2013 Volkswagen Jetta on 2040-cars

Florence, Alabama, United States

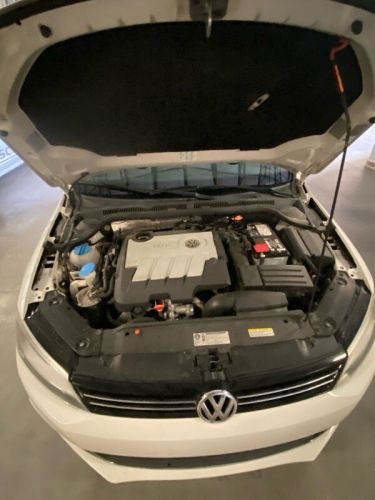

Engine:2.0L

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

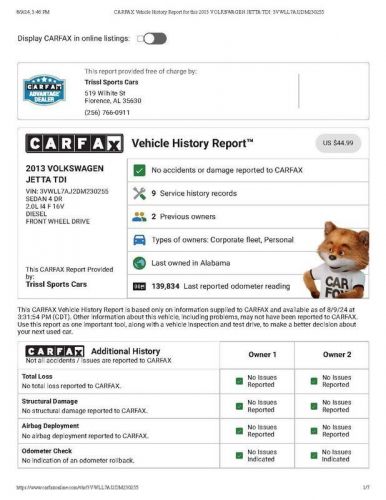

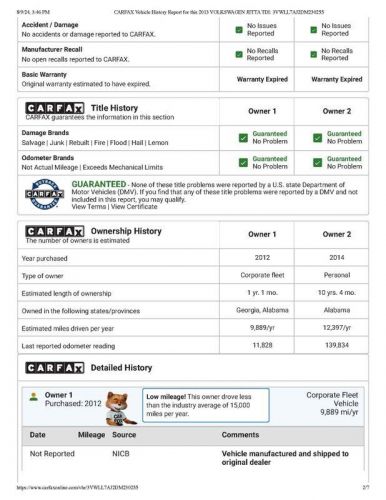

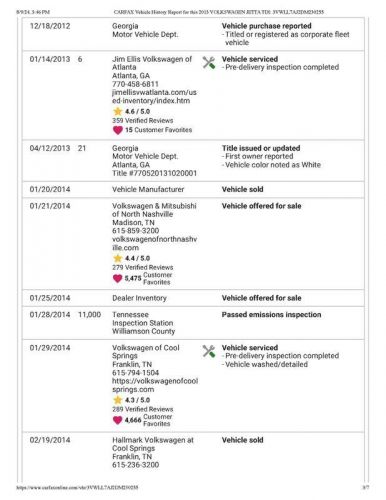

VIN (Vehicle Identification Number): 3VWLL7AJ2DM230255

Mileage: 139841

Make: Volkswagen

Drive Type: --

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Model: Jetta

Volkswagen Jetta for Sale

2012 volkswagen jetta tdi(US $8,300.00)

2012 volkswagen jetta tdi(US $8,300.00) 2012 volkswagen jetta(US $1,900.00)

2012 volkswagen jetta(US $1,900.00) 2019 volkswagen jetta 1.4t se sedan 4d(US $12,565.00)

2019 volkswagen jetta 1.4t se sedan 4d(US $12,565.00) 2020 volkswagen jetta 1.4t se(US $21,995.00)

2020 volkswagen jetta 1.4t se(US $21,995.00) 2013 volkswagen jetta se insurance theft recovery salvage(US $6,995.00)

2013 volkswagen jetta se insurance theft recovery salvage(US $6,995.00) 2013 volkswagen jetta 2.0l s sedan 4d(US $5,918.00)

2013 volkswagen jetta 2.0l s sedan 4d(US $5,918.00)

Auto Services in Alabama

United Auto Repair ★★★★★

Transmission Doctor and More ★★★★★

Townsend Roadside Assistance ★★★★★

Tire Express ★★★★★

Stadium Grill ★★★★★

Radiators Inc ★★★★★

Auto blog

2015 Volkswagen Touareg [w/video]

Fri, Dec 5 2014The second-generation Volkswagen Touareg has been in production since 2010, and is therefore staring down the last part of its model cycle. To keep buyers interested, the company has undertaken a refresh of its upscale midsize SUV. As is typical of these things, the changes include some exterior and interior rejuvenation, as well as increased content levels and a slight uptick in price. The basics of the styling changes are pretty straightforward. The 2015 Touareg can be pretty easily spotted versus the outgoing model by way of its four-bar chrome grille, a cleaner headlight design, bigger VW badge and a completely new lower front clip. (I got one photo of the old and new models side-by-side for my Twitter followers before we rolled out on the drive.) There's also a thin strip of chrome that runs around the bodywork, standard LED taillights and a selection of three new wheel styles and five new paint colors. Inside, I found it harder to spot the changes, old to new. The Touareg's switchgear has been updated and there's a new frame for the infotainment display, but there's no piece that stands out and says "new model year!" Powertrains and mechanical bits all carryover from the 2014 Touareg, too. But there were a few functional changes to the vehicle, primarily in the new Driver's Assistance Package, for me to take note of as I took a lap of my favorite Ann Arbor, MI driving route. Drive Notes Let me start with the newest news then, the Driver Assistance pack. Volkswagen will sell you this suite of safety gear on either the mid-level Lux or the top-end Executive trims, for $2,500. The package included adaptive cruse cruise control, "Front Assist" for emergency braking situations, lane-keep assist and blind spot monitoring. If the contents of that package don't strike you as revolutionary, you're not alone. Some or all of the technologies that are new to the Touareg have been around other showrooms – and other VW family products – for quite a while. Still, they're nice to have as options. All of the driver assistance features that I was able to test worked as advertised, too. The adaptive cruise uses cameras, radar and ultrasonic sensors, so it isn't likely to be impacted by inclement weather, which is nice. I also appreciate that the lane-keep assist (which offers the driver a haptic buzz to the steering wheel when straying out of the lane) can be turned off, or turned down in terms of intensity and reaction time.

Lexus tops JD Power Vehicle Dependability Study again, Buick bests Toyota

Wed, Feb 25 2015It shouldn't surprise anyone, but Lexus has once again taken the top spot in JD Power's Vehicle Dependability Study. That'd be the Japanese luxury brand's fourth straight year at the top of table. The big news, though, is the rise of Buick. General Motor's near-premium brand beat out Toyota to take second place, with 110 problems per 100 vehicles compared to Toyota's 111 problems. Lexus owners only reported 89 problems per 100 vehicles. Besides Buick's three-position jump, Scion enjoyed a major improvement, jumping 13 positions from 2014. Ram and Mitsubishi made big gains, as well, moving up 11 and 10 positions, respectively. In terms of individual segments, GM and Toyota both excelled, taking home seven segment awards each. The study wasn't good news for all involved, though. A number of popular automakers finished below the industry average of 147 problems per 100 vehicles, including Subaru, (157PP100), Volkswagen (165PP100), Ford/Hyundai (188PP100 each) and Mini (193PP100). The biggest losers (by a tremendous margin, we might add) were Land Rover and Fiat, recording 258 and 273 problems per 100 vehicles. The next closest brand was Jeep, with 197PP100. While the Vehicle Dependability Study uses the same measurement system as the Initial Quality Survey, the two metrics analyze very different things. The VDS looks at problems experienced by original owners of model year 2012 vehicles over the past 12 months, while the oft-quoted IQS focuses on problems in the first 90 days of new-vehicle ownership. Like the IQS, though, the VDS has a rather broad definition of what a problem is. Because of that, a low score from JD Power is no guarantee of extreme unreliability, so much as just poor design. In this most recent study, the two most reported problems focused on Bluetooth connectivity and the voice-command systems. The former leaves plenty of room for user error due to poor design (particularly true of the Bluetooth systems on the low-scoring Fords, Volkswagens and Subarus), while the second is something JD Power has already confirmed as being universally terrible. That makes means that while these studies are important, they shouldn't be taken as gospel when it comes to automotive reliability. News Source: JD PowerImage Credit: Copyright 2015 Jeremy Korzeniewski / AOL Buick Fiat Ford GM Hyundai Jeep Land Rover Lexus MINI Mitsubishi RAM Scion Subaru Toyota Volkswagen Auto Repair Ownership study

Italian investigators search Lambo headquarters in VW probe

Thu, Oct 15 2015Italian investigators searched Lamborghini headquarters on Oct. 15 to look for evidence of managers' involvement in Volkswagen's emissions cheating. VW's main office in Verona was also inspected, according to Reuters. Lamborghini is owned by Volkswagen, and Lambo in turn is listed as the owner of VW Group Italia. Authorities wanted to find out if employees were conscious that the vehicles were skirting emissions rules. "It is one thing if I sell water and pretend it's wine, but if I sell water believing it is wine it's different." Verona chief prosecutor Mario Giulio Schinaia said to Reuters. Italian newspaper Gazetta del Sud reported that several managers in Italy were under investigation for alleged fraud. Prosecutors in Germany have also been rigorously investigating VW, and they recently staged a similar raid on the company's headquarters in Wolfsburg, Germany. The automaker reportedly turned over documents and other data relating to the software defeat device. Meanwhile, VW's internal investigation has turned up little wrongdoing, though a recent leak suggested otherwise, and at least 30 managers could have known about the defeat device. The automaker has disputed that figure. Volkswagen of America CEO Michael Horn testified before Congress that he believed only a few individuals were involved. The situation hasn't been easy on VW in the US, either. The Department of Justice has also been pursuing an investigation into the automaker. Plus, state attorneys general are filing lawsuits against the company for defrauding customers. VW has until Nov. 20 to explain a repair for the problem to the California Air Resources Board. Related Video: