We Finance 09 Eos Convertible Dsg Luxury Power Hard Top Nav Alloys Clean Carfax on 2040-cars

Cleveland, Ohio, United States

Volkswagen Eos for Sale

2010 vw eos, 2.0l turbo, mt, runs like new, warranty, pictures before & after(US $12,500.00)

2010 vw eos, 2.0l turbo, mt, runs like new, warranty, pictures before & after(US $12,500.00) 2009 volkswagen lux(US $20,488.00)

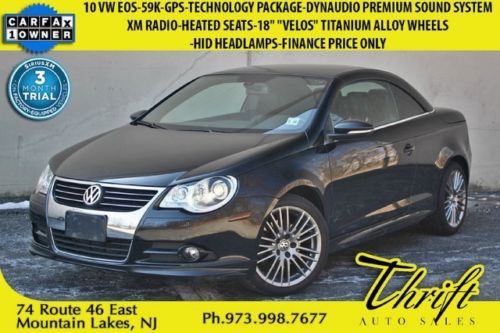

2009 volkswagen lux(US $20,488.00) 10 vw eos-59k-navigation-parking aid-xm radio-heated seats-18 wheels(US $16,995.00)

10 vw eos-59k-navigation-parking aid-xm radio-heated seats-18 wheels(US $16,995.00) 2.0t retractable convertible dsg automatic heated seats(US $10,900.00)

2.0t retractable convertible dsg automatic heated seats(US $10,900.00) 2012 volkswagen eos hard top convertible red/tan only 101 miles!(US $27,500.00)

2012 volkswagen eos hard top convertible red/tan only 101 miles!(US $27,500.00) 2012 volkswagen eos komfort convertible 2-door 2.0l(US $21,499.00)

2012 volkswagen eos komfort convertible 2-door 2.0l(US $21,499.00)

Auto Services in Ohio

Westside Auto Service ★★★★★

Van`s Tire ★★★★★

Used 2 B New ★★★★★

T D Performance ★★★★★

T & J`s Auto Body & Collision ★★★★★

Skipco Financial ★★★★★

Auto blog

Mixed sales results, but automaker stocks rise on need for cars in Houston

Fri, Sep 1 2017DETROIT — The Big Three Detroit automakers on Friday reported better-than-expected August sales and issued optimistic outlooks for demand as residents of the Houston area replace flood-damaged cars and trucks after Hurricane Harvey, sending their stocks higher. General Motors, Ford and Fiat Chrysler posted mixed August U.S. sales, with GM up 7.5 percent and Ford and Fiat Chrysler down. Japanese automaker Toyota improved sales by nearly 7 percent, while Honda fell 2.4 percent. Still, analysts focused on the potential for Detroit automakers to cut inventories and stabilize used vehicle prices as residents of Houston, the fourth largest city in the United States, are forced to replace tens of thousands, perhaps hundreds of thousands, of vehicles after the devastation from Hurricane Harvey. Mark LaNeve, Ford's U.S. sales chief, told analysts on Friday that following Hurricane Katrina in 2005 "we saw a very dramatic snapback" in demand. That said, Ford sales fell 2.1 percent in August. It sold 209,897 vehicles in the United States, compared with 214,482 a year earlier. Sales were down 1.9 percent in the Ford division and off 5.8 percent at Lincoln. Demand was down for cars, crossovers and SUVs. It was not clear how many vehicles in the Houston area will be scrapped, LaNeve said, saying he had seen estimates ranging from 200,000 to 400,000 to 1 million. Ford's Houston dealers may have lost fewer than 5,000 vehicles in inventory, he said. Ford is the No. 1 automaker in the Houston market, with 18 percent share, according to IHS Markit. The company plans to ship used vehicles to Houston dealers and has "every indication we would have to add some production" of new vehicles to meet demand, LaNeve said. Investor concerns about inventories of unsold vehicles and falling used car prices have weighed on Detroit automakers' shares most of this year. Now, automakers can anticipate a jolt of demand from a big market that is a stronghold for Detroit brand trucks and SUVs. "It's got to be a positive for the industry," LaNeve said. Investors appeared to agree. GM shares rose as much as 3.3 percent to their highest since early March. Ford increased 2.8 percent at $11.34, and Fiat Chrysler's U.S.-traded shares were up 5.2 percent $15.91, hitting their highest in more than five years. GM reported a 7.5 percent increase in U.S. auto sales in August, helped by robust sales of crossovers across its four brands.

French probe alleges 2 million PSA cars had engine cheats

Fri, Sep 8 2017PARIS — A French investigation into alleged emissions cheating by PSA Group found that suspect software had been used on almost 2 million vehicles sold by the maker of Peugeot and Citroen cars, Le Monde reported on Friday. Paris-based PSA denies any use of fraudulent engine software, a spokesman said in response to the newspaper report, which sent PSA shares sharply lower. The stock was down 4.4 percent at 17.78 euros as of 1019 GMT. So-called "defeat devices" restrict exhaust output of toxic nitrogen oxides (NOx) under regulatory test conditions while letting emissions far exceed legal limits in real-world driving. In February, PSA became the fourth carmaker to be referred to French prosecutors by the country's DGCCRF watchdog over suspected emissions test-cheating, after Volkswagen, Renault and Fiat Chrysler. PSA's engineering chief acknowledged at the time that emissions treatment in the group's diesels was deliberately reduced at higher temperatures to improve fuel efficiency and carbon dioxide (CO2) emissions in out-of-town driving, where NOx output is considered less critical. According to Le Monde, an internal PSA document obtained by DGCCRF investigators includes discussion of the need to "make the 'defeat device' aspect less obvious and visible." However PSA insists there is nothing fraudulent or illegal about its engine calibrations. "PSA denies any fraud and firmly reaffirms the pertinence of its technology decisions," the company said on Friday. Reporting by Laurence FrostRelated Video: Image Credit: Getty Government/Legal Green Volkswagen Citroen Peugeot Emissions Diesel Vehicles dieselgate volkswagen diesel

VW confirms development of 10-speed dual clutch, 134-hp/liter diesel

Fri, 26 Apr 2013Each year, the Vienna International Motor Symposium showcases some of the up-and-coming technologies automakers are engineering for the use in passenger cars, and Volkswagen AG CEO Martin Winterkorn revealed some big developments VW is working on for its future products. Winterkorn discussed a multi-faceted approach that VW is looking to reduce its fleet fuel consumption and exhaust emissions.

Some of the bigger news he discussed included a "high-performance" diesel engine that will produce 134 horsepower per liter and a 10-speed DSG automatic transmission. While no specific applications were mentioned, we can only hope this is for the Audi R4 we keep hearing about.

Another topic he touched on that caused us to perk up our ears was had to do with VW's plug-in hybrid technology. While we know the PHEV versions of the Audi A3 and Porsche Panamera are on the way, Winterkorn also said that these two models will be followed up by Golf, Passat, Audi A6 and Porsche Cayenne plug-in models. Scroll down for a press release highlighting the automaker's future fuel-saving initiatives.