovers across its four brands.