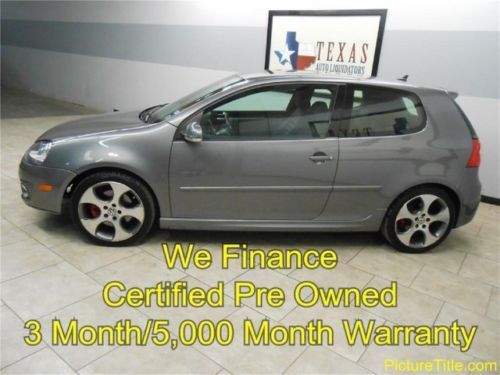

09 Vw Gti Turbo 6spd Sunroof Certified Warranty We Finance Texas Car on 2040-cars

Arlington, Texas, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:2.0L 1984CC 121Cu. In. l4 GAS DOHC Turbocharged

Body Type:Hatchback

Fuel Type:GAS

Year: 2009

Make: Volkswagen

Model: GTI

Trim: Base Hatchback 4-Door

Disability Equipped: No

Doors: 2

Drive Type: FWD

Drivetrain: Front Wheel Drive

Mileage: 101,272

Number of Doors: 2

Sub Model: Coupe 6spd

Exterior Color: Gray

Number of Cylinders: 4

Interior Color: Gray

Volkswagen Golf for Sale

2012 volkswagen tdi hatchback(US $19,977.00)

2012 volkswagen tdi hatchback(US $19,977.00) 2008 volkswagen gti base hatchback 2-door 2.0l(US $12,000.00)

2008 volkswagen gti base hatchback 2-door 2.0l(US $12,000.00) 2001 volkswagen gti 2-door hatchback black on black golf gls * low reserve *

2001 volkswagen gti 2-door hatchback black on black golf gls * low reserve * 11 vw golf-22k-diesel-xm radio-automatic-alloy wheels-sunroof(US $19,995.00)

11 vw golf-22k-diesel-xm radio-automatic-alloy wheels-sunroof(US $19,995.00) 09 vw gti 6spd leather heated seats sunroof warranty we finance cpo warranty(US $13,795.00)

09 vw gti 6spd leather heated seats sunroof warranty we finance cpo warranty(US $13,795.00) 2012 volkswagen gti turbocharged 6-speed spoiler 8k mi texas direct auto(US $22,980.00)

2012 volkswagen gti turbocharged 6-speed spoiler 8k mi texas direct auto(US $22,980.00)

Auto Services in Texas

Zepco ★★★★★

Xtreme Motor Cars ★★★★★

Worthingtons Divine Auto ★★★★★

Worthington Divine Auto ★★★★★

Wills Point Automotive ★★★★★

Weaver Bros. Motor Co ★★★★★

Auto blog

What's big at the Chicago show | Autoblog Podcast #503

Fri, Feb 10 2017On this week's podcast, Mike Austin and David Gluckman discuss the big debuts at the 2017 Chicago Auto Show. They also recap what they've all been driving lately, and the episode wraps up with Spend My Money buying advice to help you, our dear listeners. And there's an awful Dad Joke thrown in there for you to find. The rundown is below. Remember, if you have a car-related question you'd like us to answer or you want buying advice of your very own, send a message or a voice memo to podcast at autoblog dot com. (If you record audio of a question with your phone and get it to us, you could hear your very own voice on the podcast. Neat, right?) And if you have other questions or comments, please send those too. Autoblog Podcast #503 The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics and stories we mention Jaguar XE Volkswagen Golf R Toyota Highlander Hybrid Chicago Auto Show coverage Used cars! Rundown Intro - 00:00 What we're driving - 01:46 Chicago show preview - 22:58 Spend My Money - 35:36 Total Duration: 52:48 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show on iTunes Podcasts Chicago Auto Show Chevrolet Dodge Jaguar Toyota Volkswagen Truck Hatchback SUV Performance Sedan ford expedition jaguar xe volkswagen golf r 2017 Chicago Auto Show

VW Up Buggy may be headed to showrooms

Tue, 02 Jul 2013Volkswagen showed six conceptual takes on its Up at the 2011 Frankfurt Motor Show, one of those being the Up Buggy. Although few will probably remember it, VW has not forgotten it, applying for a patent for the Meyers Manx revival roadster way back in March 2012 and being approved in June of this year, according to a report in Autocar. That will give the automaker a 14-year lock on the design while it decides whether to move forward with a reboot of its past.

A patent doesn't mean the Up Buggy will ever move beyond the sheet-of-paper stage, but Autocar says VW is studying the market to see if a production version is feasible. We can't see North America ever getting it, but even so, we wouldn't complain if they made it - especially if they put an exposed engine in back that was set off by 18-inch-long twin tailpipes jutting straight up into the air. However, for a company that aims to be the world's number-one automaker by 2018, a niche vehicle for its mass-market brand would be a surprising use of resources.

Major automakers urge Trump not to freeze fuel economy targets

Mon, May 7 2018WASHINGTON — Major automakers are telling the Trump administration they want to reach an agreement with California to avoid a legal battle over fuel efficiency standards, and they support continued increases in mileage standards through 2025. "We support standards that increase year over year that also are consistent with marketplace realities," Mitch Bainwol, chief executive of the Alliance of Automobile Manufacturers, a trade group representing major automakers, will tell a U.S. House of Representatives panel on Tuesday, according to written testimony released on Monday. The Trump administration is weighing how to revise fuel economy standards through at least the 2025 model year, and one option is to propose freezing the standards through 2026, effectively allowing automakers to delay investments in technology to cut greenhouse gas emissions from burning petroleum. The National Highway Traffic Safety Administration has not formally submitted its joint proposal with the Environmental Protection Agency to the White House Office of Management and Budget for review. Even so, last week, California and 16 other states sued to challenge the Trump administration's decision to revise U.S. vehicle rules. Auto industry executives have held meetings with the Trump administration for months and have urged the administration to try to reach a deal with California even as they support slowing the pace of reduction in carbon dioxide emissions that the Obama administration rules outlined. One automaker official said part of the message to President Donald Trump at a meeting on Friday will be to consider California like a foreign trade deal that needs to be renegotiated. Automakers want to urge him to get automakers a "better deal" — as opposed to potentially years of litigation between major states and federal regulators. On Friday, Trump is set to meet with the chief executives of General Motors, Ford, Fiat Chrysler and the top U.S. executives of at least five other major automakers, including Toyota, Volkswagen AG and Daimler AG, to talk about revisions to the vehicle rules. Senior EPA and Transportation Department officials will also attend. Environmental groups are eager to keep the rules in place, saying they will save consumers billions in fuel costs. A coalition of groups plans to stage a protest outside Ford's headquarters in Michigan.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.104 s, 7891 u