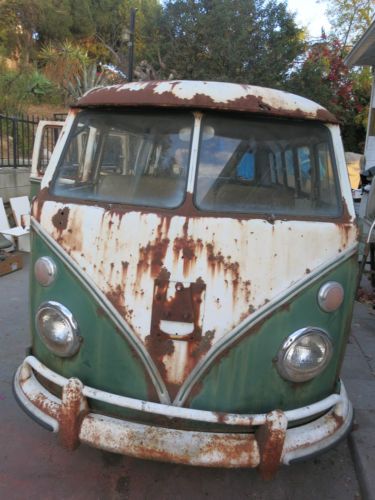

Vw Bus T1, 1966, 1600, Drink-bar on 2040-cars

Gdynia, Poland

|

perfect bus

|

Volkswagen Bus/Vanagon for Sale

1984 vw vanagon country homes camper(US $6,800.00)

1984 vw vanagon country homes camper(US $6,800.00) 1967 volkswagen t1 type 2 westfalia camper microbus

1967 volkswagen t1 type 2 westfalia camper microbus Vw bus 1964 - 13 windows deluxe - project - no reserve price

Vw bus 1964 - 13 windows deluxe - project - no reserve price 1974volkswagen westfalia camper wow!!

1974volkswagen westfalia camper wow!! Fully restored- pop up roof- 2 beds- removable cabinet w/ 12 volt coolers-

Fully restored- pop up roof- 2 beds- removable cabinet w/ 12 volt coolers- 1985 vw volkswagen vanagon bus

1985 vw volkswagen vanagon bus

Auto blog

TN politicians may push to end VW incentives if plant goes union

Tue, 11 Feb 2014Volkswagen's Chattanooga Assembly Plant is scheduled to vote on whether to unionize in the coming days, but Tennessee state lawmakers are threatening to deny future tax subsidies to the factory, if the vote is successful. The factory is currently the only Volkswagen plant worldwide that is not unionized.

The states's Republican lawmakers have been particularly vocal against the union vote. Tennessee state senator Bo Watson said during a press conference that VW would have a "very tough time" with future incentives if the vote were successful, according to Automotive News. Tennessee House Majority Leader Gerald McCormick said the "heavy hand" of the UAW is not welcome there. VW has drawn criticism from both sides because it has allowed both pro- and anti-union groups to speak to workers and hand out leaflets.

Roughly 1,500 factory employees will vote on whether to unionize from February 12-14. If successful, the Chattanooga factory would be the first in the US organized under a German-style works council system where white- and blue-collar workers directly negotiate factory issues with the company's management.

French probe alleges 2 million PSA cars had engine cheats

Fri, Sep 8 2017PARIS ó A French investigation into alleged emissions cheating by PSA Group found that suspect software had been used on almost 2 million vehicles sold by the maker of Peugeot and Citroen cars, Le Monde reported on Friday. Paris-based PSA denies any use of fraudulent engine software, a spokesman said in response to the newspaper report, which sent PSA shares sharply lower. The stock was down 4.4 percent at 17.78 euros as of 1019 GMT. So-called "defeat devices" restrict exhaust output of toxic nitrogen oxides (NOx) under regulatory test conditions while letting emissions far exceed legal limits in real-world driving. In February, PSA became the fourth carmaker to be referred to French prosecutors by the country's DGCCRF watchdog over suspected emissions test-cheating, after Volkswagen, Renault and Fiat Chrysler. PSA's engineering chief acknowledged at the time that emissions treatment in the group's diesels was deliberately reduced at higher temperatures to improve fuel efficiency and carbon dioxide (CO2) emissions in out-of-town driving, where NOx output is considered less critical. According to Le Monde, an internal PSA document obtained by DGCCRF investigators includes discussion of the need to "make the 'defeat device' aspect less obvious and visible." However PSA insists there is nothing fraudulent or illegal about its engine calibrations. "PSA denies any fraud and firmly reaffirms the pertinence of its technology decisions," the company said on Friday. Reporting by Laurence FrostRelated Video: Image Credit: Getty Government/Legal Green Volkswagen Citroen Peugeot Emissions Diesel Vehicles dieselgate volkswagen diesel

European new car sales drop nearly 8% in first half of 2019

Thu, Jul 18 2019PARIS ó European car sales dropped 7.9% in June, led by bigger declines for Nissan, Volvo and Fiat Chrysler (FCA), according to industry data published on Wednesday. Registrations fell to 1.49 million cars last month from 1.62 million a year earlier across the European Union and EFTA countries, the Brussels-based Association of European Carmakers said in a statement. Calendar effects resulted in two fewer sales days in most markets, accentuating the decline. Registrations for the first half closed 3.1% lower, ACEA said. For European carmakers, weakening demand at home compounds the pressure from a sharper contraction in China and emerging markets that may yet bring more profit warnings. Nissan¬ís aging model lineup contributed to a 26.6% June sales slump while Volvo Cars, owned by China¬ís Geely, saw deliveries tumble 21.7%. Registrations also fell 13.5% last month at FCA, 10.1% at BMW, 9.6% at Volkswagen Group and 8.2% for both Mercedes parent Daimler and France¬ís PSA Group. The Peugeot maker¬ís domestic rival Renault suffered less, posting a 3.9% decline. By the Numbers BMW Chrysler Fiat Nissan Volkswagen Volvo Peugeot Renault